-

Paul Reid Galietto's lawyer says he was let go by Credit Suisse in 2021 after the firm tried to unfairly blame him for losses from the collapse of the giant family office Archegos Capital Management.

February 24 -

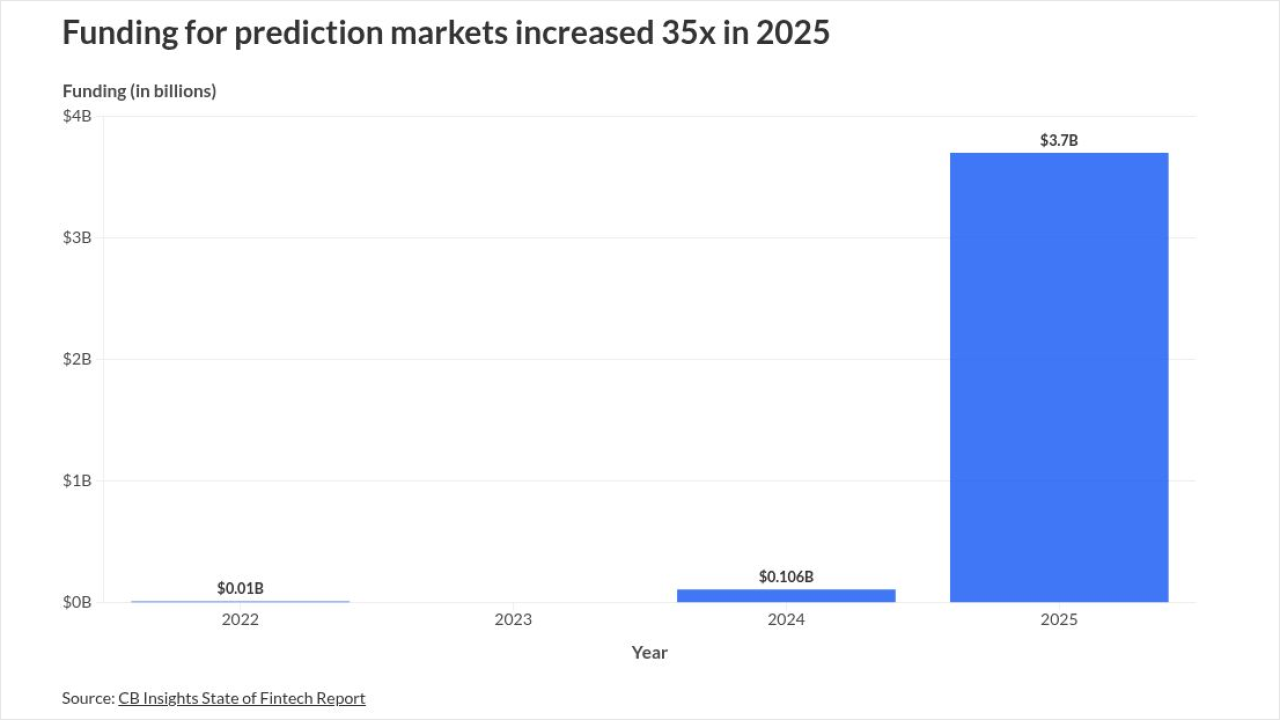

The platforms, where bets are placed on everything from U.K. soccer teams to the price of bitcoin, are getting traction from investors and attention from regulators.

February 23 -

-

A federal judge rejected Stifel's bid to dismiss a FINRA penalty. The firm has paid millions to former clients, with 20 more cases still in the works.

February 10 -

The SEC's decision marks a startling reversal from the full-court press it had mounted against Commonwealth Financial Network in 2019 over alleged failures to disclose conflicts of interest in its brokers' mutual fund recommendations.

February 3 -

Brokers were worried a new rule intended to lighten their responsibility to monitor advisors' side hustles would ironically mean greater supervision duties with RIAs.

January 22 -

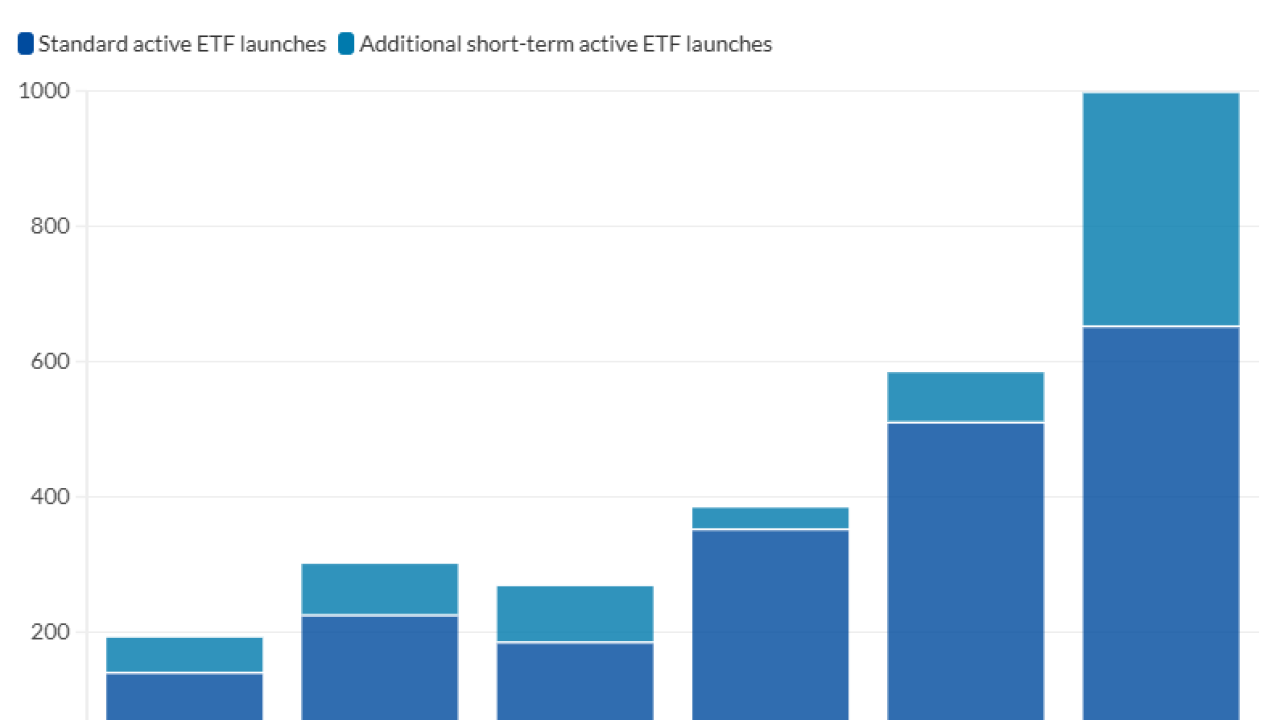

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

The justices are scheduled to resolve disagreement among lower courts over whether market regulators can order fraudsters to repay ill-gotten gains to victims.

January 12 -

A new proposal would allow firms to tack three additional months onto the amount of time they can place holds on the accounts of clients 65 and older in cases of suspected financial exploitation.

January 9 -

The regulator considers raising the AUM threshold it uses when considering how newly proposed rules are likely to affect small RIAs.

January 8