-

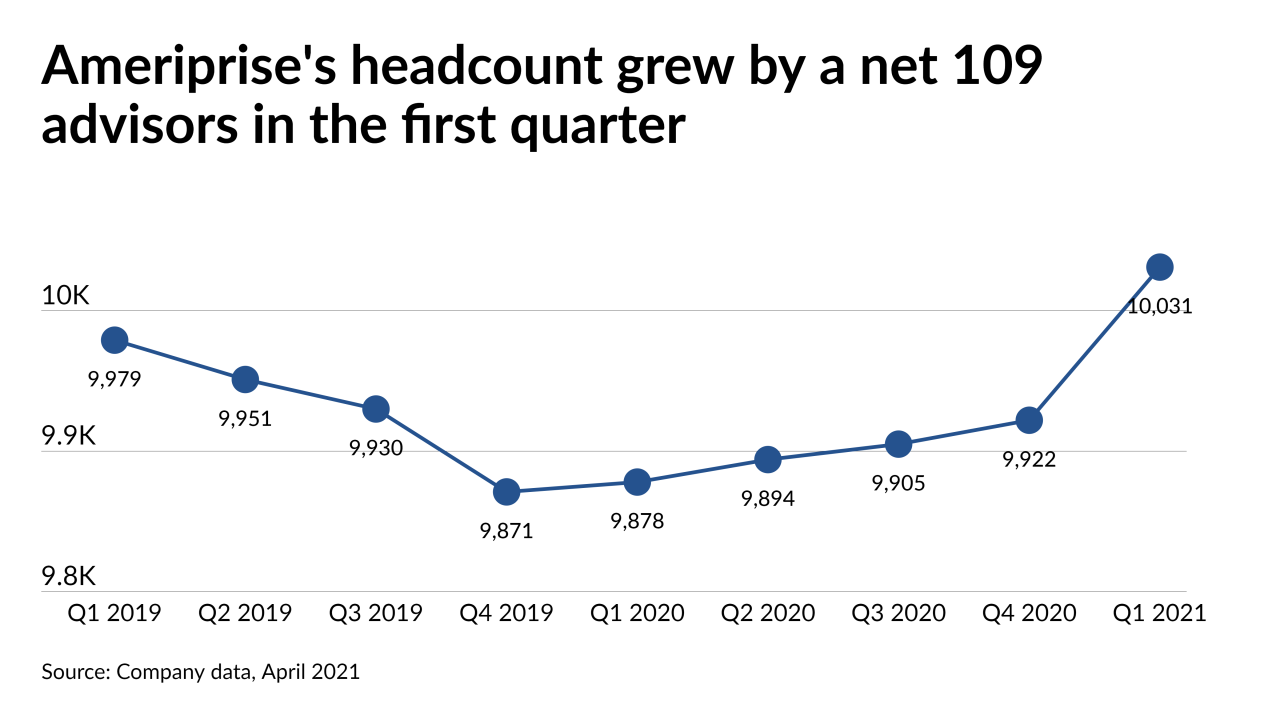

CEO Jim Cracchiolo views incoming advisors as “a continued good opportunity” for the firm, he told analysts on an earnings call.

July 27 -

Financial advisor Jennifer Marcontell went independent after more than 20 years with her prior brokerage, which itself is making a major change to its structure.

July 8 -

The regulator charged RiverSource with violating a provision of the Investment Company Act that’s never previously been part of an enforcement action.

May 26 -

The wealth programs in the channel are going through a significant shift amid major recruiting moves and consolidation, according to a consultant’s report.

May 2 -

The firm’s financial advisor headcount and its client assets drove up its business in the first quarter, despite the impact of lower asset values.

April 26 -

The advisor failed to disclose the low-interest loans he received from a fraudulent crypto securities issuer in exchange for selling the products, investigators say.

March 2 -

Financial advisor Alan Kodama’s team aligned with the No. 1 IBD as it reeled in $35 billion in recruited client assets in the second quarter.

