Some financial advisors are nearly

Companies including YCharts and AssetMark told Financial Planning their advisor communications have spiked in recent weeks. Fidelity Institutional had “historic call volumes” in March, according to the firm.

“People have been working late nights and weekends to make sure that we're staying current on those [advisor] requests,” says Carrie Hansen, COO of AssetMark.

Clients want to hear more from their advisors — they opened up 47% more emails from their planners in March than February, according to data from advisor marketing platform AdvisorStream. Demand is up for vendors, too.

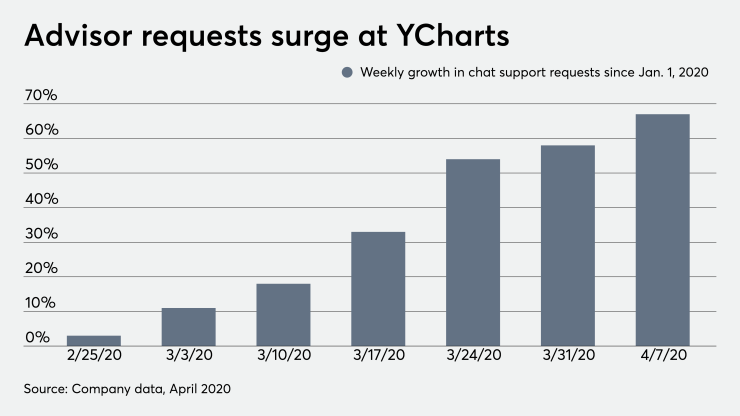

The surge for YCharts came after an initial decline — early in the coronavirus crisis, advisor interactions slipped as planners started working from home and spent more time on client outreach, says James Han, vice president of customer success at YCharts.

Then it flipped in the last two weeks of March. Advisor conversations — whether via phone call, email or digital chat — were up about 50% compared to last year, Han says. The types of questions have been more in-depth, and conversations tend to be longer. “[Advisors] are asking a couple follow-up questions,” he says.

Schwab, which also saw advisor inquiries slip in early March, says planners now are looking for reassurance — they want to know Schwab will function at the same level they’re used to.

“The most reassuring thing we can do is continue to operate the way that we always have in terms of being able to deliver … whether it's handling their transaction, or being here to answer the call for them,” says Jalina Kerr, senior vice president of client experience at Schwab Advisor Services.

Kerr says her team of about 150 people is focused on helping advisors learn to adopt digital tools. The custodian now offers webinars four times a week (up from once a week) to demonstrate useful tech and business practices.

The team is also using its data to find firms still generating a lot of paperwork. Then they reach out to those RIAs to recommend tools like DocuSign or electronic authorization features. The client experience team has added new popups for digital tools in the Advisor Center platform.

Asset manager AssetMark, which has about 7,000 advisors using its platform and TAMP, says calls are up. Over the last two weeks of March, the firm fielded approximately 1,600 to 1,900 calls a day — up from the standard 1,000 or 1,200 daily calls from advisors, Hansen says.

Advisors and clients of the company make changes/new selections of investment products about 100 times a day, Hansen says, but trading volume has shot up. “Our highest day we got 1,800 investment solution changes,” she says.

Firms that service advisors are having to meet this demand while settling into a remote environment. All YCharts and AssetMark employees are working from home. About 90% of Schwab’s employees are doing so, according to Kerr, who spoke with Financial Planning April 3.

Schwab has separated employees into groups — some of whom are fielding inbound phone calls and others who are supporting inbound operational processing support. Kerr says the strategy is working well, and calls are answered in four seconds, on average.

For YCharts, streamlining operations has been key. “We are just being more efficient with our time,” Han says, noting they have become more efficient at answering commonly asked questions. For example, YCharts has added chart templates that allow advisors to see data related to coronavirus — such as hospitalizations and cases per day.

Hansen says the company has upped communications with all advisors on its platform through meetings, including webinars. She updates them on the latest trading volume, how many calls are coming in and lets advisors know the company is answering all inbound calls within 20 seconds.

“What we're finding really is if you don't communicate, people are going to make assumptions about what you're doing,” Hansen says.

At the beginning of April, David Canter, head of Fidelity’s RIA custody division, began a

New York WFH: Conference calls from my “home office “. pic.twitter.com/wVndRCYZwD

— Kathy Jones (@KathyJones) March 27, 2020

Despite the increase in work and stress, companies say employees are supporting one another and getting creative with ways to keep morale high. Schwab and AssetMark are passing along pictures of employees’ home offices. YCharts had a Tiger King happy hour April 3.

“I think it's just really trying to find those connection points and find the silver lining in the challenges that people are facing, and I think it's helping the team rally and stay together,” Schwab’s Kerr says.