-

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

3h ago -

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 12 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

Missed IRA RMDs can cost clients thousands, Vanguard research shows. But financial advisors can help erase tax penalties and avoid future ones with a few key strategies.

January 27 -

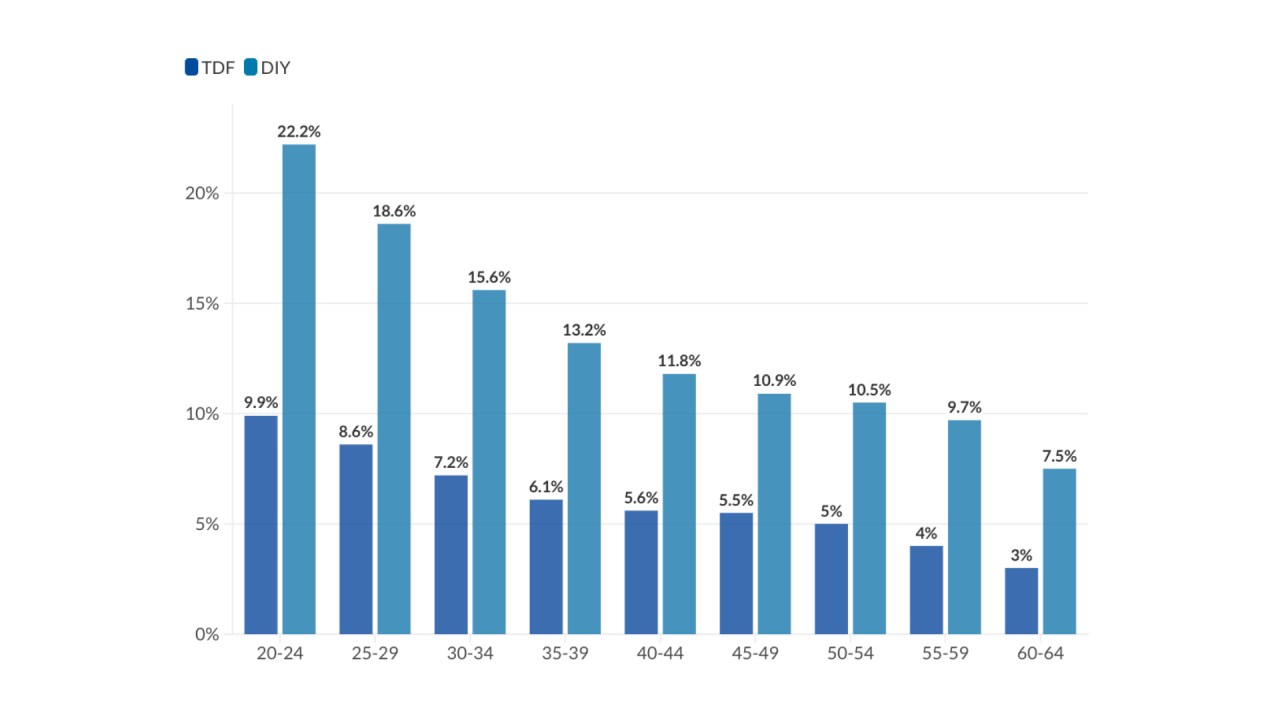

A new Morningstar study suggests managed accounts can significantly boost retirement wealth, particularly for younger workers and those currently managing their own portfolios.

