(Bloomberg) --UBS plunged the most in three months after first-quarter profit missed analysts’ estimates, hurt by a slump in earnings across wealth-management and trading businesses.

Net income fell 64% to 707 million Swiss francs ($741 million) from a year earlier, the Zurich-based bank said on Tuesday. That missed the 735 million-franc average estimate of five analysts in a Bloomberg survey. At the investment-banking unit, led by Andrea Orcel, profit declined 67% to 253 million francs.

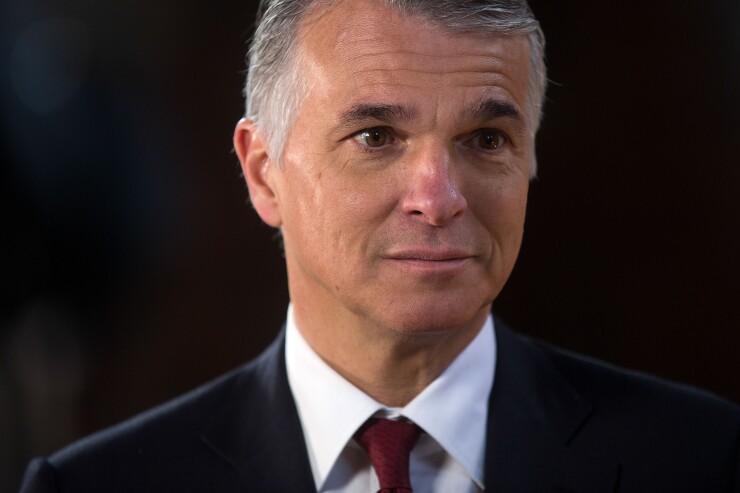

Chief Executive Officer Sergio Ermotti, 55, who has shifted the bank’s focus away from investment banking in favor of wealth management, is struggling with market volatility that led to a slump in trading across the firm. While there have been some signs of improvement, economic challenges and geopolitical risks mean clients are avoiding risks and that’s “unlikely to be resolved in the foreseeable future,” the lender said.

“We definitely entered into a kind of new territory in the first quarter,” Ermotti said in an interview with Bloomberg Television’s Guy Johnson. “The first quarter was an environment that had only one constant -- risk aversion from January 1 until the end of the quarter.”

UBS shares dropped as much as 8.1% and traded at 15.21 francs at 12:43 p.m. in Zurich, down 8%. They have tumbled about 22% this year, while Swiss rival Credit Suisse, which is following UBS in shrinking its securities business to focus on wealth management, has lost 37%.

Revenue slipped 23% to 6.8 billion francs in the first quarter, while the adjusted return on tangible equity, a measure of profitability, dropped to 8.5% from 14.4%. Ermotti said the bank maintains its 15% target for 2017 and will be “in a better position” to update markets at the end of June.

While UBS remains committed to grow its dividends, Ermotti said on a call with analysts that it’s “difficult” to asses the impact for the full year at this stage.

“This cocktail of macro issues, geopolitical issues is now coming on,” he said in the interview. “You see a lot of factors that may affect market sentiment -- and in that sense you might see volatility -- but it’s not the kind of volatility that is translating to client activity. It’s a paralyzing volatility.”

SECURITIES REVENUE

Europe’s largest lenders are seeking to weather a drop in securities revenue, hurt by market swings, record-low interest rates and tougher regulation. The five biggest U.S. investment banks saw their combined trading revenue drop 22% in the first quarter, while BNP Paribas said on Tuesday that revenue from trading fixed income, currencies and commodities slipped 13%.

At UBS, the profit drop at the investment bank missed analysts’ estimates of 396 million francs. Corporate client solutions, the part of the unit that helps clients issue debt and equity and advises on mergers and acquisitions, had a decline in revenues of 39% to 474 million francs in the first quarter. Investor client services, which houses the trading business, had a drop in revenue of 25% to 1.4 billion francs.

The wealth management division, led by Juerg Zeltner, reported a pretax profit of 557 million francs, down from 951 million francs a year earlier as the bank had “the lowest transaction volumes recorded for a first quarter” at the unit. The unit’s profit fell short of the 682 million-franc average estimate of six analysts compiled by Bloomberg News.

'MORE CAUTIOUS'

"The outlook wording sounds a bit more cautious than usual,” said Tomasz Grzelak, a Zurich-based analyst at MainFirst, with a neutral recommendation on UBS shares. “The soft start of the financial markets into 2016 continues to bode ill for both the wealth-management unit as well as the investment-banking division.”

Wealth management attracted 15.5 billion francs in net new money in the first quarter, reversing 3.4 billion in outflows in the previous quarter and making for annualized growth of 6.5%. While that’s above UBS’s target of 3% to 5%, Ermotti said that the bank expects “more moderate growth” in the rest of the year.

Asset management saw net outflows of 5.9 billion francs, with one client pulling 7.2 billion francs over pricing. The unit’s pretax profit almost halved to 90 million francs.

“The very good net new money development is the bright spot in the first quarter after two weak quarters,” said Andreas Brun, an analyst at Zuercher Kantonalbank in Zurich, who has a market perform recommendation on UBS shares.

‘CHALLENGING ENVIRONMENT'

The bank’s CET1 ratio, a measure of financial strength, dropped to 14% at the end of March, from 14.5% three months previously, following an increase in risk-weighted assets. The leverage ratio increased to 5.4% from 5.3%.

UBS said it’s on track to cut costs by 1.4 billion francs by the end of June under a plan announced in 2014, as part of efforts to lower expenses by 2.1 billion francs by 2017.

“UBS earnings are sensitive to broader market headwinds, but the company is doing its best to offset this through ongoing cost saves,” Andrew Coombs, an analyst at Citigroup Inc. with a buy recommendation on the shares, said in a note on Tuesday. “We believe today’s share price reaction is overdone and see this as a buying opportunity.”