As the debate over advisory fee models escalates, advisors are taking a closer look at the subscription pricing model.

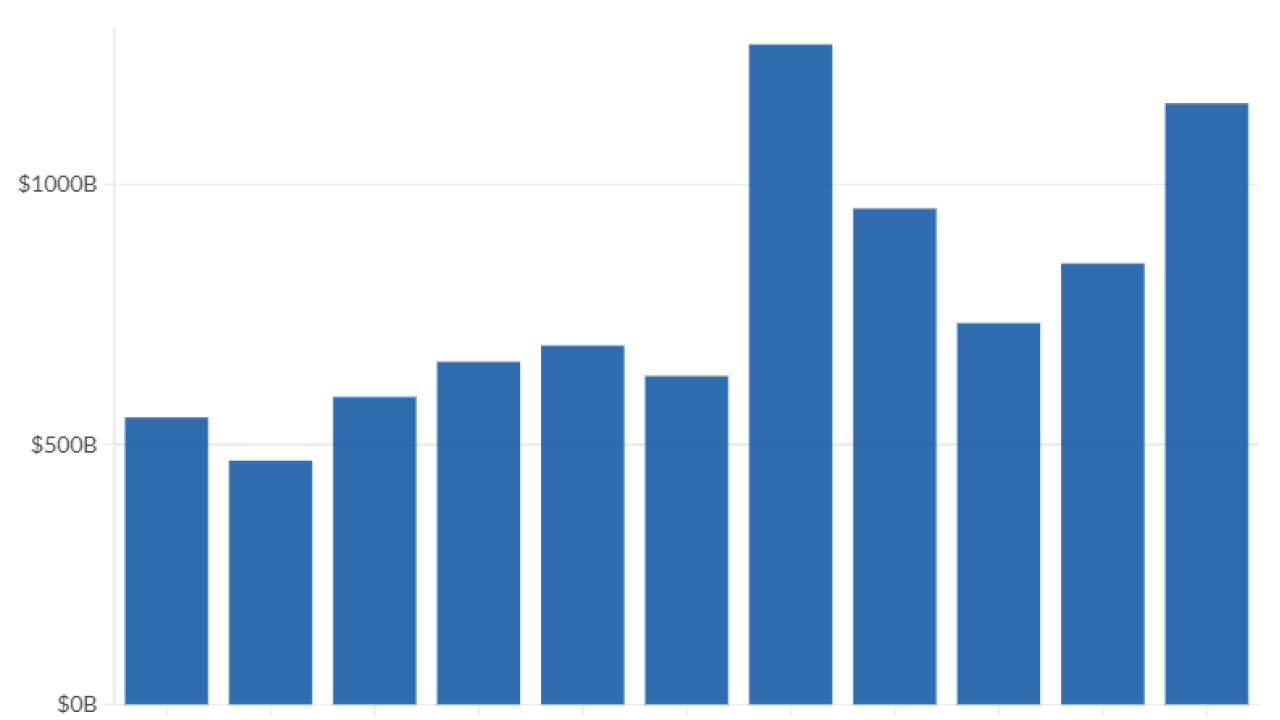

It’s little wonder: Charles Schwab’s new subscription service brought in

The industry’s “pricing model needs to change,” Bernie Clark, executive vice President of Schwab Advisor Services, said at the recent SourceMedia In|Vest conference.

While not everyone is as convinced — “The AUM model will prevail,” predicted David Canter, head of Fidelity’s Clearing & Custody Solutions RIA segment at In|Vest — there’s little doubt that subscription pricing is

“We started to see some interest in this model [from RIAs] about five years ago, and now it’s become a mainstream concern,” says Pete Dorsey, managing director of institutional sales at TD Ameritrade.

So if an advisory firm is considering the model, what should they take into account?

- Fee flexibility

“It’s critical that fee escalators are built into the [subscription] model,” says Scott Slater, vice president of practice management & consulting, Fidelity Clearing & Custody Solutions.

