Key Insights

- The trade war between the U.S. and China is likely to persist through this year and possibly beyond, which will impact several key Chinese industries.

- Property prices, which were slowing anyway, could be hit further by weakened buyer sentiment if the trade dispute continues, as could auto sales.

- Chinese manufacturers may struggle to procure suitable technology if investment restrictions prevent them from purchasing from U.S. vendors.

The trade war between the U.S. and China is likely to continue dragging on markets for a while yet, despite recent progress. While the agreement reached at the November 30 G-20 meeting in Argentina (to suspend new tariffs for 90 days to allow for talks) may eventually lead to a new trade deal, there are many obstacles to overcome before that happens. There is a strong probability that tensions will continue through this year and possibly beyond, potentially damaging the Chinese property, auto, and manufacturing sectors and disrupting global commodity markets.

Chinese Economic Growth Under Pressure

GDP already falling—and could be further hit by trade war impact.

As of November 30, 2018

* Source: International Monetary Fund.

Efforts to end the trade war have proved to be very difficult so far for a simple reason: The two sides’ goals are largely incompatible. On the one hand, the United States Trade Representative (USTR) wants substantial changes to current trading arrangements to enable it to monitor China within its own borders to end what the USTR sees as unfair trading practices. On the other hand, China wants to continue pursuing its China 2025 industrial policy plan without outside interference.

The two sides remain far apart on core issues such as industrial policy, support for state-owned enterprises (SOEs), and technology. The recent agreement—to suspend the imposition of further sanctions for 90 days, due to take effect on January 1, 2019—could herald the beginning of a better relationship, but barring a major change of heart from President Trump, it is difficult to see how things will improve in the short to medium term.

This will impact Chinese growth, which is already slowing. Last year, China grew by 6.9% and the baseline estimate for 2018 is 6.5%–6.6%, falling further to 6.0%–6.5% this year. Estimates of the net impact from tariffs on growth vary significantly, but the consensus is between 0.5%–0.7% for the current round of measures. There is the potential for further deceleration if the trade war disrupts supply chains or impacts confidence—the International Monetary Fund has estimated a 1.6% reduction in growth from a full-blown trade war scenario of 25% tariffs across the board.

Chinese Homebuilders Face Uncertain Outlook

China is seeking to offset the impact of tariffs with calibrated stimulus, which will continue in order to keep overall growth within the target range. However, it is highly likely that a continuation of the trade war will significantly impact certain Chinese industries. For example, weakened homebuyer sentiment is likely to hit the Chinese property market if trade hostilities persist. Home sales have been slowing anyway as elevated prices and uncertainty over the economy have encouraged potential buyers to adopt a wait-and-see approach; continuing U.S./China tensions are only likely to exacerbate the slump.

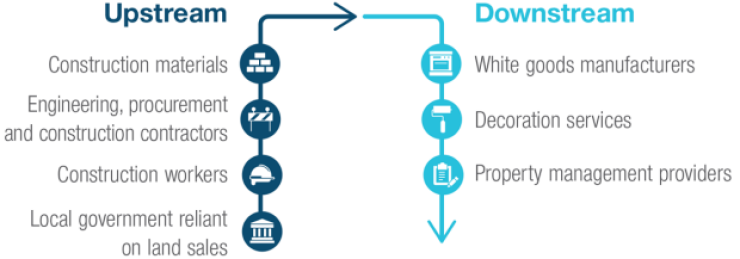

This is important because the Chinese property market accounts for 10%–12% of gross domestic product (GDP)—rising to 20%–25% if upstream and downstream industries are included. Chinese housing industry policy remains tight—onshore bond issuance remains halted by local exchanges, while sector-specific restrictions remain in place. A continued slump in property prices is possible, which would impact the ability of developers to deliver predicted returns to clients.

Property Downturn—Industries Affected

Aggregate impact of 20%—25% GDP

Source: International Monetary Fund.