August 2 -

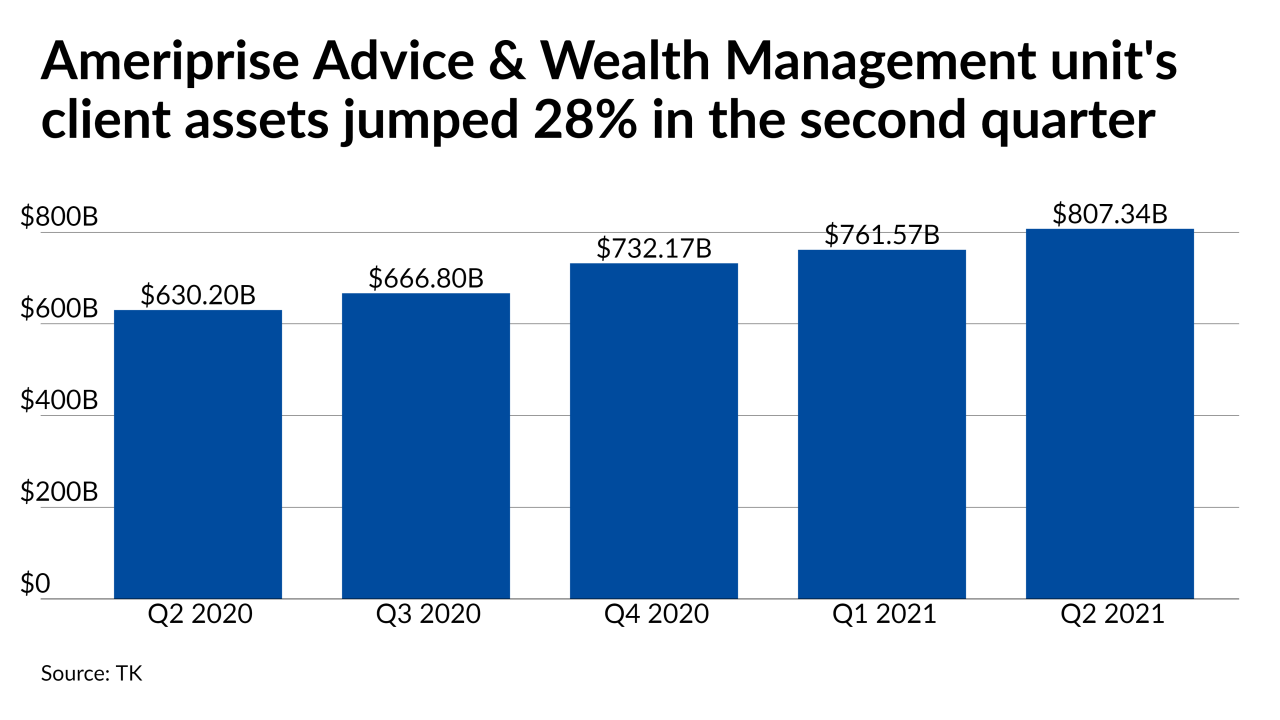

CEO Jim Cracchiolo acknowledged that the firm attracted fewer experienced reps in the second quarter, even as its headcount ticked up by 2%.

July 27 -

Banks and other institutions are driving significant recruiting moves while aiming to convince more members and clients to sign up for financial advice.

July 13 -

The giant wealth manager is re-hitting its stride after its best quarterly net gain in advisors in at least two years.

June 28 -

Two representatives in a New Jersey office made lewd comments and created a hostile work environment, the former employee says.

June 11 -

The firm’s recruiting is also gaining steam, despite the ongoing impact to its bottom line from low interest rates.

April 28 -

The acquisition will add $124 billion of European AUM and give Ameriprise access to the Canadian bank’s ESG strategies. It will also initiate a distribution relationship with the Bank of Montreal’s North American wealth management business.

April 12 -

The rare move to set aside the regulator’s ruling came more than a decade after the rep ran into trouble by adding notes about his client into a software program.

March 11 -

The brokers collectively generated more than $88 million in annual revenue while overseeing nearly $15 billion in assets under management.

February 2 -

At an average age of 37, the top-producing brokers operate in 18 different states, plus the District of Columbia and Guam.

February 1 -

The nearly 10,000 advisors affiliated with the firm grow 2.5 times as fast as their peers at rival brokerages, CEO Jim Cracchiolo says.

January 29 -

Necessary new approaches include better cultural understanding, more flexibility for new entrants and more outreach, advisors and executives say.

November 19 -

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30 -

The father-son practice with two other advisors switched their affiliations after its founder had spent 18 years with New York Life.

August 18