January 20 -

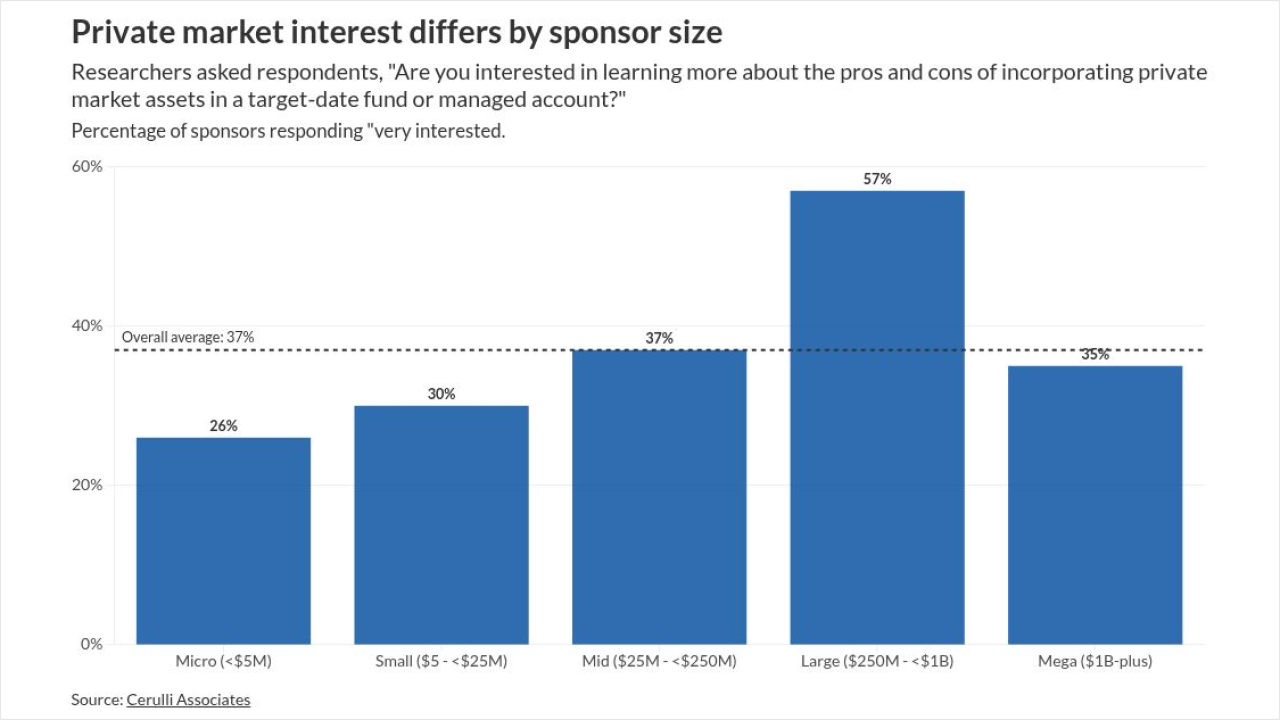

Plan sponsors show growing interest in private market investments for 401(k) plans, but regulatory uncertainty, fees and litigation risk continue to slow adoption, a Cerulli study found.

January 9 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29 -

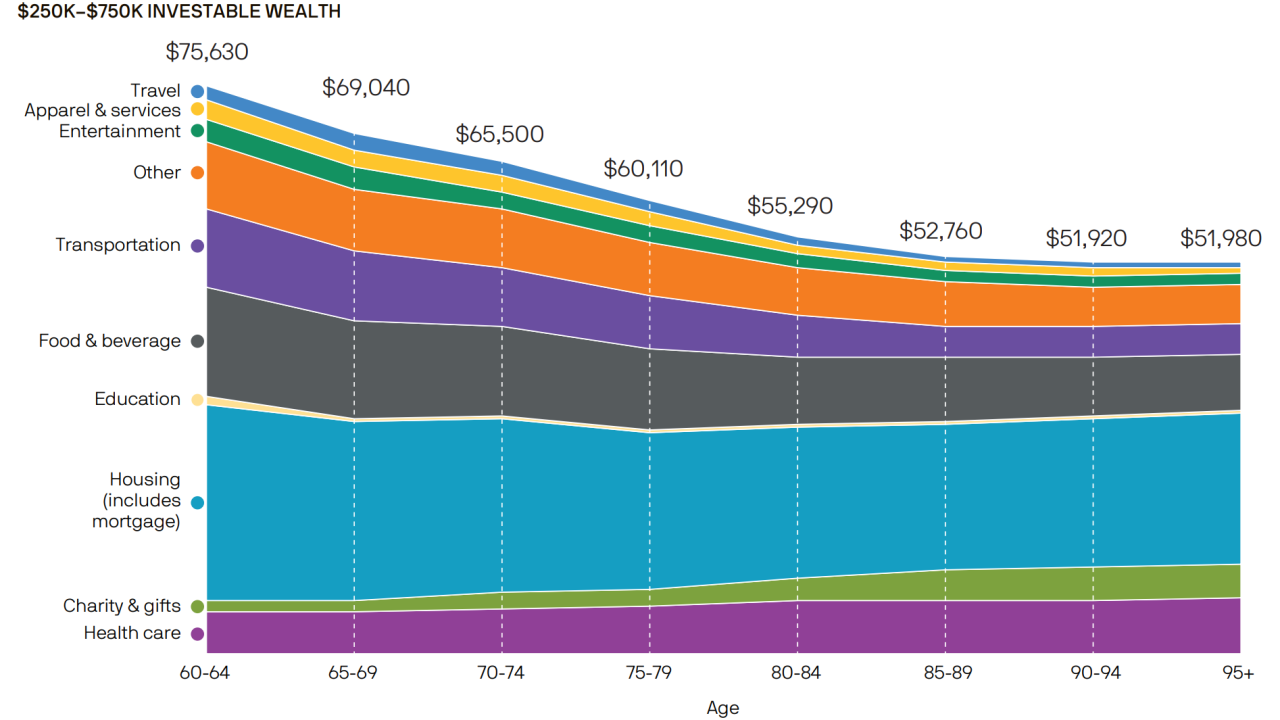

Popular retirement withdrawal strategies like the 4% rule assume a steady rate of spending for retirees. But new research from J.P. Morgan shows that premise is often disconnected from reality.

