-

Retirees who have reached the age of 70 1/2 should take required minimum distributions from tax-deferred accounts, while those who are younger should draw from their taxable accounts.

December 12 -

-

Medicare Part B premiums will stay flat next year, but most retirees will still pay more.

December 5 -

Clients should consider tax breaks such as education expenses, mortgage interest payment and small business costs.

December 5 -

Attracting them means knowing what’s really important (hint: it’s not retirement).

December 4 -

Advisors should contact every client who did a Roth conversion in 2017 to discuss a key change in tax regulations, Ed Slott says.

December 4 -

Workers can improve the odds of getting bigger Social Security benefits after they retire by asking for a salary raise from their employer.

December 1 -

Retirees should remain invested in stocks even if they have to scale back their exposure to this investment type, experts say.

November 30 -

Winding down a long and successful career often comes with angst. Follow these steps to make the process a little bit easier, Bob Veres says.

November 29 Financial Planning

Financial Planning -

Variable products suffered their worst quarter in two decades, while fixed contracts also declined.

November 29 -

A new body of research suggests an ideal retirement-planning approach may exist — but buyer beware.

November 29 -

One-third of households headed by Americans aged 65 and older derive 90% of their retirement income from Social Security, according to a GAO report.

November 28 -

The strategy could provide lifelong cash flow by trimming longevity risk.

November 28 -

Whether they have a mortgage does not affect the capital gains calculation, according to a CFP.

November 27 -

Retirees should ensure that they take their first required minimum distribution from their tax-deferred retirement account in the year they reach 70 1/2 or face a 50% penalty.

November 27 -

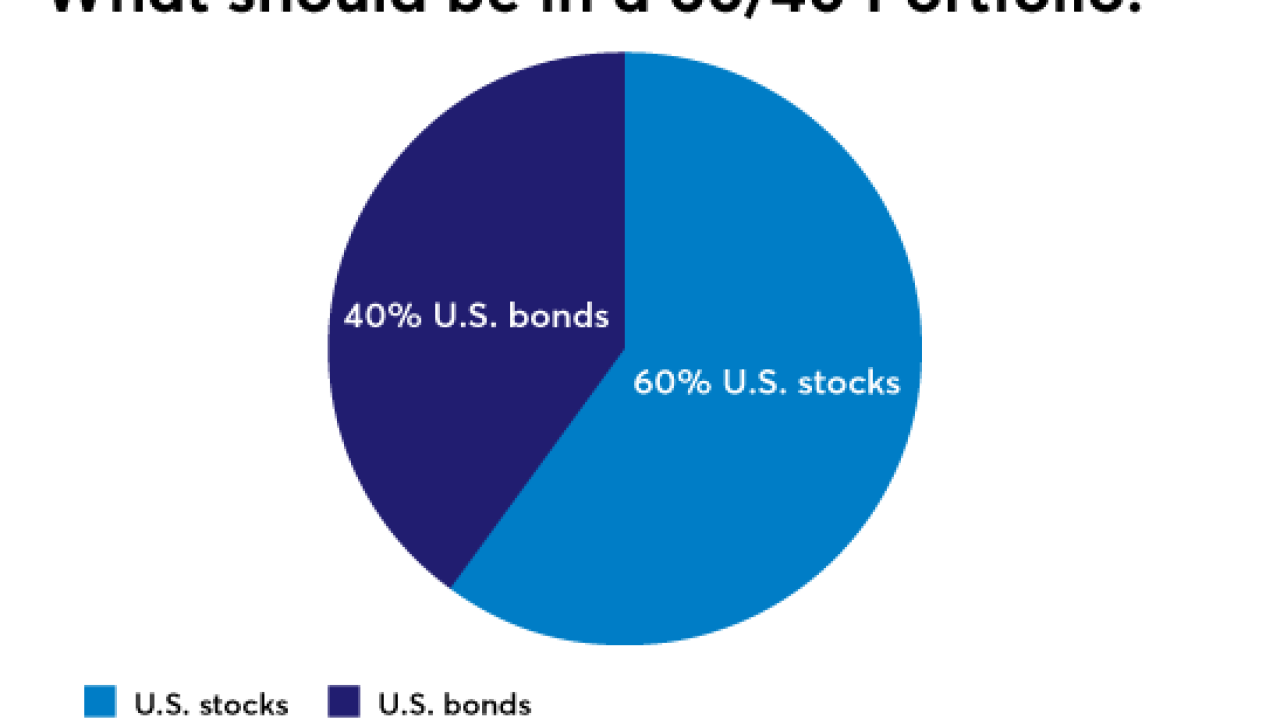

Conventional wisdom is that 60/40 portfolio is highly effective. But there could be a better way to accompany large-cap U.S. stocks than U.S. bonds.

November 27 -

Most Americans would prefer to age in place, but sometimes the costs make it impractical. Here's how to help.

November 27 -

When it comes to planning, hitting financial goals is only part of the story.

November 21 Retirement Matters

Retirement Matters -

For a retired military service man, delaying his Social Security would mean he's not subject to the earnings test that can reduce his check by $1 for every $2 he earns over the current threshold of $17,040.

November 20 -

Ignoring lessons from past income-boosting strategies can lead to disastrous results.

November 20 Wealth Logic

Wealth Logic