When it comes to disclosure, everyone’s for transparency. But that doesn’t mean that fund boards know what’s in the trades their brokers have completed for the customers. Or, worse, what the stocks they trade in might actually be worth.

Take Monday’s final session of the day, on omnibus accounting. Or rather the reporting of trade and position details from deep inside those accounts to fund boards.

Sharing all the information in omnibus accounts “can be overwhelming,’’ said Brendan J. Sullivan, a director at the Pershing unit of BNY Mellon.

Brokers are struggling with the amount of detail to supply and putting the information in a format that “gives the information you need in a format you need when you need it.’’

Then there is the simmering brouhaha with the Securities and Exchange Commission, which sooner or later is going to revisit the subject of whether the net asset value of shares in a money market mutual fund need to float every day to reflect what the fund’s holdings really are worth.

And now investors are suddenly surging back into domestic stock funds, to the tune of $20 billion last month.

Do they really know what a stock is worth? That is to say, what brokers are matching up buy and sell orders at?

While listening (and writing about) Monday’s sessions, I also was putting together a spreadsheet. It might be interesting for a fund board to know that the amount of off-exchange trading in stocks is rising to levels that are generally considered to be harmful to discovering the real prices of securities.

In January, more than 40% of the trading in 3,845 of 7,824 publicly listed stocks took place off exchange. That’s nearly half of all stocks, 49.1%.

That’s up from 38.2% of all stocks that crossed the 40% off-exchange line in January 2012 and 29.2% in 2011.

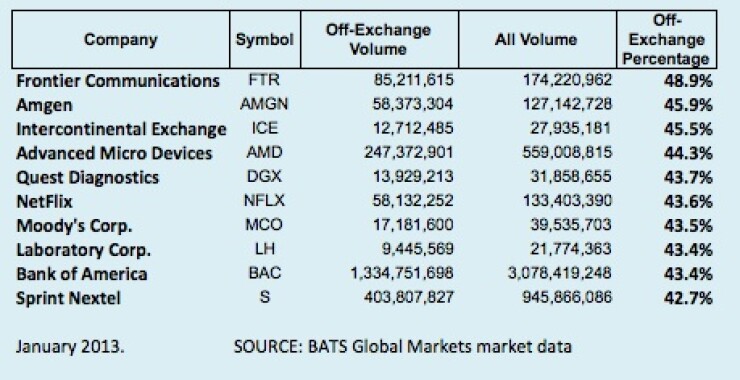

Using Trade Reporting Facility and other market data from BATS Global Markets, I also came up with this “Top 10” from the Standard & Poor’s 500:

What is almost ironic is the company holding down position no. 3: Intercontinental Exchange, which saw 45.5% of trading in its shares happen off exchanges.

ICE is trying to buy the New York Stock Exchange for $8 billion-plus. That is still the flagship venue for “transparent” trading in publicly owned shares. ICE chief executive Jeffrey Sprecher will probably have a little bit of convincing to do, before the Securities and Exchange Commission, on how to change the rules of stock markets – and the regulations that have allowed this – to eliminate this problem.

Also on that Top 10 list: NetFlix, the video streaming company; Sprint Nextel, the wireless services company; and, not surprisingly, Bank of America.

BATS Global Markets chief Joe Ratterman in fact has noted that 1,300 stocks traded more than 50% of the time off-exchange in June of last year.

Didn’t figure out that number for January of this year, in between NICSA sessions.

But fund managers probably ought to try.