Decline In Auto Sales Could Be Exacerbated

Mirroring declining home purchases, auto sales have deteriorated rapidly in the second half of 2018. October (when sales fell by 12%) was the fourth straight monthly decline, while the third quarter’s slump of 8% was the worst full quarter fall since 2006. An ongoing trade war is likely to exacerbate the decline. While there is the potential for stimulus to help support sales in the form of a purchase tax cut from 10% to 5% on vehicles with engines no larger than 1.6 liters, the impact of this may be muted as it would come on the heels of previous packages that had minimal effects.

A secondary impact of tariffs is on gross margins, which could be degraded by 67–135 basis points. Given the weak state of the industry, it is unclear how much of this could be passed through to consumers via higher prices. If developers attempt to pass through higher costs, their U.S. sales could be reduced by 1 million units.

Tech Firms May Struggle With Non‑U.S. Procurement

The trade war is not just affecting internal demand—supply chains are also being disrupted. Chinese companies across different sectors are searching for improved technology capabilities but are finding it increasingly difficult to acquire them from the U.S. due to tariffs and other investment restrictions (the conflict over technological capability and intellectual property rights goes beyond the trade war and will persist irrespective of which party is in power in the U.S.).

Although technology supply chains are flexible, with manufacturing locations across Asia, companies are facing at least a year of uncertainty over the manufacturing capacity of non-U.S. tech firms. For example, Chinese firm Huawei would appear to be a good candidate as an “alternative” telecommunications equipment supplier as it generates less than 1% of its revenues from the U.S. and has high net cash on its balance sheet, strong cash flows, and solid growth prospects globally. However, it has been widely labelled as a security threat to the U.S., and the rising influence of nationalism in other countries could put its global business at risk.

The complexity of supply chain arrangements makes it difficult to ascertain precisely the financial impact of Chinese manufacturers being forced to direct procurement to non-U.S. vendors, but it is likely to cost them jobs and access to technology that is superior to that available elsewhere. However, of bigger concern is the global impact of the tariffs on the broader technology customer base. To date, there has been a slowdown in semiconductors, with most companies issuing guidance below recent growth rates—other areas could follow. Overall, the technology outlook is clouded by uncertainty over tariffs, supply chain restrictions, and possible sanctions.

Commodity Exporters Could Be Hit By Falling Chinese Demand

The impact of a U.S./China trade war will be felt in many other countries, too. A number of leading global commodity markets, including copper, iron ore, and oil, are highly dependent on Chinese demand. If trade tensions cause China to go into recession, oil would come under pressure (though not to 2016 levels), and there could be substantial downturn in metals as there is no other marginal buyer to take China’s place.

Regionally, Indonesian coal issuers face a more uncertain outlook for seaborne coal pricing. China remains the biggest consumer and importer of thermal coal, so any growth slowdown due to trade tensions would put pressure on coal prices. At the same time, Chinese domestic coal production is likely to grow as mines have upgraded to meet environmental standards.

Trade Disruption Could Open Up Opportunities Elsewhere

Overall, a continuation of the U.S./China trade war through 2019 would be likely to significantly hit markets within China and further afield as the full impact of tariffs and other investment restrictions becomes felt. However, the subsequent disruption may create opportunities as well as risks.

Other countries are already focused on attracting a portion of the supply chains likely to be relocated out of China, with frontier markets such as Vietnam, Cambodia, and Bangladesh poised to gain more foreign direct investment in the textile industries. On the high end, Taiwanese companies have told investors they may move some production back to Japan, while Malaysia may also benefit from its electronics cluster. Elsewhere, Thailand, which is on the lower end of the tech supply chain, may gain in areas that are related to natural resource manufacturing such as tires.

WHAT WE’RE WATCHING NEXT

Although the agreement to suspend new tariffs for 90 days marks an official pause in the trade war, the potential for an escalation of tensions over the next three to six months remains very real. The White House retains full discretion over what “progress” means regarding behavioral change from China, and a lack of clear advancement in key areas could reignite the threat of new tariffs. Moreover, the G-20 agreement did not address the biggest obstacle to a future harmonious trading relationship between the U.S. and China: Beijing’s “Made in China 2025” agenda.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of January 2019 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Investors will need to consider their own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., Distributor.

201902-733350