Waddell & Reed Financial’s independent broker-dealer is boosting advisor pay across all tiers of its compensation grid. The company is making a raft of other changes, too, that President Shawn Mihal calls the most significant of his short but eventful tenure.

Mihal took over his role just

“Advisors have asked for a more robust product offering, they’ve asked for increases in the compensation grid,” Mihal said in a phone interview from Waddell & Reed’s suburban Kansas City office after the webcast. “We are delivering on all those things that advisors have been requesting.”

Most of the advisor payout rates on the firm’s grid will increase by between two to five percentage points, with one portion rising by 10, to a maximum of 94% in January, according to Mihal. In

The firm also plans to close its 100 remaining brick-and-mortar offices by the end of 2020 in favor of personal branches for advisors. Waddell & Reed is also enhancing its technology and home-office services, while adding more unaffiliated funds to its advisory programs.

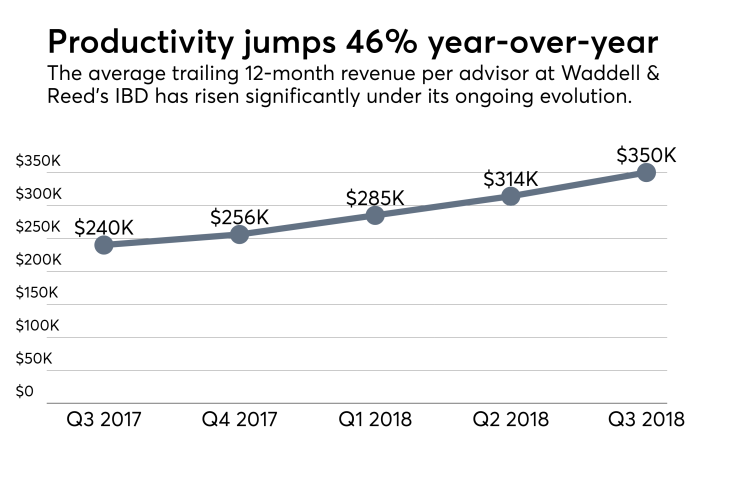

Fintech investments under the firm’s “Project E” (for evolution) multi-year reorganization began in 2016. New productivity requirements have also cut advisor head count by more than 400 advisors year-over-year and

Waddell & Reed’s transition is reminiscent of Ameriprise’s transformation, says John Turner, an ex-Ameriprise executive who is now a senior loan officer for the investment advisory team at Live Oak Bank.

Ameriprise, the No. 2 IBD in revenue, was once also “emerging from more of a captive, agency-type role” to an independent model, he says.

Turner says advisor satisfaction, retention and recruiting are the most important metrics to watch, adding, “It’s hard to recruit into a captive system, but it’s much easier to recruit into an open system.”

-

The firm remains in transformational flux, but the results of its "Project E" evolution are beginning to show.

August 1 -

The firm is prioritizing its most productive advisors after shedding some 30% from its headcount.

May 1 -

A multi-year reorganization of the firm has lowered head count by more than a quarter but boosted productivity by nearly a half.

November 2

The firms with the highest percentage growth year-over-year are cutting their head counts and fueling the record level of M&A deals.

Waddell & Reed’s advisors have already vacated 36 offices this year, ahead of an expected 54 in 2019 and 46 in 2020, according to Mihal. Advisors with the firm, the No. 13 IBD in revenue, will instead operate from personal branches leased or owned by themselves with their own infrastructure, like other firms in the sector.

Advisors can start their own “doing-business-as” name for their practices, or lease space under the Waddell & Reed brand. The home office serves as the office of supervisory jurisdiction, with regional OSJ representatives from the corporate office in the field.

Waddell & Reed’s parent began a field structure realignment of the IBD last year,

The firm is helping advisors with real estate through transition loans, vendor discounts and client notification letters, among other services adding up to “an overarching infrastructure of support,” Mihal says. “It’s a relatively long runway to work with those advisors and make that transition.”

The firm is also taking an incremental approach to tech, with

MAP Navigator, the IBD’s fastest-growing advisory product, has

Another third-party advisory program slated for a 2019 rollout will tap multiple ETF providers, including Blackrock, State Street Global Advisors and Wilshire Associates. Wilshire will also manage an open-architecture mutual fund platform, and the IBD has even payouts for affiliated and third-party funds.

The IBD is also building up its advisor service model. Waddell & Reed is starting a “white glove” support program for top advisors pairing them with dedicated home-office staff. The firm is also expanding its recruiting team, bringing in a new practice development group and adding supervisory staff.

“We’re really trying to put that advisor experience at the forefront,” Mihal says. “In order to provide the end client with a really positive experience, you have to put your advisors in a position to deliver that to clients.”