-

CEO Dan Arnold listed three reasons why the firm thinks its rivals peeled off some advisors.

November 8 -

CEO Dan Arnold said the acquisition of NPH’s assets will serve as a model for the future.

October 27 -

The nation’s largest broker-dealer must convince thousands of NPH advisors to make the transition.

August 16 -

The nation’s largest IBD paid $325 million, but it may spend as much as $508 million in the deal.

August 15 -

Dan Arnold says behavioral management, automation and portfolio and planning services need to be combined to win future clients.

July 31 -

CEO Dan Arnold said advisers’ uncertainty about the fiduciary rule is waning.

July 27 -

The $420 million team marks the latest wirehouse exit over a lack of flexibility around the rule.

May 9 -

Dan Arnold expects that upheaval to lead to more movement of advisers and assets.

April 28 -

The firm also granted its new chief stock options worth $4.8 million following a debt refinancing.

March 20 -

The layoffs are part of a shift of personnel to LPL Financial's South Carolina campus to cut costs and position the independent broker-dealer for future growth.

February 23 -

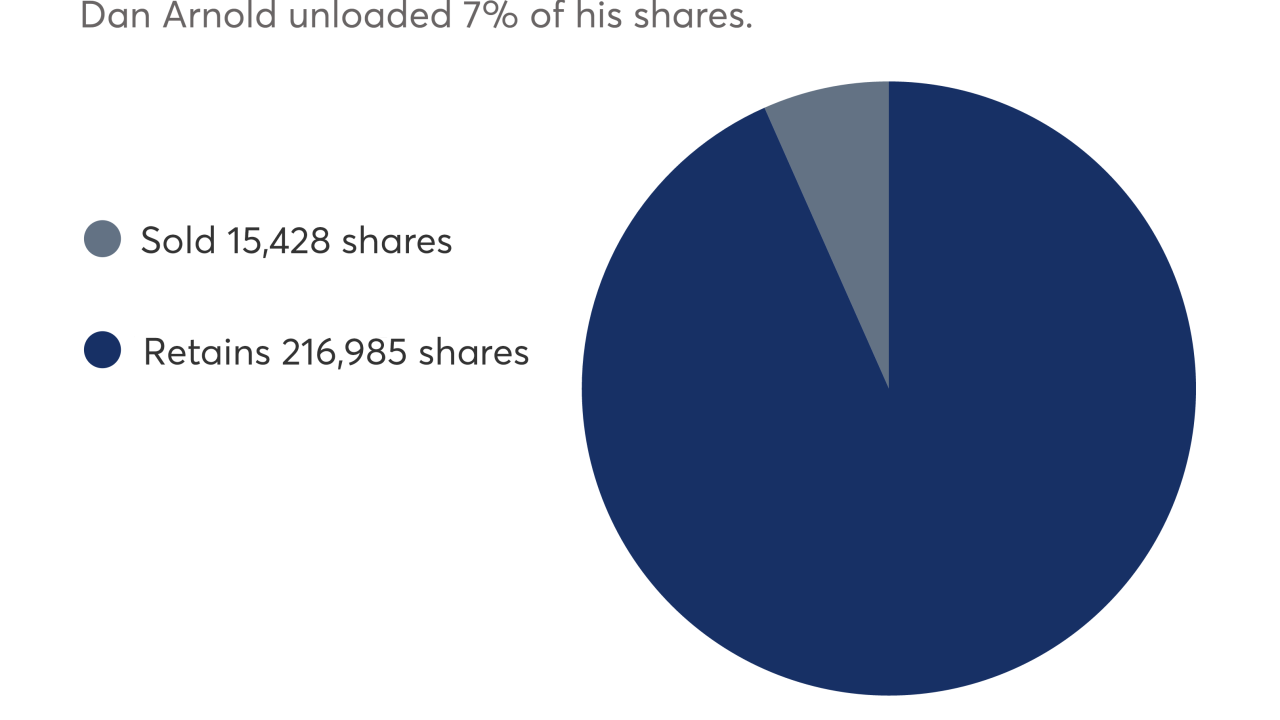

Former head Mark Casady, new chief Dan Arnold and board member Marco Hellman each netted millions.

February 17 -

The nation's largest IBD vows to take a “proactive approach” to the fiduciary rule.

February 9 -

The firm says it "terminated" its relationship with the large OSJ. It’s the third large split in two months.

February 1 -

From regulators to technology providers to CEOs, these are the players who will remake wealth management in 2017.

December 14 -

The potential for the fiduciary rule to be scuttled by the Trump administration helped drive the decision, sources say.

December 8 -

Casady provides both consistency and a fresh approach, leaders of the firm's OSJs say.

December 5 -

President Dan Arnold will be tasked with managing the rollout of new digital technologies and implementing the fiduciary rule.

December 5 -

The president and former CFO will step up at a critical time for the nation’s largest IBD amid competitive threats and pressure to boost its stock price.

December 5 -

The country's largest independent broker-dealer says compliance with the new fiduciary rule will offer competitive advantages.

August 23