Active vs. Passive: Where Money's Flowing

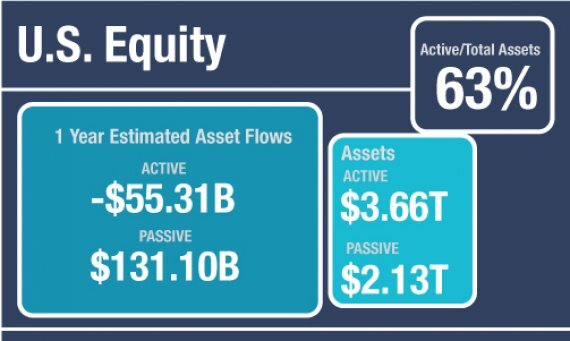

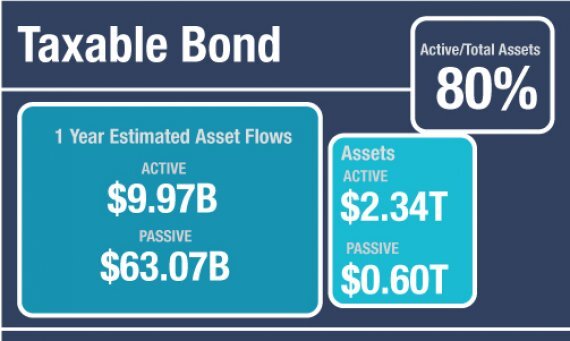

At the end of August, long-term U.S. funds and exchange-traded funds held $13.85 trillion in assets. Although slightly more than 71% of those assets were in portfolios using active management, Morningstar notes that growth of fund flows to actively managed assets was a mere 2% over the past year vs. 11% organic growth in flows to passive investment portfolios.

In two smaller fund categories, sector equity and commodities, passive assets have come close to or eclipsed active. In sector equity, passive funds hold 46% of assets. In commodities, indexing accounts for 64% of assets.

Heres how assets are flowing into and out of all long-term funds and

eight fund categories. Joseph Lisanti

Click here to view this list in a single-page version.

Source: Morningstar Direct Asset Flows, all data as of end of August, 2014.

ALL LONG TERM

U.S. EQUITY

SECTOR EQUITY

INTERNATIONAL EQUITY

ALLOCATION

TAXABLE BOND

MUNICIPAL BOND

ALTERNATIVE