-

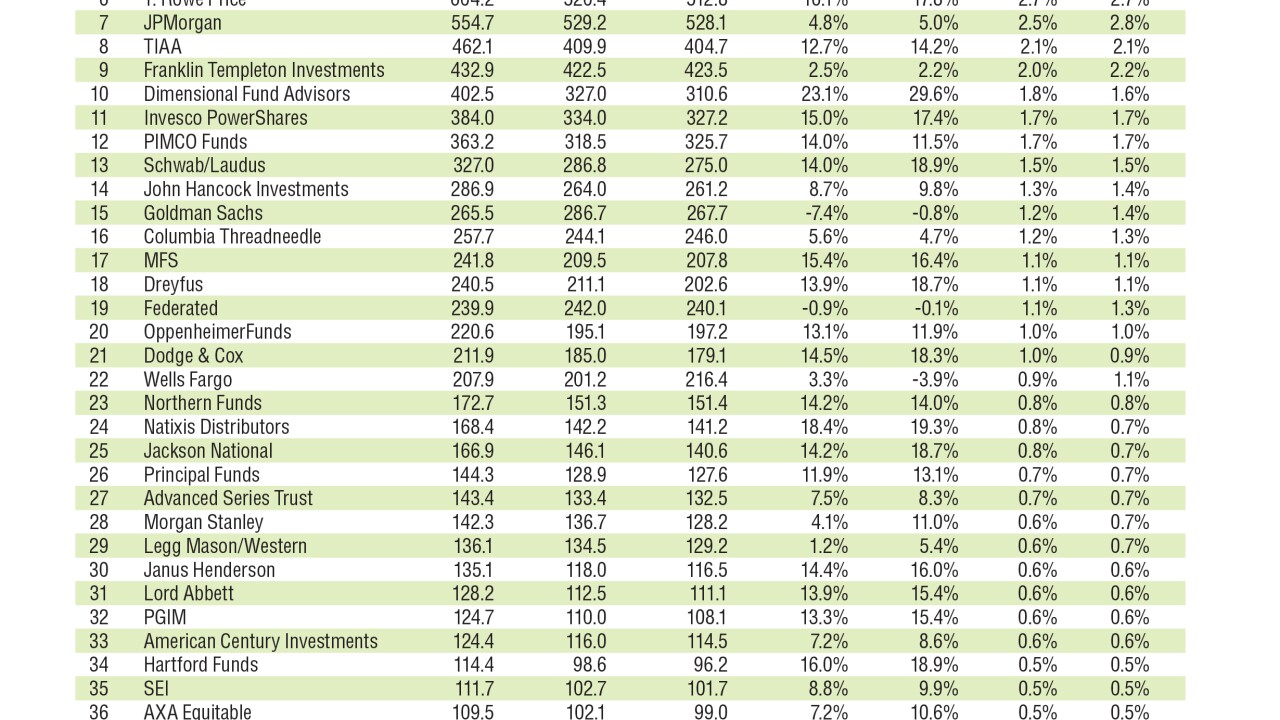

Data reported by FUSE Research.

November 22 -

The majority of public and private funds using the strategy launched in the last three years.

November 16 -

The launch from EventShares provides investors access to economic and policy-driven themes.

October 20 -

Managers are asking the SEC to relax constraints it imposed on the funds as they become the fastest growing products for investing in equities.

October 10 -

BNY Mellon, DST Systems and State Street are among the firms recognized for their excellence and operational achievements.

October 4 -

These turbulent times of regulatory upheaval have raised the existential question of how to adapt and protect profitability.

September 15 -

Despite having “exaggerated” merits, most strategic-beta ETPs outperformed their replicating portfolios, according to Morningstar.

September 13 -

The firm wants to adopt a new benchmark that would add specialty REITs to the mix.

September 13 -

The firm plans to charge nine basis points for exposure to a basket of large-cap stocks, lower than any other comparable offering.

September 12 -

Those recognized for their excellence in innovation and leadership across the asset management industry includes State Street CEO Jay Hooley.

September 1 -

These funds have the smallest beta scores, either positive or negative, indicating the least variability from market returns.

August 30 -

July 31: Being a good judge of character is a central ingredient, the co-founder of LM Capital says.

July 28 -

Distributors are no longer content with labeling their products with star investors.

June 28 -

Assets in products susceptible to the risk of fire sales during a future shock are up 673% since 2000.

June 26 -

Many new products are great for the industry and not so great for our clients.

June 26 Wealth Logic

Wealth Logic -

Low costs and an overall shift toward passive are only part of the reasons why they are leaving such an impact, according to four experts’ testimonies.

June 19 -

Although the funds experienced a combined $586 billion in outflows over the last two years, this segment reported inflows of $41 billion.

June 7 -

The outflows have rekindled a popular concern that the funds could portend the start of a liquidity crunch.

June 2 -

The move is a plus for clients looking to tap into emerging markets stocks and equities in Europe after run-ups the past year.

February 27