An RIA consolidator and hybrid LPL Financial enterprise made its 10th deal of the year. The acquisition agreement comes as its private equity backer is reportedly considering a sale of part of its stake.

Wealth Enhancement Group is buying Miami-based Investor Solutions, a fee-only firm with six financial advisors and $1.1 billion in client assets, the firm

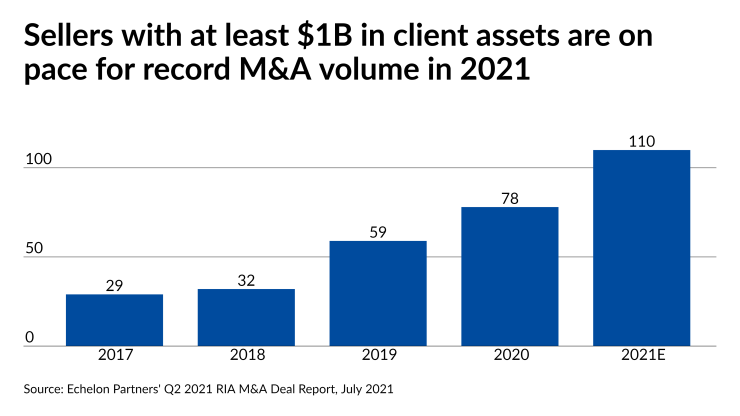

The number of M&A deals this year in the industry is on track for its ninth straight annual record volume, due to “strong secular trends (consolidation, succession planning, competition), supportive capital markets (cheap debt, heightened corporate cash balances, significant private equity dry powder) and fears of potential changes in the tax legislation,”

As PE firms and other investors converge on RIAs based on metrics such as client attrition of little more than 2% or 3% per year and a business that doesn’t seem as tied to equity values as once thought, sellers are jumping, says Savant Wealth Management CEO Brent Brodeski.

“A lot of the RIAs had hoped that the next generation would be able to buy them out,” Brodeski says. “We've done a lot of deals, we've got a lot more coming. There's a lot of demand to become part of something bigger.”

Savant itself is

CEO Frank Armstrong launched Investor Solutions in 1993, and advisors Richard Feldman, Robert Gordon and Brett Fingerhut are part of its executive leadership. The practice represents Wealth Enhancement’s first location in South Florida and fourth in the state alongside two offices in Jacksonville and one in Tampa. The parties expect the deal of an undisclosed price to close in October.

“We had a wide range of choices as to which wealth management firm to partner with in order to facilitate Investor Solutions' next stage of growth, but Wealth Enhancement Group made our decision an easy one” due to its technology, expertise and management team, Armstrong said in a statement.

In an interview in June shortly after news

“As a matter of policy, we do not comment on strategic transaction processes that may be undertaken by ourselves or our capital partners,” Clemens said in a statement.