-

While passive funds track an index, active managers can still beat the averages and earn the much-discussed small-cap premium.

June 5 -

A fund weighted against brick-and-mortar businesses dropped 13% while the industry’s largest retail product tripled the return of the broader benchmark.

June 5 -

Some may be afraid to deploy cash into stocks now because they think the market will tank sooner rather than later.

May 31 -

The Treasury is expected to sell a combined $99 billion of fixed-rate notes this week, in some of its largest offerings since 2010.

May 21 -

The average annualized return of the top 20 funds has been nearly 15%.

May 16 -

Investors slammed the sell button on passive products in February amid the return of volatility that saw a record jump in Wall Street’s fear gauge.

May 14 -

One topic under alleged examination is the monthly process through which prices of the benchmark’s futures contracts are calculated.

May 4 -

“Securities that offer souped-up returns are just too dangerous,” says Executive Vice President Jim Ross.

April 30 -

Investment firms are pushing into the country as financial reforms open access to an industry that’s expected to grow more than five-fold by 2030.

April 24 -

At some point, stock price gyrations became synonymous with bad performance. Actually, it’s "only a reflection of volatile movements in the market.”

April 16 -

Like selling a car, asset managers can list their products’ specifications, but that isn’t always enough.

April 13 SunStar Strategic

SunStar Strategic -

Assets topped $6 trillion as investors continue to move money into passively managed funds.

April 13 -

The continued ascendancy of low-cost passive funds puts pressure on compensation overall, particularly in active management.

April 9 -

“It’s bad when this happens on a Friday, because then people get freaked out over the weekend.”

April 6 -

The convertible bond ETF has its heaviest weighting in the semiconductor industry.

April 3 -

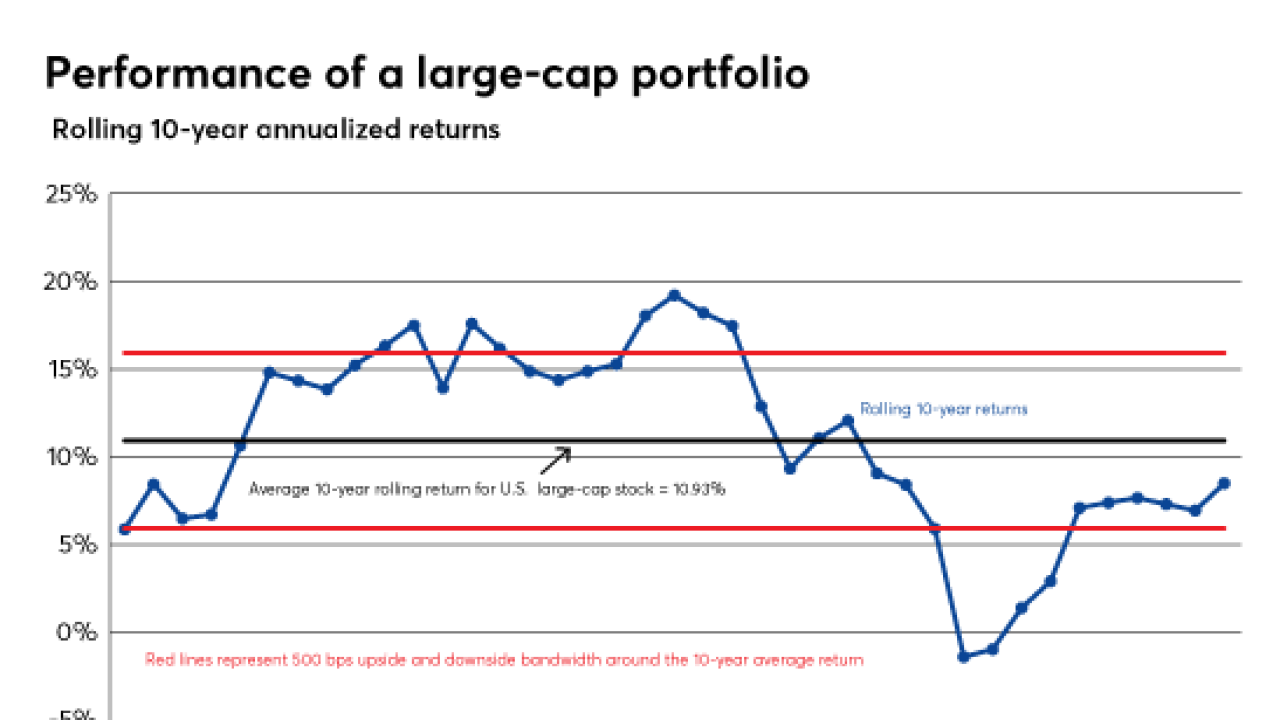

Booms and busts both have the potential to create unrealistic outlooks on both ends of the performance spectrum.

March 29 -

This time inverse leveraged technology funds are at the center of the action.

March 29 -

While the S&P 500 has risen or fallen by more than 2% six times this year, it swung by twice that amount nine times in October 2008.

March 28 -

S&P 500 enjoys its biggest one-day jump since August 2015.

March 26 -

It’s been a miserable week for higher-risk markets, as a trade war edged closer and the tech sector was roiled by Facebook’s scandal.

March 23