In the face of increasing consolidation and a torrent of capital flooding the RIA business, industry veterans Greg Friedman and Norm Boone will merger their firms and software expertise in a bid to keep pace with industry leaders.

Private Ocean, wealth management firm with $1.5 billion in AUM headed by Friedman, has acquired Boone’s Mosaic Financial Partners for a combination of cash, equity and notes. Terms of the deal were not available, but it was funded by internal capital, according to Friedman.

Both firms are based in the lucrative San Francisco Bay area market.

Friedman and Boone both have extensive software backgrounds, unusual for advisors. Friedman owned Junxure, a popular CRM software firm that he sold to Advisor Engines last year. Boone and his wife Linda Lubitz, who owns her own RIA in Miami, owned IPS AdvisorPro, software that built and maintained investment policy statements. The company was they sold to Fi360 five years ago.

That tech background gives Friedman and Boone a competitive advantage in the coming battles with RIA giants, according to M&A consultant and investment banker David DeVoe, whose eponymous company represented Mosaic.

“They have innovation coded into their DNA,” he says. “Greg will see technology changes and opportunities in this space before nearly anyone else. His experience with Junxure puts him in that rare seat."

"I don’t think 12 firms will dominate anytime soon," says Private Ocean CEO Greg Friedman.

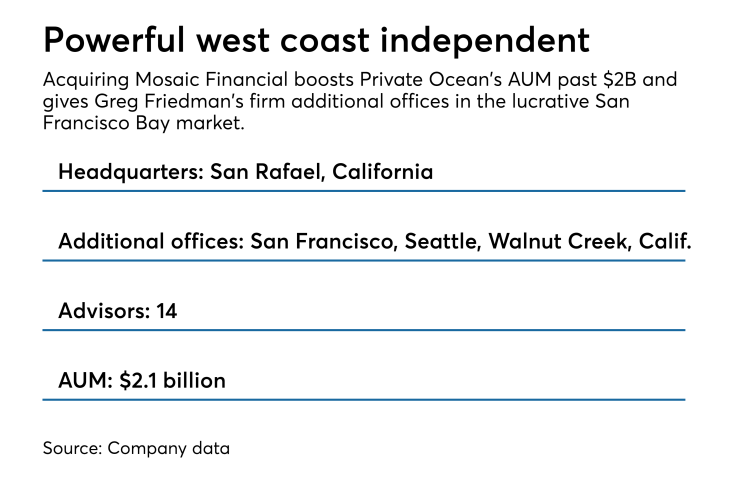

Adding Mosaic’s $620 million in assets gives Private Ocean over $2 billion in AUM. While certainly an impressive number, that sum still leaves Private Ocean lagging behind industry leaders and aggregators such as HighTower Advisors and United Capital, with AUM totals of over $40 billion and $20 billion, respectively.

The deal is significant as expansion-minded RIA executives commonly predict a world of a dozen or so national RIA firms dominating the business. “There will be big players, no doubt,” says Friedman. “But there’s also plenty of room for smaller and mid-sized firms. I don’t think 12 firms will dominate anytime soon. There certainly will be firms with higher profiles but it will take a lot longer to dominate the market nationally. I have yet to see a platform that still doesn’t have technical limitations.”

San Rafael, California-based Private Ocean is positioning itself as a regional power. It will now have offices in San Francisco and neighboring Walnut Creek

“Clearly, the transaction strengthens Private Ocean's position as one of the dominant firms in the Bay Area and beyond,” says DeVoe. “It also signals that Greg and his growing executive team have broader aspirations.”

-

Rockefeller Capital Management poaches Michael Bapis' billion-dollar HighTower team.

September 10 -

Money pouring into the advisory business is making one prominent banker nervous.

July 22 -

The long-standing feud between founder Mark Hurley and majority owner Emigrant Bank has reached the boiling point.

July 18

The seeds of the deal were planted at a dinner on Fisherman’s Wharf in San Francisco three years ago, Boone says.

“We had great philosophical alignment when it came to planning, clients and investments,” he explained. “We’ve known each other for around 20 years and our offices are about 30 miles apart. The timing was also good. I’m 71 and was thinking about internal succession.”

Boone also talked to a range of other suitors, including “individuals with private equity backing and major roll-ups. While they “said all the right things, it was obvious Private Ocean was the right choice. We complimented each other and had too much in common — we both loved software, process and planning.”

Boone’s advice to other RIA sellers: “Be clear about you want and don’t want. In our case, we wanted continuity for our clients and employees as well as a minimum pricing level. While Private Ocean did not have the best financial offer, it was close enough not to worry about it.”