A newer version of this story is available. To view the top index funds of the past 10 years, from Jan. 1, 2013, through Dec. 31, 2022,

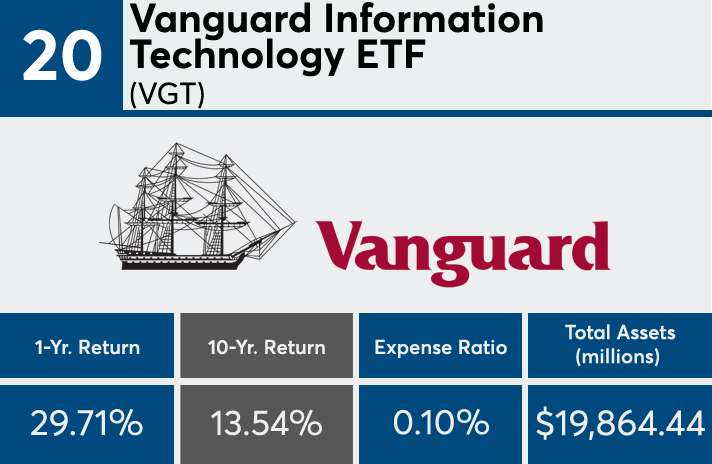

20. Vanguard Information Technology ETF (VGT)

10-Yr. Return: 13.54%

Expense Ratio: 0.10%

Total Assets (millions): $19,864.44

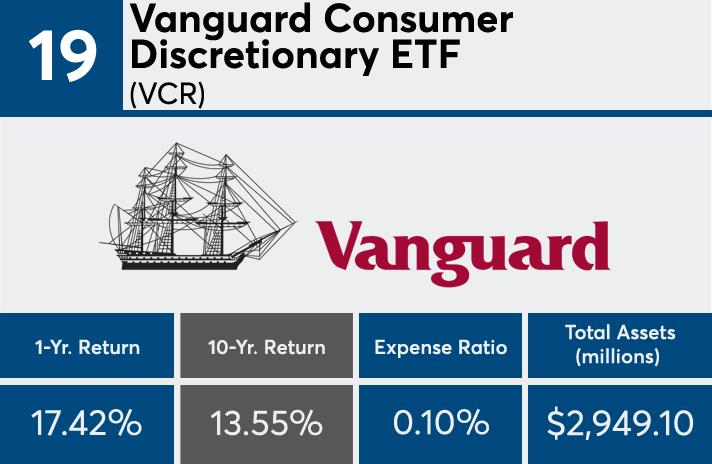

19. Vanguard Consumer Discretionary ETF (VCR)

10-Yr. Return: 13.55%

Expense Ratio: 0.10%

Total Assets (millions): $2,949.10

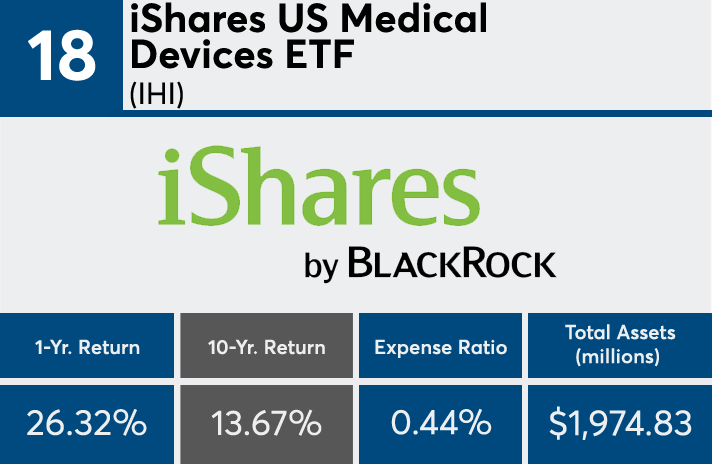

18. iShares US Medical Devices ETF (IHI)

10-Yr. Return: 13.67%

Expense Ratio: 0.44%

Total Assets (millions): $1,974.83

17. USAA NASDAQ-100 Index (USNQX)

10-Yr. Return: 13.76%

Expense Ratio: 0.51%

Total Assets (millions): $1,850.18

16. iShares North American Tech ETF (IGM)

10-Yr. Return: 13.78%

Expense Ratio: 0.48%

Total Assets (millions): $1,525.45

15. iShares PHLX Semiconductor ETF (SOXX)

