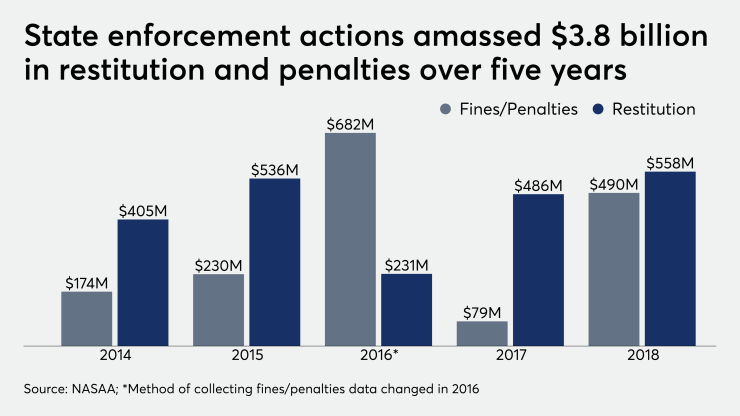

AUSTIN, Texas — State enforcement cases take on many forms due to the varying lengths of time and agencies involved. But after enforcement cases yielded more than $1 billion in restitution, fines and penalties related to securities crimes in 2018, monetary relief soared 85% year-over-year.

The North American Securities Administrators Association — which compiled the data from 51 U.S. jurisdictions —

The tally of restitution, fines and penalties reached a five-year high, coinciding with the largest number of investigations (5,320) and license sanctions (5,543) since at least 2014. The 2,067 enforcement actions represented the second most in the past five years, just below 2,150 in 2017.

More than $1.07 billion in monetary relief included $558 million in restitution that members ordered to be paid to clients and $490 million in fines and penalties. The enforcement also led to 1,048 years of combined prison sentences and 705 years of probation, NASAA says.

NASAA presented the report at its annual meeting, which also commemorated its 100 years as an organization. A 1917 Supreme Court ruling codified states’ ability to enact securities laws, and the 2010 Dodd-Frank Act expanded states’ RIA purview to firms with up to $100 million in AUM.

“The more things change, the more they stay the same,” said Wendy Coy, director of enforcement in the Arizona Securities Division. “Fictitious businesses, Ponzi schemes, insider trading, fake stock — all of these schemes were all done 100 years ago, and I bet most of you have most of these schemes somewhere in your current investigation stack.”

It's difficult to pinpoint exactly what caused the large amount of monetary relief. For example, New York

However, the numbers provide a glimpse into state-level enforcement cases that often go unnoticed in the wider industry. They also display regulators’ supervision of RIAs and broker-dealers and how larger economic trends boost fraud.

In keeping with a long-term trend, the number of unregistered firms and individuals matched the combined figure at RIAs and BDs. At least 639 unregistered defendants were charged in a case file that included 249 unregistered securities schemes targeting seniors.

“The crooks are coming out of the woodwork; it’s gone from greed factor to fear factor,” says Joe Borg, the chairman of NASAA’s enforcement section and director of the Alabama Securities Commission. Concerns about a looming recession are working in scam artists’ favor, he says.

“The fear factor affects seniors a lot more,” Borg continued in an interview at the conference. “What drives it is that everybody realizes that the over-65 crowd has all the assets.”

At least 23 jurisdictions have enacted regulations or laws based on a NASAA model act, which was approved in 2016. In the past year, state securities officials received 426 tips from BDs and RIAs as part of the requirement to report any suspicion of fraud.

Texas Securities Board Enforcement Director Joe Rotunda credited a registered firm’s report to the state for unearthing a precious metal investment scam that has resulted in $12.9 million in rescission payments in two states to more than 80 clients.

Ten states, FINRA and the SEC have also lodged enforcement proceedings against the Woodbridge Group of Companies since 2015. Former CEO Robert Shapiro

Cryptocurrency came under state regulators’ crosshairs as well in the past year. Since launching Operation Cryptosweep last April, state regulators have filed more than 85 enforcement actions involving initial coin offerings and cryptocurrencies.

NASAA first

“We looked into the crystal ball and we became concerned that unscrupulous promoters may be attempting to capitalize on Bitcoin’s popularity by illegally offering securities tied to digital currencies,” Rotunda said. “It was quite some time ago, but it proved to be true.”

Fraud cases take on personal significance to NASAA President Chris Gerold of the New Jersey Bureau of Securities. Taking over the one-year, elected position at the conference, he told the story of his parents, who were victims of the $700-million Bennett Funding Group

“I saw firsthand the impact of securities fraud,” Gerold said. “I reflect upon this experience in my daily responsibilities as a securities regulator and challenge you to do the same. Because what we do matters.”