The data calls into question the view that market forces stemming from the DoL rule have

The subtlety of commission-based clients’ perceptions about the fees they pay comes through in the findings of the latest study, its author says.

“I don’t necessarily think they support one side or the other in terms of the rule. What they reinforce is that what clients want is transparency and flexibility,” J.D. Power wealth management practice director Mike Foy says in an email.

J.D. Power quizzed more than 1,000 full-service investors online last month, with 449 of the investors reporting that they pay some form of commissions. The firm also interviews more than 6,000 clients each year to gauge their level of satisfaction with their adviser’s services and expenses.

To find out more on the opinions of commission-based investors, click through our slideshow.

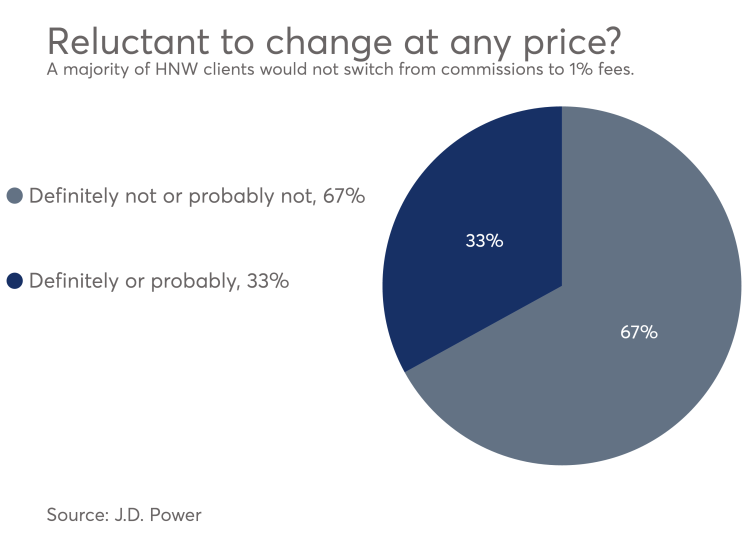

About 59% of the clients responded that they would “definitely” or “probably” not want to make the shift.

The results show that firms and advisers need to “do a better job explaining the value proposition and how it connects to fees they pay,” Foy says.

Planners also must get better at “making sure that investors know their options and are informed enough to pick a service model that best aligns with their needs and circumstances, and hopefully one that can grow along with them,” he adds.

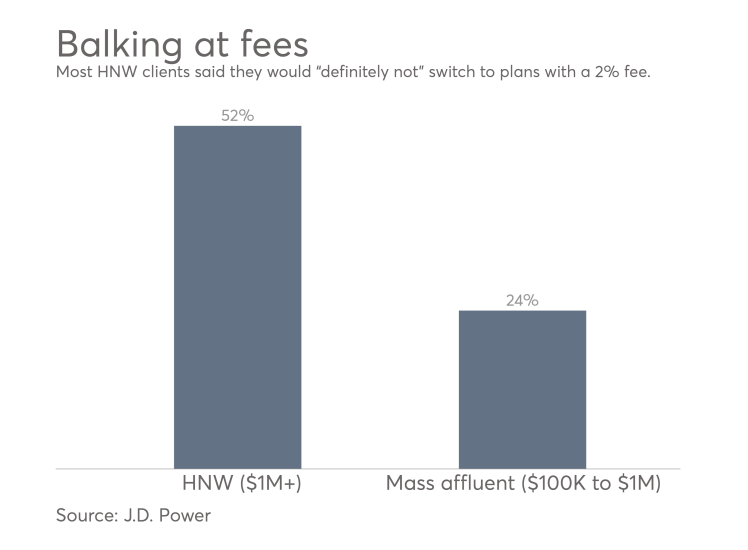

Fifty-two percent of high-net-worth clients said they would “definitely not” move to fee-only plans, compared with 24% of mass-affluent clients, when J.D. Power presented both groups with plans charging a flat fee of 2% of the assets in their account.

HNW investors’ overall satisfaction with their advisers also correlates with their satisfaction with fees, Foy says. While the rate of 200 basis points represents a larger fee than most fee-only clients pay, even 1% of $1 million is much more than 1% of $100,000, he notes.

“For a buy-and-hold investor paying commission, a flat fee based on AUM may be more than they pay now,” Foy says. “Every case will be different, but part of the problem is we know that many clients, even more wealthy and sophisticated ones, really don’t know what they pay.”

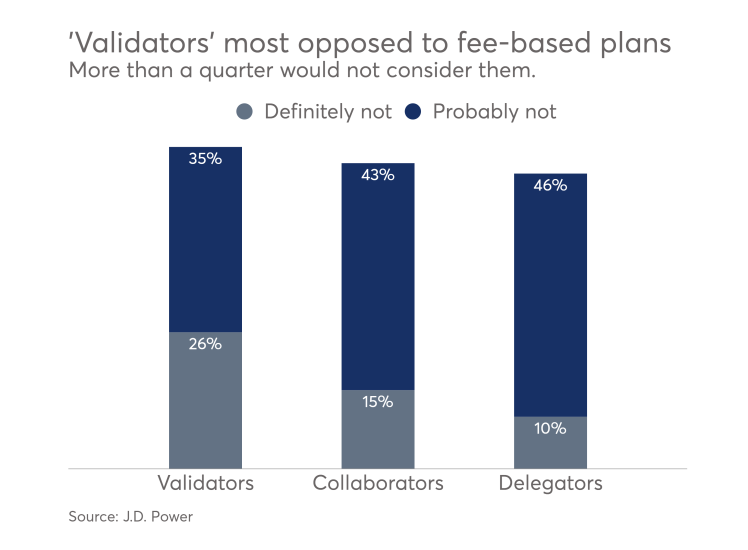

Delegators leave all their decisions to their adviser, while collaborators depend on their planner’s advice to choose investments together. Validators take their ideas to their advisers but make all decisions themselves.

