Cadaret Grant will pay $1.7 million in regulatory penalties to settle SEC and FINRA claims of broad supervisory lapses at the independent broker-dealer involving complex investments and variable annuities.

In its case, the SEC penalized the firm as well as three individuals, including its president, nearly $1 million collectively for putting clients into investments that, the commission says, the advisors themselves failed to understand.

"Before recommending the investment, the brokers did not take steps to reasonably research or understand inherent risks" of leveraged oil-linked exchange traded notes they sold investors, the commission said in a statement.

In a separate action, FINRA announced $800,000 in penalties against the firm failing to supervise, in part, its brokers' sales of variable annuities; the regulator found that Cadaret has far too few people in supervisory and compliance roles.

Darryl Cohen faces a maximum of 20 years in prison for fraudulently persuading professional atheletes to buy insurance policies at massive markups.

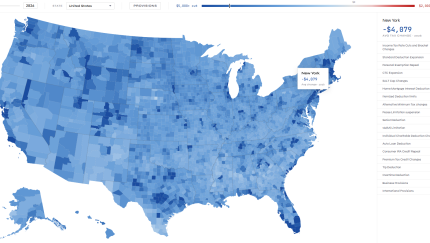

New Tax Foundation research reveals which households and regions gain most from President Donald Trump's One Big Beautiful Bill Act.

RIA leaders are debating "digital employees" but expect service models to expand to meet growing HNW needs, says industry observer Ric Edelman.

In the SEC case, the exchanged-traded notes were meant to be a tool for highly sophisticated investors to hold for just one day. Instead, Cadaret's brokers put their clients in them for months at a time, the commission says, causing some clients to lose as much as 90% of their money.

The penalties collected by the SEC will fully reimburse the firm's clients for their losses, the regulator says.

Without admitting or denying the findings, the firm agreed to a $500,000 penalty from the SEC, plus $13,194 in disgorgement and interest. Firm founder and President Arthur Grant as well as the firm's compliance officer, Beda Lee Johnson, both agreed to a 12-month supervisory suspension, according to the regulator. Grant will pay a $100,000 penalty and Johnson a $75,000 one.

One of the Syracuse, New York-based firm's brokers, Eugene Long, who the commission says sold the most notes to his clients will pay a $250,000 penalty, the commission says.

Reached by phone at the office, Grant read from a prepared statement about the cases, saying, "Many of the allegations in these cases relate to conduct that occurred several years ago, and we have already taken significant steps to address the issues discussed in the SEC and FINRA matters to ensure they do not occur again."

The firm has retained a compliance consulting firm he added, to help with supervisory needs going forward.

The firm declined to make Johnson or Long available for comment.

“Brokers have an obligation to understand complex products and their risks before recommending them to customers,” Daniel Michael, chief of the SEC Enforcement Division’s Complex Financial Instruments Unit, said in a statement. “As this action shows, we will continue to hold people accountable at every level for unsuitable recommendations that harm investors."

In the FINRA case, the regulator illustrated how little the firm has invested in its own oversight.

From August 2012 to May 2017, "the firm employed just three individuals to review for suitability the securities transactions of more than 676 representatives working from more than 450 branch locations," according to FINRA.

In addition to monetary penalties, the regulator is also requiring Cadaret Grant to hire an independent consultant to review its compliance and supervisory procedures.

As in the SEC case, Cadaret Grant agreed to pay the FINRA penalty without admitting or denying the charges, according to regulatory filings.