Investor advocates and one of their leading voices in Congress are upping pressure on FINRA to ensure that bilked investors are paid the compensation they were awarded through arbitration.

Sen. Elizabeth Warren (D-Massachusetts) on Tuesday introduced the Compensation for Cheated Investors Act, which would direct FINRA to create a pool of money earmarked to pay compensation to investors who might otherwise go unpaid. The funds would be drawn from enforcement penalties collected from brokers. .

"FINRA has the authority to make sure defrauded investors don't get stiffed — and this bill will make sure it uses it," Warren says in a statement. "FINRA is supposed to be looking out for them, not the brokers and dealers who cheat them."

The next day, the Public Investors Arbitration Bar Association released a report estimating that investors have been unable to collect hundreds of millions in unpaid awards.

"The

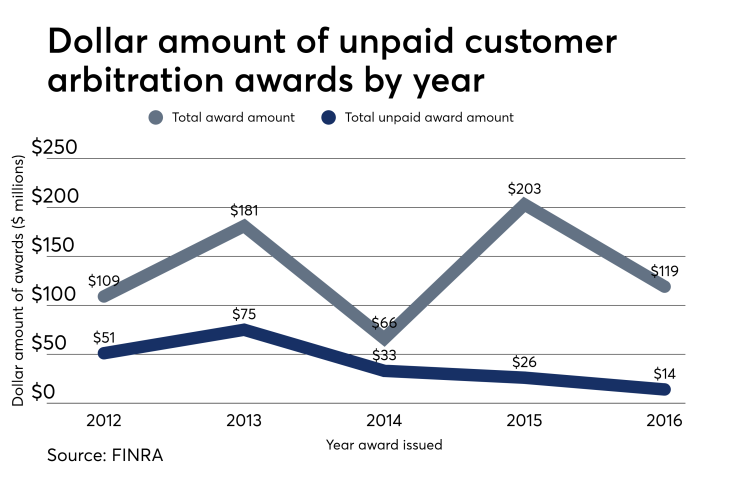

From 2012 to 2017, brokers found at fault for cheating investors failed to pay about $220 million in arbitration awards, according to PIABA's new study. Last year, 36% of investors who won an award received nothing. Collectively, brokers found at fault paid out 72 cents on the dollar of arbitration awards.

-

Investor advocates laud regulator's newest steps to address the longstanding problem.

February 9 -

Critics say the practice of using non-attorneys, some with criminal records, to represent investors often makes their problems worse. Advocates say it's cheaper.

January 4 -

"Sunlight is the best disinfectant," investor advocate says of regulator's move to keep disciplinary problems in public view.

December 12 -

The regulator skips creating a fund for investors with unpaid arbitration claims, despite raising hopes that it might.

May 12

FINRA has

"FINRA has taken many steps in recent years to use the tools within its power to help customers recover the awards they are owed," a FINRA spokeswoman says in an email.

"Through the

FINRA's paper included a number of policy avenues Congress, the SEC or FINRA itself could take to address the shortfall in arbitration awards payments, including the establishment of a separate brokerage fund apart from the Securities Investor Protection Corporation. Other suggestions include new rules raising capital requirements for brokerage firms, new insurance mandates, or legislation to stipulate that arbitration award obligations cannot be forgiven through bankruptcy proceedings.

But there is an "undeniable logic" in creating a pool from the fines FINRA collects from bad actors to redress uncompensated investors, according to Hugh Berkson, an arbitration attorney and former PIABA president who co-authored the new report.

The penalties FINRA collects would be "more than sufficient to fund a pool," Berkson says.

PIABA is holding its annual Capitol Hill advocacy day this week, when Stoltmann says more than 100 members of the group are planning to meet with lawmakers and staffers from both parties in the House and Senate. In those meetings, they expect to press the issue of unpaid arbitration, a matter in which PIABA officials say they see interest from both sides of the aisle.

Stoltmann credits FINRA for taking preliminary steps to identify unpaid arbitration awards as a problem and publish some data on the issue, but he was dismayed that the regulator did not go further.

"We don't really need legislation. FINRA could do this on their own if they were inclined to do so," says Stoltmann, the report's other co-author. "But so far they've been unwilling to do it, so the legislation from Sen. Warren comes in over the top to force them to do it."

Other observers see the bill as a long shot, particularly if it's not folded into a larger legislative package. More likely, it will elevate the profile of the arbitration issue, and could compel FINRA to act on its own, says Duane Thompson, senior policy analyst at the fiduciary training firm fi360.

"The Warren bill appears to be political messaging designed to keep pressure on FINRA and highlight the issue," Thompson says. "I think there is very little chance a Warren stand-alone bill like this one will pass in Congress. I think any change that occurs is more likely to be initiated by FINRA."