-

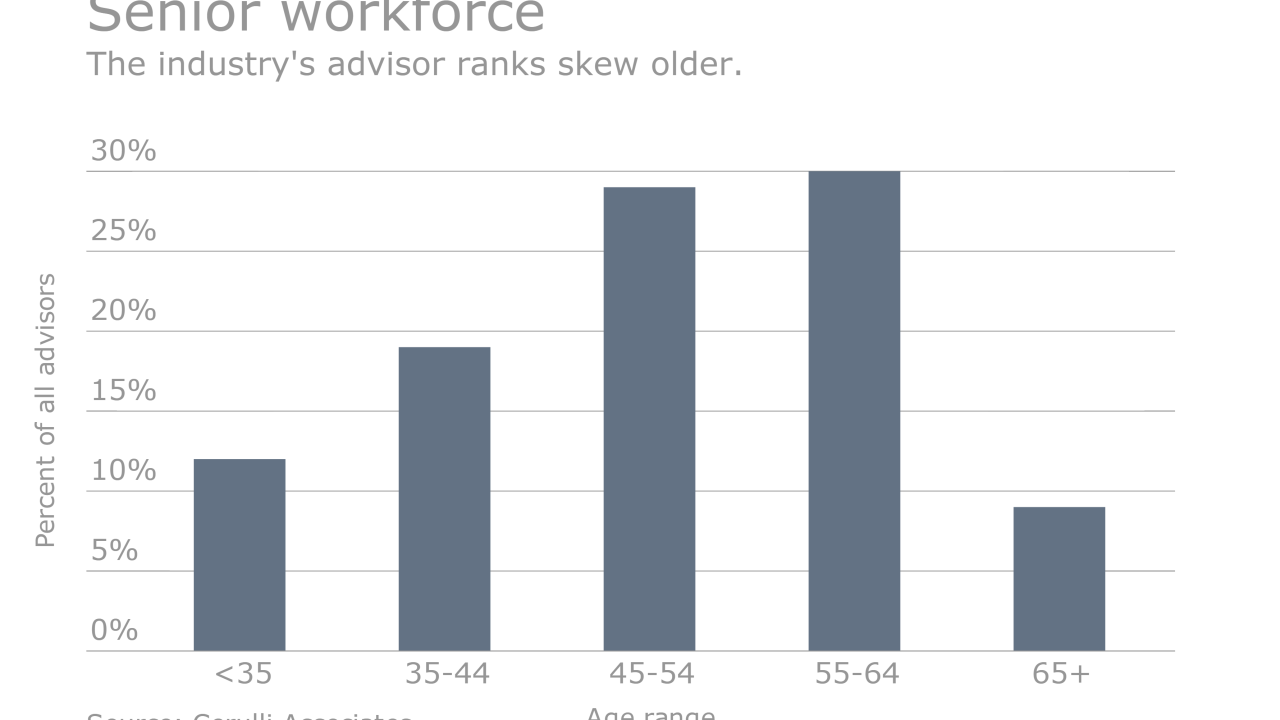

Whatever planners learned when they were trained for the job decades ago is most likely outdated.

April 25 -

To understand the challenge posed by big tech disruptors, wealth managers should look at how those firms unexpectedly adapt to enter new markets.

April 25 -

Much of the industry animus toward robo advisors, writes veteran fintech analyst Davis Janowski, is rooted in frustration, envy, and fear.

April 25

-

The fresh funding demonstrates the support behind the concept of simple apps that help consumers save and invest.

April 24 -

When the product was announced a number of customers took to social media to voice questions and concerns.

