Two financial advisors’ fund manager friendships allegedly paid off — at their own clients’ expense.

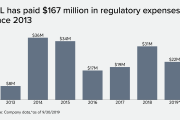

Robert A. Gravette and Mark A. MacArthur of Criterion Wealth Management Insurance Services leveraged a close relationship with an alternative fund manager to reap undisclosed “side compensation” out of their clients’ returns, according to the SEC. The advisors and their Santa Clarita-based RIA made $1.1 million over four years in undisclosed extra compensation, the regulator says.

In a

The conflicts of interest relating to three types of side compensation from the two alt managers should have been disclosed to clients in Form ADV, according to the SEC. The advisors and the RIA also continued to “withhold the whole truth” from clients and failed to update their procedures after warnings by SEC examiners and a compliance consultant, the complaint says.

Private placements like the $16 million in real estate investments the regulator says Criterion's clients made between 2014 and 2017 often result in cases

While most firms and advisors restrict alts

“Defendants kept their clients in the dark as to all these material facts and, in doing so, they violated their fiduciary duty and defrauded their advisory clients,” the complaint states.

“What’s more,” it goes on, “these undisclosed compensation arrangements rendered Criterion’s Form ADV filings with the Commission materially misleading, and no policies and procedures had been adopted and/or implemented at Criterion to prevent these compliance failures.”

BROKERCHECK AND SEC FILINGS

Gravette didn’t respond to requests for comment at Criterion’s offices. MacArthur didn’t return inquiries to M2 Financial, the RIA he formed after leaving Criterion in June 2016. Gravette is the current sole owner of Criterion, but MacArthur had previously held a 50% stake, the SEC says.

The SEC alleges the fund managers made side payments to Ausdal, which then paid 95% to the RIA and the advisors. The alt investments also came in brokerage accounts, and Gravette and MacArthur have been registered with the BD since 2006, according to FINRA BrokerCheck.

Still, the complaint doesn’t charge or identify the fund companies or Davenport, Iowa-based Ausdal. Representatives for the BD declined to comment on the case.

Although MacArthur has no other disclosures on BrokerCheck,

Gravette and Ausdal “made the decision to resolve this matter in order to avoid the expense and uncertainty involved in the litigation process” even though they viewed the complaint as “without merit,” according to the broker comment listed on his file.

The RIA’s latest Form ADV

“Certain investments have historical compensation arrangements that are still being paid to Robert based on performance of the underlying investments,” it says. “That compensation is allowed to be received, but no new non-advisory compensation arrangements are allowable.”

FRIENDLY ARRANGEMENTS WITH FUNDS

MacArthur is a former colleague of the principals of one of the fund companies discussed in the case, and the two advisors have known the other alt manager’s principals since they all attended the same college together, the complaint states.

The university acquaintances agreed to pay Criterion a recurring referral fee of 2% per year “based on the amount of capital invested by Criterion clients in Real Estate Fund 3 and Real Estate Fund 4,” according to the document. No other Ausdal reps recommended the products, and Criterion clients represented half of their investors, the SEC says.

In the same vein, no other clients who invested in the other alt manager’s products used the Class C shares of one fund or the so-called feeder used by Criterion clients into another one, according to the SEC. Above respective 6% and 8% annualized return thresholds, the other clients received 80% of the gains and returned 20% to the fund manager, the SEC says.

Criterion clients who invested in the identical product, though, received only 60% of the returns after the hurdles, according to the regulator. The manager agreed to pay the RIA and the advisors half of the extra performance allocation and carried interest profits from the two funds, the complaint states.

“They owed their clients – who entrusted them with the discretionary management of their money — a fiduciary duty to act with loyalty, fairness, and good faith,” the document says. “This civil enforcement action arises from defendants’ breach of their fiduciary duty when failing to disclose a glaring conflict of their financial interests with those of their clients.”

In addition, the SEC accuses the advisors of failing to follow through when instructed to update their compliance. A third-party specialist told them in 2014 that they needed to review their procedures annually and make a new compliance manual to replace their 6-year-old version, among other steps. The SEC says Criterion didn’t implement many of the recommendations.

Three years later, the SEC’s Office of Compliance Inspections and Examinations issued a deficiency letter alerting Criterion, Gravette and MacArthur to the undisclosed arrangements with the fund managers, according to the complaint.

Criterion responded by sending a letter that June to clients saying that they “should have provided more disclosure,” given the “potentially considerable amounts of non-advisory compensation” relating to the funds, the complaint states.

The letter didn’t spell out the fact that clients “were steered away from investments with more favorable performance allocation formulas” or mention that the compensation agreements with one of the fund managers had reduced their returns, investigators say.

The six-count SEC complaint charges Gravette, MacArthur and Ausdal with violating the anti-fraud statutes and other provisions of the Investment Advisers Act of 1940. The SEC requested a civil penalty and full disgorgement of the ill-gotten gains, plus interest.