December 29 -

The epic OBBBA tax law brings glad tidings to most families, but complacency can lead to costs for financial advisors and their clients.

December 23 American College of Financial Services

American College of Financial Services -

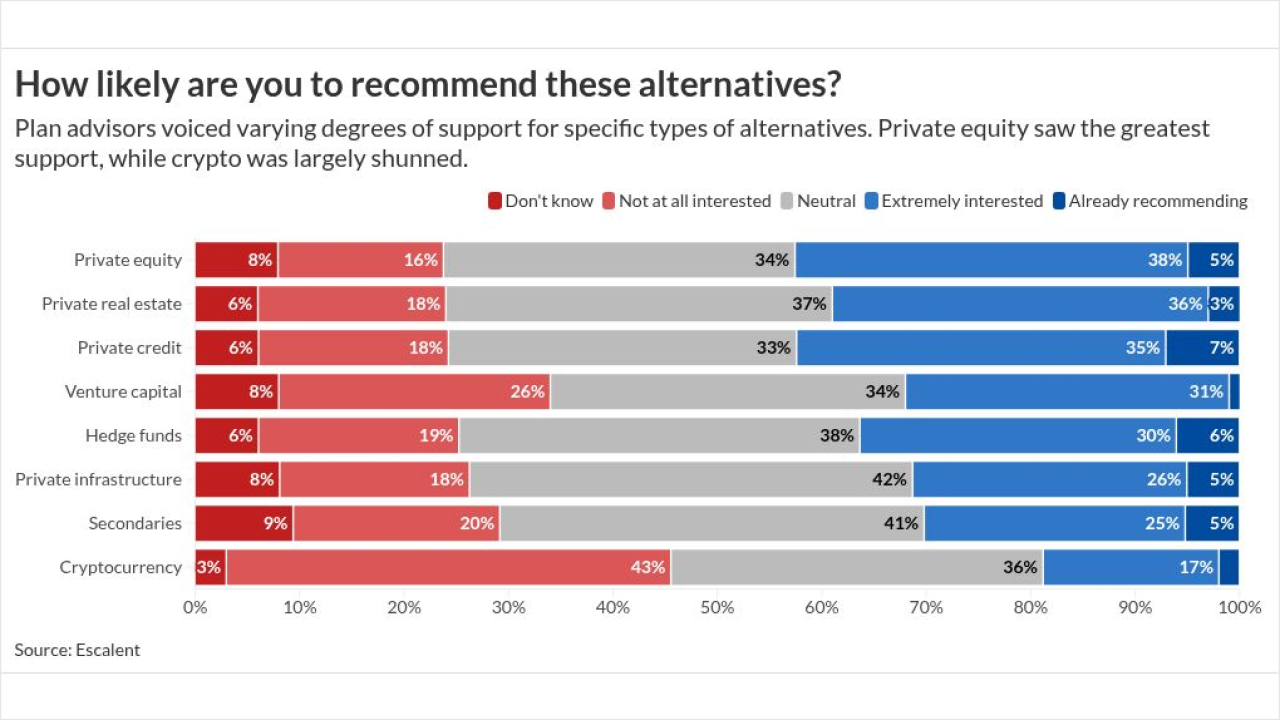

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows. Here's why younger investors are betting on post-tax retirement savings.

November 20 -

A similar measure stalled years ago, but some advisors say the current bill has more momentum among lawmakers.

November 13 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

A credit scare last month could have been a momentary blip, but financial advisors have always known there are a lot of risks in private investments.

November 5 -

An expert adviser explains the many considerations to take into account before deciding on this as an option for employees.

October 30

-

Public-sector pensions are shifting more risk onto employees through hybrid designs, variable contributions and COLA changes, transforming retirement planning for millions.

October 27 -

Millions of small 401(k) balances end up in safe harbor IRAs, where fees and low returns erode growth. But advisors can help reclaim lost savings.

October 23