Services that firms will deliver for clients will change over time, says Abby Salameh, chief marketing officer at HighTower Advisors. “So when firms are considering subscription pricing, they need to look at service delivery and how they can move clients to the next tranche.”

XY Planning Network has been a pioneer in employing the fee-for-service model, having used subscription pricing since it launced five years ago.

“It’s especially crucial under a fee-for-service model to get clients in the habit of paying an additional 3% to 5% every year,” XY co-founder Alan Moore writes in a blog for his business partner Michael Kitces titled

- Target markets

Young people who don’t have a lot of liquid assets but are in the early stages of their careers careers are a natural target market for the subscription pricing model.

As TD Ameritrade’s Dorsey puts it: “It’s definitely a way to capture people early in the sales cycle. Subscription pricing is going to be more affordable for people in their 20s and 30s who are still building assets and it’s a model that they are used to.”

But millennials shouldn’t be the only target market, says XY’s Moore.

“Subscription pricing can be the right service model for other client segments who don’t have a lot of liquid assets,” Moore says.

“Real estate developers, for example, have their net worth tied up in their buildings and business owners often reinvest their excess cash back into their businesses. And while doctors are building wealth, they are often in debt into their 40s.”

Many clients of Facet Wealth, another industry trailblazer which has been using subscription pricing since the firm launched two years ago, “have a negative net worth but pretty high income,” says Anders Jones, Facet’s CEO. “The industry is not set up to service those folks, and subscription pricing can definitely expand the market.”

- Value

Switching to a subscription pricing model increases the need to explain what they provide to clients, industry experts say.

“You have to articulate the value proposition and explain why it’s better than charging a percentage of AUM or a commission,” says Facet Wealth’s Jones. “Clients are being charged every month and they will want to know exactly what they’re paying for.”

Moore suggests providing an annual service calendar to clients as one way to demonstrate value to clients.

“The calendar shows clients everything the advisor will do for them throughout the year, from webinars and newsletters to investment and insurance reviews,” he says. “It’s a good way to help build confidence in the service being provided.”

Indeed, when it comes to subscription pricing, “it’s all about articulating what’s in the service delivery,” says HighTower’s Salameh.

- Transition … or not?

Subscription-based billing generally brings in less revenue than AUM-based fees.

At the same time, there are fewer opportunities to add services since younger clients attracted to the model often have less complex planning needs than AUM clients.

Fidelity’s Slater says advisors considering a subscription model should plan for how they will transition clients over time to a traditional AUM fee structure when they have “a broader set of needs.”

But Salameh disagrees.

“Transitioning back to an AUM fee is not a good idea,” she argues. “I believe the AUM model is antiquated. Subscription pricing is very appealing to 25-to-34- year-olds. They will want to continue using it if advisors can price the service profitably and demonstrate the value.”

An advisory firm considering subscription pricing should be committed to the model, Jones maintains.

“Don’t do it halfway,” he says. “The firms who will be successful are not going to jerry rig the model to get more AUM business. I believe a fundamental shift in the market is coming and the successful firms are adapting to it.”

- Branding

Firms that have introduced subscription pricing are generally proceeding with caution.

“It’s important how you put a subscription model out there,” says TD Ameritrade’s Dorsey. “If you’re charging less for a subscription model, you don’t want to undermine your existing AUM business, so some firms are branding the new service differently.”

St. Louis-based RIA Plancorp, for example, has introduced a lower cost digitized advisory service under the BrightPlan brand that uses a subscription pricing model.

For a monthly fee of $20, BrightPlan automates investing of deposits, asset allocation, tax loss harvesting and dividend reinvestments for clients and uses Vanguard and Dimensional funds for their portfolios. Clients can also set up a goals-based plan and speak to an advisor once a year.

BrightPlan is owned by Prumentum Group, which owns 40% of Plancorp. Most BrightPlan clients are younger, still building up their net worth and “not ready for our [AUM-based] service,” says Christopher Kerckhoff, Plancorp CEO.

But BrightPlan clients may one day have more wealth and complex needs. When that happens, and they “decide they want a dedicated advisor, they can click to become a Plancorp client,” Kerckhoff says.