10-Yr. Return: 13.83%

Expense Ratio: 0.48%

Total Assets (millions): $1,762.76

14. PowerShares S&P 500 Equal Wt HC ETF (RYH)

10-Yr. Return: 13.89%

Expense Ratio: 0.40%

Total Assets (millions): $611.05

13. Consumer Discret Sel Sect SPDR ETF (XLY)

10-Yr. Return: 13.93%

Expense Ratio: 0.13%

Total Assets (millions): $13,040.78

12. VALIC Company I NASDAQ-100 Index (VCNIX)

10-Yr. Return: 13.93%

Expense Ratio: 0.53%

Total Assets (millions): $474.98

11. iShares North American Tech-Software ETF (IGV)

10-Yr. Return: 13.99%

Expense Ratio: 0.48%

Total Assets (millions): $1,694.18

10. Shelton Nasdaq-100 Index Direct (NASDX)

10-Yr. Return: 14.03%

Expense Ratio: 0.49%

Total Assets (millions): $584.86

9. PowerShares QQQ ETF (QQQ)

10-Yr. Return: 14.28%

Expense Ratio: 0.20%

Total Assets (millions): $64,844.58

8. First Trust Health Care AlphaDEX ETF (FXH)

10-Yr. Return: 14.78%

Expense Ratio: 0.62%

Total Assets (millions): $977.93

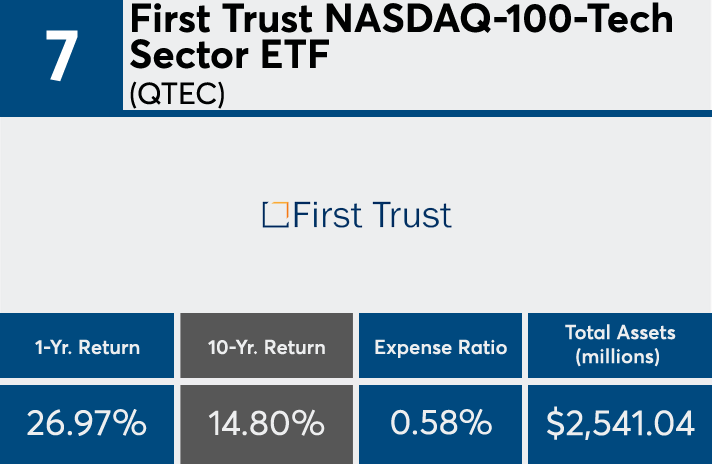

7. First Trust NASDAQ-100-Tech Sector ETF (QTEC)

10-Yr. Return: 14.80%

Expense Ratio: 0.58%

Total Assets (millions): $2,541.04

6. PowerShares Dynamic Software ETF (PSJ)

10-Yr. Return: 14.94%

Expense Ratio: 0.63%

Total Assets (millions): $177.96

5. iShares Nasdaq Biotechnology ETF (IBB)

10-Yr. Return: 15.57%

Expense Ratio: 0.47%

Total Assets (millions): $8,964.36

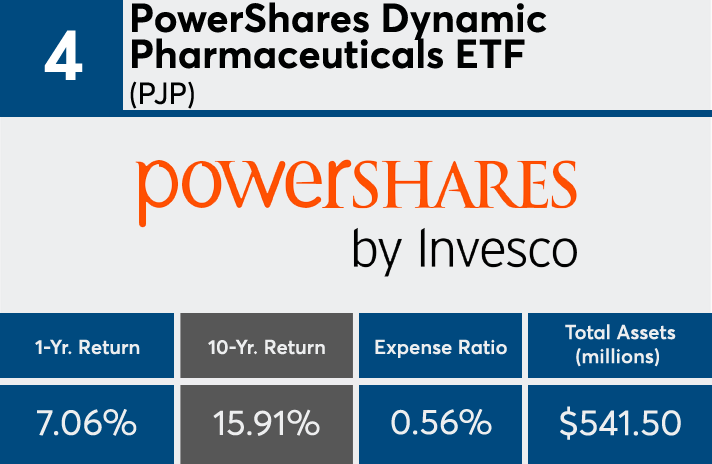

4. PowerShares Dynamic Pharmaceuticals ETF (PJP)

10-Yr. Return: 15.91%

Expense Ratio: 0.56%

Total Assets (millions): $541.50

3. SPDR S&P Biotech ETF (XBI)

10-Yr. Return: 17.49%

Expense Ratio: 0.35%

Total Assets (millions): $5,258.19

2. First Trust Dow Jones Internet ETF (FDN)

10-Yr. Return: 18.23%

Expense Ratio: 0.53%

Total Assets (millions): $7,968.19

1. First Trust NYSE Arca Biotech ETF (FBT)

10-Yr. Return: 19.78%

Expense Ratio: 0.56%

Total Assets (millions): $1,521.32