(Bloomberg) -- Robo advisers aren't going away any time soon, and the wealth management industry needs to make some changes if it wants to beat them and a host of other threats it is facing.

That's according to a new note from Morgan Stanley, one of the largest wealth managers on Wall Street with more than $2 trillion in assets under management. The report, sent out by Michael Cyprys, an equity analyst at the firm, says adapting to the new environment is critical.

"[The] rising threat from robo-advice leads financial adviser’s role to evolve: greater focus on financial planning, embracing digital tools such as robos as a means to become more efficient; pairing human and machine," he writes. "Digital capabilities become increasingly more important as millennials are more digital savvy than previous generations which is transforming the investment and wealth management landscape; innovative new entrants such as robos could take share."

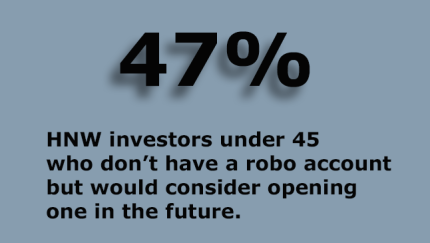

In fact, the note points out that a recent survey found more than 50% of both Generation X and millennials said they would be open to using robo advice.

Low fees and an investing-on-autopilot approach have attracted about $50 billion in assets to the broad universe of robo-advisers, according to researcher Aite Group. This is still a relatively small amount given that there is more than $130 trillion in assets currently under management globally, but Cyprys says the robo advisers "have a long runway for growth."

Blockbuster industry deals and unforeseen shifts in client attitudes are altering future forecasts for digital advice.

ADDITIONAL HURDLES

This isn't the only threat the industry faces, he says, adding that there are another four areas that are worrisome.

Low rates and low growth: With the macro environment accounting for more of the performance in equities than the historical norm, it's harder for active managers to beat their benchmarks.

Passive management inflows: Going off of the first point, passive management and ETFs have seen massive inflows since the financial crisis, meaning managers are getting less of the wealth pie than they have in the past.

Regulation: Tougher rules on giving investment advice are another tailwind for passive alternatives and a headwind for active managers.

Demographics: As referenced above, younger generations are more open to other forms of financial advice, meaning traditional wealth managers are going to have to change in order to gain their trust and access to their growing wealth. At the same time, baby boomers are retiring and starting to take money out of their 401(k)s, not putting more in.

So what does Cyprys think the industry needs to do in order to stay on top?

As noted earlier, more digital tools and financial planning services are appropriate and entering partnerships or even making some acquisitions would help firms. There have already been a number of partnerships and acquisitions in this space, with UBS' wealth management unit in the U.S. partnering with robo adviser SigFig earlier this year, as well as Northwestern Mutual acquiring LearnVest, an online financial planning startup, in 2014.

Morgan Stanley itself hasn't made any acquisitions or partnerships in the space, but the firm recruited Naureen Hassan from Charles Schwab, where she had helped that firm develop its own robo platform.

Read more:

Morgan Stanley CEO James Gorman has previously said it's imperative for the firm to develop robos to complement the firm's existing wealth management offerings.