April 18 -

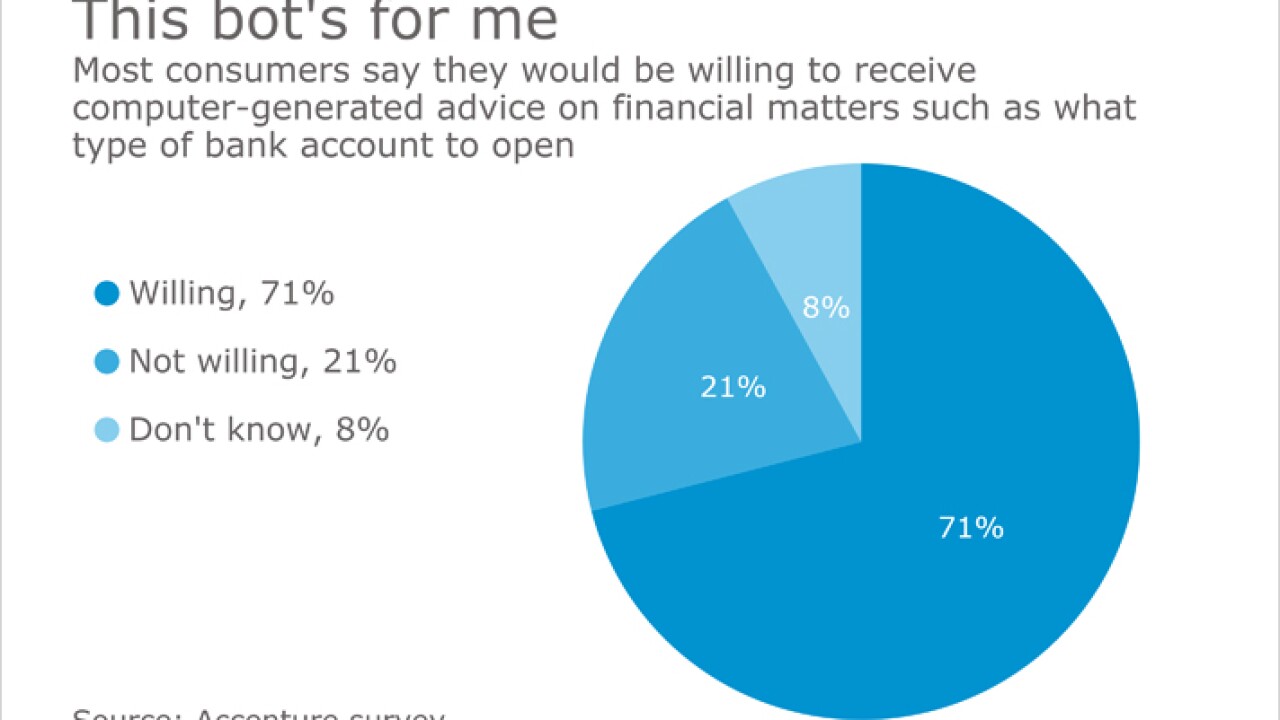

Listen up, advisors — chatbots are talking their way into wealth management. Some see them as part of a low-cost, entirely automated option that commoditizes financial advice even further.

April 18 -

The hiring plans coincide with the firm's rollout of its digital advice offering, UBS Advice Advantage, which is offered through its call center.

April 17 -

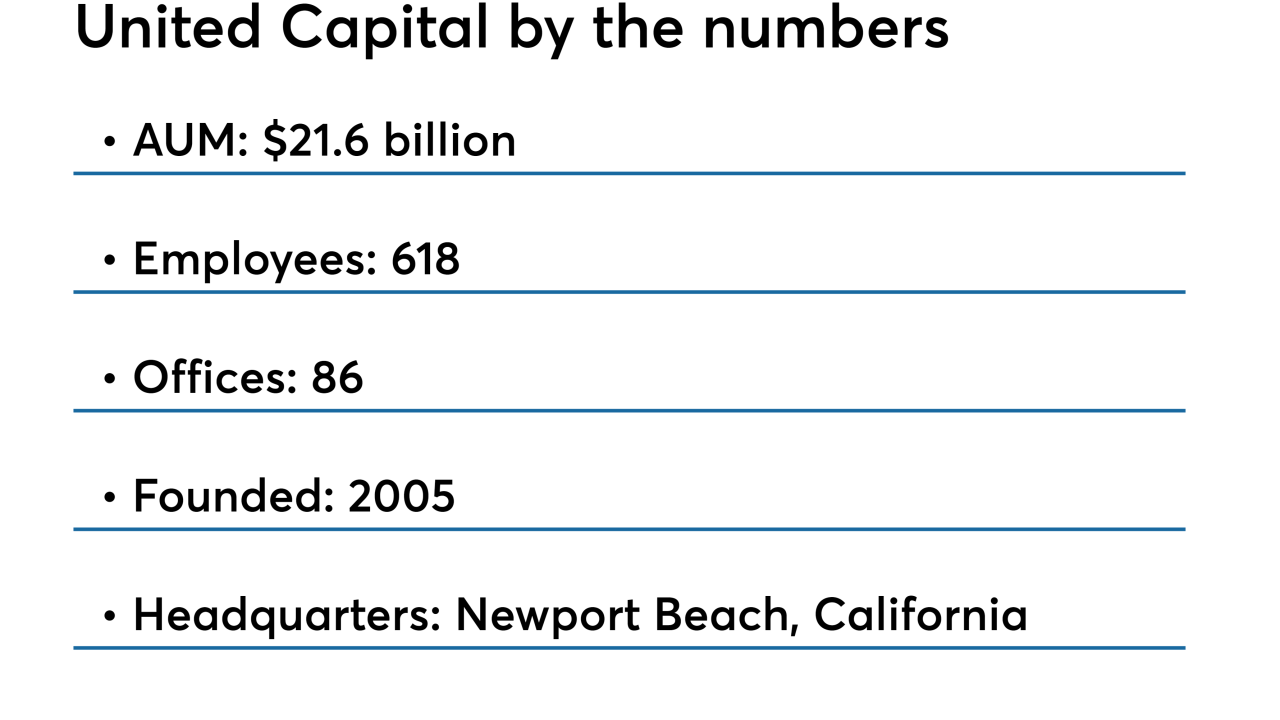

By focusing on the relationship, RIAs can outdo automated investors — and charge accordingly, says CEO Joe Duran.

April 16 -

The WiseBanyan platform currently has $153 million in assets under management and 32,000 clients.

April 10 -

BMO Wealth Management aims to modernize its investment service and give planners better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 9 -

Bill Capuzzi has had a first-hand view of wealth management’s disruption. He details the key innovations winners will bring to the industry.

April 4 -

IBDs and regional firms are making the biggest changes, but RIAs have room for growth as well.

April 2 -

Technology is rapidly changing many, but not all aspects of the business.

March 29 CoughlinGiambrone

CoughlinGiambrone -

The bank aims to have a total of 4,000 representatives by year-end in Merrill Edge, which now has 2.4 million accounts and $184.5 billion in assets.

March 29 -

After the digital advice firm reportedly saw its valuation drop $200 million, industry executives ask if independent robo advisors are on borrowed time.

March 28 -

The digital advice firm acknowledges RIAs using its institutional platform "needed more control."

March 28 -

Portfolios will be selected based on machine learning and natural-language processing.

March 26 -

The latest influx, which closed late last year, brought in $75 million.

March 23 -

Speculation grows that any retailer with a robust e-commerce platform, physical ubiquity, brand awareness and trust could become a wealth management player.

March 21 -

A federal court has struck down the rule and the industry’s top online advice executives are speaking out.

March 16