The third group has been growing in recent years, particularly among younger investors, according to Foy. Commission-based validator investors said they would “definitely” not change to fee-only plans at the highest rate of all three types of clients.

“If they want to be making a lot of the decisions, that would suggest a reluctance to pay advisers an advisory fee that’s not clearly tied to a transaction,” Foy says. “Also, validators tend to be younger and less affluent, so they’re likely getting a lower level of service from their advisers.”

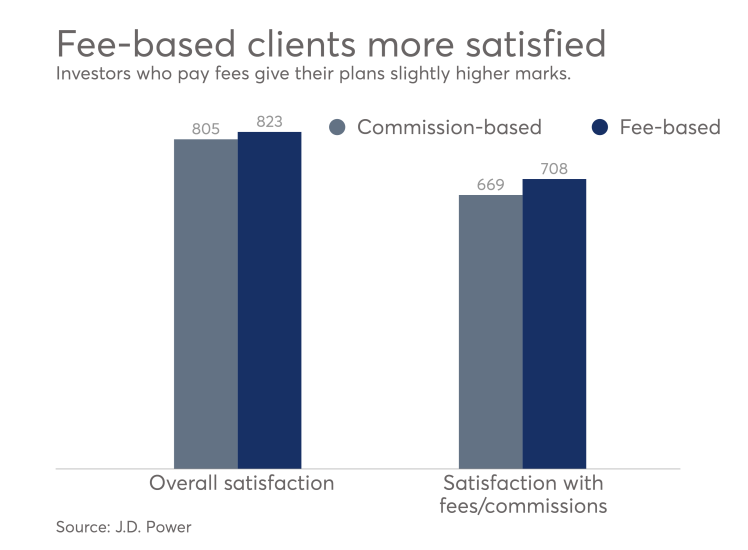

The firm tracks both groups’ opinions each year, and fee-based investors rated their plans more positively on a 1,000-point scale in January 2016. Yet the findings from the two studies don’t necessarily contradict one another, according to Foy.

“I don’t think there’s a conflict there,” he says. “Those who have chosen fee-based are happier with it, but that doesn’t mean others necessarily would be. It’s not a one size fits all.”

While the latest survey shows commission-based clients often have valid reasons for balking at fee-only plans, some may well be misinformed about the cost of their plans, Foy says. The debate about the fiduciary rule has not altered the trend.

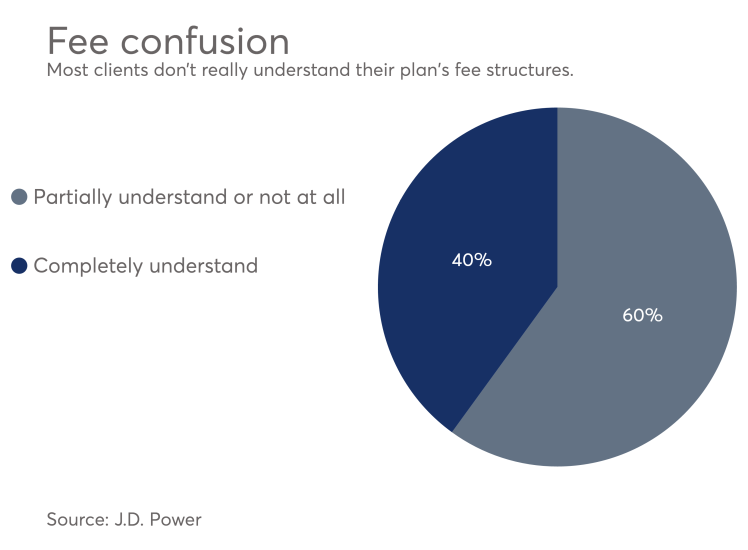

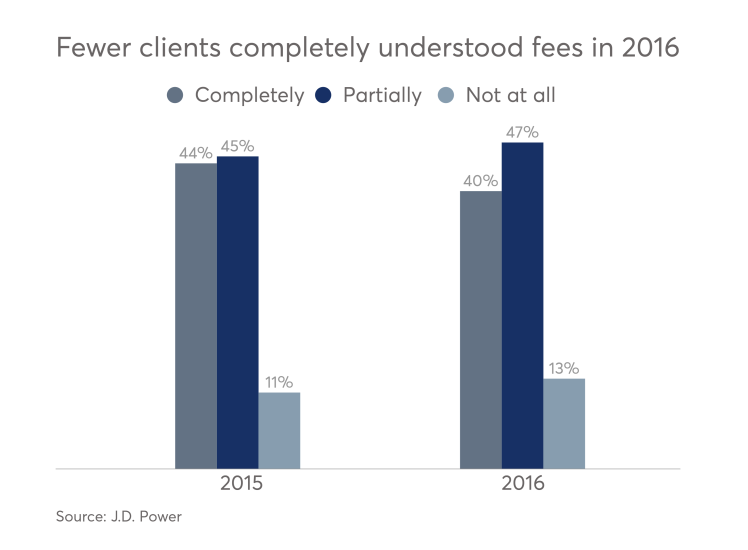

“There’s a chronic problem in the industry with fee transparency,” Foy says, noting that the segment of investors who don’t fully understand their plan’s fee structure usually comes in at around 60% in the firm’s surveys. “That’s been a stubborn number over the past several years.”