-

Threats to the program are multiplying and the coronavirus pandemic is accelerating a reckoning, according to a new analysis.

September 9 -

One problem is the proposal is focusing on the minor advantage of tax-deferred retirement plans, says Bloomberg columnist Aaron Brown.

September 9 -

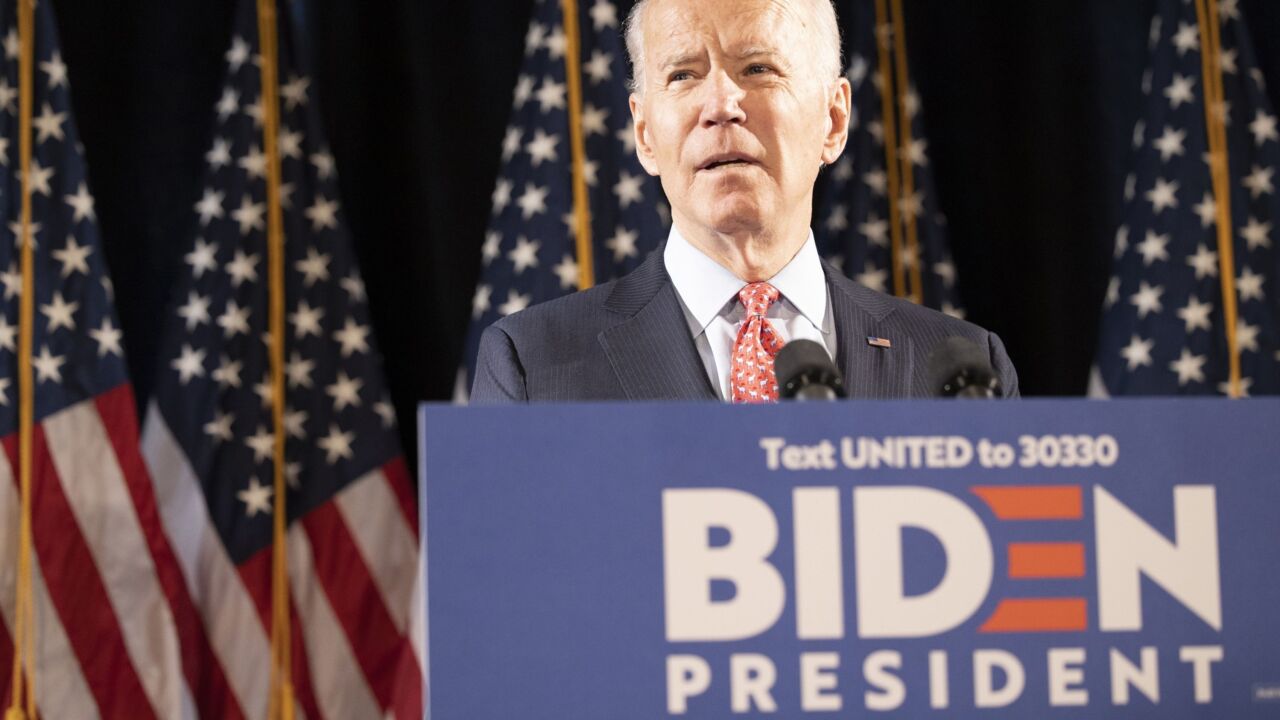

The president has deferred payroll taxes that fund the program, and says he would eliminate them if elected to a second term.

August 27 -

From regulations to taxes, big changes could be in the offing.

August 20 -

Here's an at-a-glance guide to the candidates' positions on individual taxes.

August 5 -

Any tax increases on high-income individuals and corporations would be offset by massive spending packages targeted at accelerating the country’s recovery from the coronavirus, according to the firm.

July 31 -

The party’s draft party platform criticizes lax standards implemented by the Trump administration, and vows to strengthen Social Security.

July 27 -

Recognizing the elephant — and donkey — in the room can lead to a broader conversation about long-term investing

July 24 SEI

SEI -

A weaker U.S. dollar and a rollback of some of the 2017 tax cuts are just two possibilities, experts say.

July 23 -

The Democrats’ presumptive presidential nominee called for a public credit reporting agency and for the Postal Service to offer financial services, among other proposals issued through a unity task force with Bernie Sanders. But analysts suggest the recommendations are more about electoral politics than pushing for real reforms.

July 9 -

The program faces big challenges, including the coronavirus pandemic which could deplete the program’s $3-trillion trust fund as early as 2028.

June 19 -

A Democratic-led SEC could revisit Reg BI, advocacy groups and industry observers say.

June 16 -

Critical comments about Wall Street in the first debates signal an unfriendly political environment. Here are some leading candidates’ financial policy views.

July 10