Puerto Rico’s debt crisis is taking a toll on the mainland municipal bond market.

Market participants say the ripple effects from the biggest municipal bankruptcy have shaken investor confidence in lower-rated states and cities, legal promises and credit ratings in general. Of particular concern is a ruling by Title III Judge Laura Taylor Swain that upset expectations regarding special revenue bonds, which had continued to generate payments in previous bankruptcies.

In her ruling on Jan. 30 in a case involving the bonds of the Puerto Rico Highways and Transportation Authority, Convention Center District Authority, and Infrastructure Finance Authority, Swain said the fact the bonds were special revenue bonds didn’t require the issuers to continue paying in a Chapter 9 bankruptcy.

Swain's decision has "cast doubt" on the norms of the market, says Wells Fargo Securities managing director Natalie Cohen. “The fact that an automatic stay does not apply to special revenues and that payments should continue to bondholders has been accepted as common knowledge by the investing public,” Cohen points out that a federal website of the Administrative Office of the U.S. Courts summarizes a part of Chapter 9 saying, “Holders of special revenue bonds can expect to receive payment on such bonds during the Chapter 9 case if special revenues are available.”

Bond insurers Assured Guaranty and National Public Finance Guarantee are preparing an appeal of the Swain ruling and Cohen said this may clarify its impact. For the time being, the “decision has caused concern about the safety of special revenues of distressed borrowers.”

If Swain’s decision is upheld, market participants may not respect special revenue bonds in the future, says Peter Block, head of municipal credit strategy at Ramirez.

Fitch Ratings thought Swain’s decision was important enough to put out a six-page “special report” on the topic, “What Investors Want to Know: The Impact of the Puerto Rico Ruling on Special Revenue Debt.”

On March 9 Fitch said it would include a warning in its commentaries on credits that might be affected by a final court ruling on Swain’s decision. Among other things, the warning says that the “outcome of the litigation could result in modifications to Fitch’s approach.”

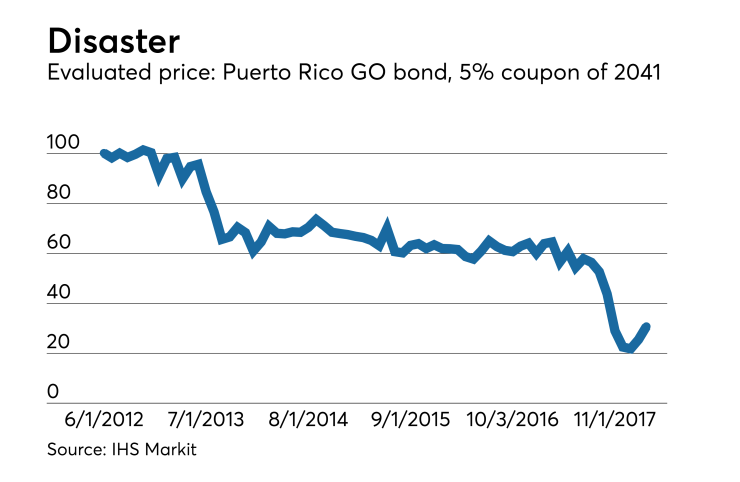

Municipal bond participants have become more cautious about purchasing bonds from distressed issuers since Puerto Rico’s bond meltdown over the last several years.

On Feb. 13, one of the historically biggest holders of Puerto Rico debt, Franklin Templeton Investments, said it had learned its lessons from its experience of the island's slide into multiple defaults. “As a result of lessons recently learned, the Franklin municipal bond group generally does not purchase general fund appropriation debt from cities, counties or states that in our view are facing unsustainable structural budget situations,” two co-directors of the group wrote in “Fundamental Changes That No Muni Investor Should Ignore.”

“As real examples, the Franklin municipal bond group has divested from – and currently won’t invest in – obligations of the State of Illinois, the City of Chicago and Chicago Public Schools, no matter what they offer in terms of security,” Co-Directors Sheila Amoroso and Rafael Costas wrote.

The U.S. Virgin Islands, which has its own financial problems, has struggled with the shadow of Puerto Rico’s default. The latter’s default played a role in the Virgin Islands’ inability to sell bonds in the late summer of 2016 and January 2017 for operating expenses.

In August 2017 the Virgin Islands’ Water and Power Authority, also in extreme financial difficulties, had to offer 11% annual interest on a 35-month-duration bond to gain a buyer.

In Detroit’s bankruptcy the judge treated general obligation bonds as unsecured debt, Block noted. In Puerto Rico the island has defaulted on its GO debt and now Swain is saying the special revenue bonds don’t have to be paid in bankruptcy either. “People have learned to look more carefully at what they own,” Block said.