Baseball greats Mickey Mantle and Roger Maris were known as the “M&M Boys” when they were hitting home runs for the New York Yankees in the 1960s.

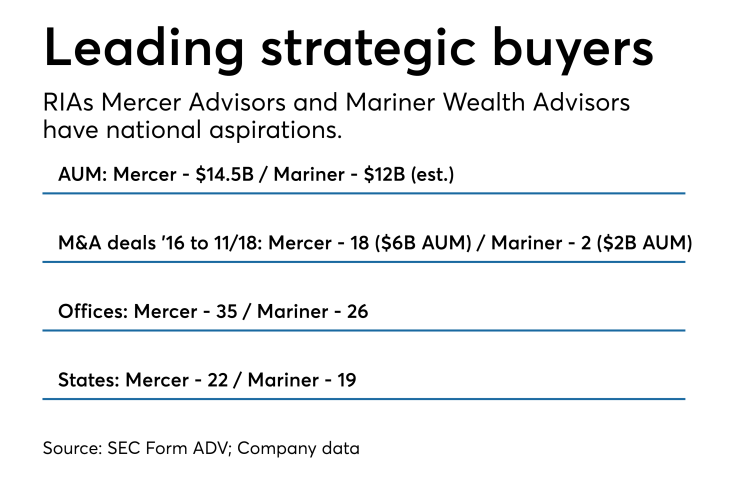

A half-century later, the RIA business has their own pair of “M&M” sluggers —Mariner Wealth Advisors and Mercer Advisors. In November alone, the two firms demonstrated their considerable M&A prowess, snapping up four advisory firms with over $3 billion in combined assets under management.

Mariner is buying Patriot Wealth Management, a Houston-based advisory firm with $1.8 billion in AUM. Mercer will acquire FIM Group, a Traverse City, Michigan, RIA with $600 million in AUM; Sigma Investment Management Company in Portland, Oregon ($500 million AUM); and Hackensack, New Jersey-based Beacon Wealth Management ($230 million).

Like Mantle and Maris, Mariner and Mercer have contrasting styles but are achieving impressive results.

“Both Mariner and Mercer have made significant progress in terms of a brand and repeatable acquisitions,” says industry consultant John Furey. “They are known quantities with advisors who help facilitate transactions. In M&A, past success is an indicator of future results. They are both well capitalized, which increases seller confidence. But more importantly, both firms have a track record of systematic organic growth.”

Furey, principal of Advisor Growth Strategies, also notes the rise of RIAs with national aspirations who are focused on building scale.

“RIAs with $700 million-plus in AUM now control over 60% of the market,” he says. “Mariner and Mercer are leading candidates to deliver further consolidation and concentration in terms of market share.”

Mariner, based in Overland Park, Kansas, is estimated to have over $12 billion in AUM and has been a strategic M&A buyer for the past decade. This year, CEO Marty Bicknell doubled down on Mariner’s wealth management business, selling off its affiliated institutional asset management arm, Montage Investments.

Mercer vice chair Dave Barton expects the M&A to remain “hypercompetitive” next year, “driving up valuations.”

The sale will give Mariner a “war chest” to implement an aggressive five-year growth plan to become “a national wealth advisory firm,” Bicknell says. The CEO wants to roughly double both the number of the firm’s advisors (to 500 from 250) and offices (to 50 from 26). Mariner says its advisors have over $23 billion in assets under advisement but does not list either AUA or AUM on its corporate SEC Form ADV.

Mariner began buying back minority interests in firms it controlled earlier this year and now owns 100% of all its affiliated RIAs. Going forward, Mariner is offering sellers an all-cash deal, Bicknell says, with the possibility of phantom equity for principals. All transactions will be self-funded by Mariner and not rely on outside capital, he added.

By contrast, Mercer, which has approximately $14 billion in AUM, is able to draw on the considerable capital resources of Genstar Capital, the private equity firm that bought the RIA in 2015 (and also owns Cetera Financial Group, one the country’s largest IBDs).

Mercer Vice Chairman Dave Barton, who heads the firm's M&A efforts, says the RIA is able to finance most deals with its cash flow and credit line. It offers sellers a cash deal of around 60% to 70% at closing and the rest after a one-year earn-out period. That amount is based on revenue retention excluding market performance, Barton says.

-

The sale of an asset management firm gives Mariner a capital source to buy RIAs. Lots of them.

October 20 -

Capital is pouring into the RIA market, resulting in more deals, more competition and higher prices.

January 1 -

One of the fastest growing RIAs in the industry, Mercer Advisors expands its tech expertise by bringing aboard Dave Welling, of financial software firm SS&C Technologies.

June 13

The FIM acquisition gives Mercer a presence in Hawaii and the Sigma deal expanded the firm's footprint in the Pacific Northwest. Mercer plans to continue to “systematically acquire and integrate firms” to build a national platform, with particular interest in the southeast, Texas and Florida, Barton says.

He expects the M&A to remain “hypercompetitive” next year, “driving up valuations.”

Most of the deals Mercer is interested in attract “multiple bidders,” Barton says, usually United Capital, Focus Financial Partners, BAM Advisors Services and, of course, Mariner.

Barton anticipates seeing more regional RIAs with between $1 billion and $4 billion in RIA in the mix in 2019. “They want to get scale,” he says.