Aggressive strategic RIA acquirers such as Focus Financial, Mercer Advisors, Mariner Wealth Advisors, and Captrust Financial Advisors tend to grab M&A headlines. But 2½ years in, make sure to include Wealth Partners Capital Group among those RIA M&A powerhouses.

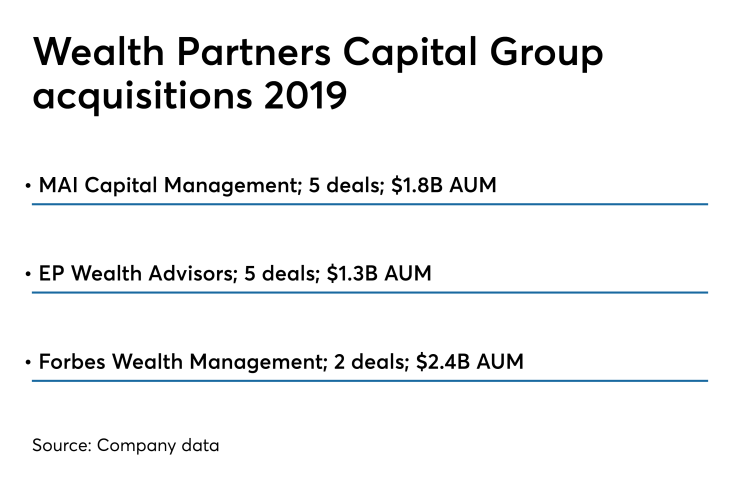

The Palm Beach, Florida-based holding company, founded in 2017, has stakes in three major RIAs across the country, which combined for a total of 12 deals last year with a total of approximately $5.5 billion in AUM.

Wealth Partners affiliate MAI Capital Management, a Cleveland firm with $6 billion in AUM, completed its sixth deal of 2019 at the end of December, acquiring J.M. Hartwell, a New York City-based RIA with $640 million in AUM.

Another Wealth Partner firm, Torrance, California-based EP Wealth Advisors, completed five acquisitions last year, including the just-announced purchase of Guidant Wealth Advisors, a $261 million firm in suburban Chicago, in mid-December.

The third Wealth Partners affiliate, New York-based FWM Holdings, parent company of Forbes Family Trust, bought two firms in 2019, including Optima, a $2 billion wealth manager in New York.

Wealth Partners has non-controlling minority investments in its three partner firms and helps the RIAs raise capital for acquisitions.

Wealth Partners managing partner John Copeland expects active deal-making for both his company and the RIA industry to continue in 2020.

“The macro-opportunity to partner with small firms for succession or growth has never been better,” said Copeland, who was a senior executive at Affiliated Managers Group before co-founding Wealth Partners with Rich Gill and Sean Bresnan in 2017. “Advisor demographics remain highly favorable and businesses are more valuable.”

Asked whether he thought a market downturn would slow the bull market for RIAs, Copeland said he was confident many RIAs would continue to want to “be part of something bigger and broader when the inevitable downturn occurs.”

We saw the business was changing a lot and clients were starting to ask for more complex services.

J.M. Hartwell began searching for an RIA to partner with in 2015, according to Jordan Press, a principal at the firm.

“We saw the business was changing a lot and clients were starting to ask for more complex services than we historically offered,” Press said.

Discussions with several RIAs and a bank proved unfruitful. Hartwell felt it would be subsumed by a much larger advisory firm. Its active portfolio management strategy emphasizing growth stocks didn’t mesh with another suitor. The bank didn’t prove to be a cultural fit.

MAI proved to have several advantages.

Affiliated Managers was a stakeholder in Hartwell, and Press and William Miller, another Hartwell principal, knew Copeland from his time at Affiliated.

“Having John be able to pre-vet MAI for us gave me a lot more confidence,” Press said. “It was like entering the game in the third quarter instead of the first.”

And MAI, founded by Rick Buoncore, who was previously a fund manager, also has an active management investment philosophy that meshed with Hartwell’s growth stock expertise.

“MAI can take over the back office and operational tasks and allow us to focus more on investing,” said Press, who is now a regional managing director at MAI. “We wanted to partner with a firm that was built for the future and MAI was the only company that seemed built for the next 30 to 40 years.”