-

The aggregator introduces banking services and says it will continue to acquire new firms.

May 9 -

With an eye on a future sale, the $48B RIA wants to build enterprise value.

May 1 -

The large aggregator faces questions about its future.

April 22 -

Strategic buyers have less cash but more flexibility, experts say.

March 21 -

Still, advisors thinking of selling are urged not to procrastinate.

March 12 -

-

Concerns mount about the aggregator counting tuck-ins as organic growth.

January 2 -

The following 17 teams oversaw about $75 billion in assets. The firms ending the year with prize recruits include a diverse cast: regional BDs, wirehouses, boutiques and RIAs.

December 14 -

The New York aggregator’s performance to date “will make it easier for other RIAs to go public,” says industry analyst Chip Roame.

November 13 -

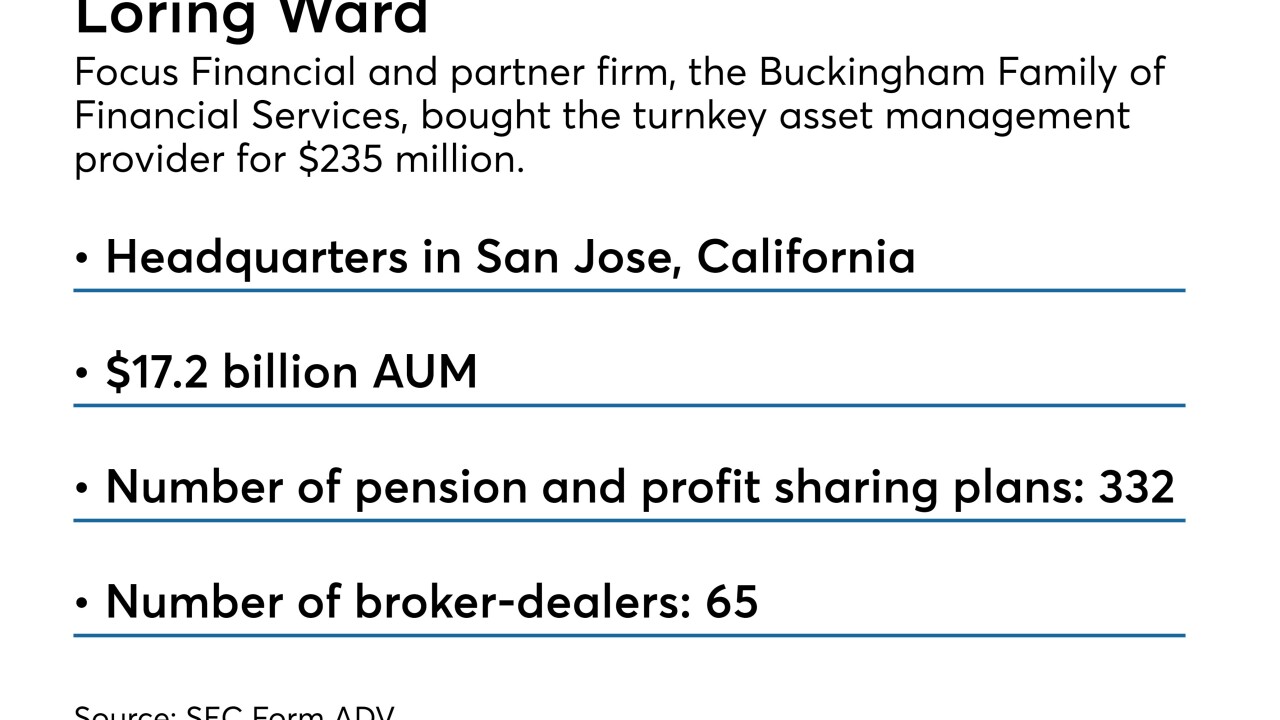

Aggregator adds a $17B TAMP as Buckingham buys Loring Ward.

September 28 -

CEO Rudy Adolf held the RIA acquirer’s first-ever earnings call, following its $564.8 million IPO, but the firm’s calculations drew questions.

August 29 -

I’ve been watching, with increasing dismay, the trend of outside investors taking ownership of advisory firms.

August 9 Financial Planning

Financial Planning -

A high valuation is a mixed blessing, industry analysts say.

August 2 -

The IPO price was lowered, but long-term performance is considered key.

July 26 -

Six of the top 10 advisor recruits — managing roughly $13.2 billion in client assets — have walked out of the wirehouse so far this year.

July 19 -

These mega brokers managed $18 billion in assets at their previous firms.

July 19 -

SmartAsset provides personal finance information and tools to over 45 million users per month, says the firm.

June 22 -

A public offering will be a landmark for the advisory business. But the aggregator will face unprecedented scrutiny from investors.

June 8 -

The definition of independence for advisors is changing, according to a new report.

June 6 -

The group is the latest in a long string of wirehouse departures.

May 30