Getting it right

Please click through the images above to see how you stack up against your competition in breaking out people-related expenses, and devising compensation structures.

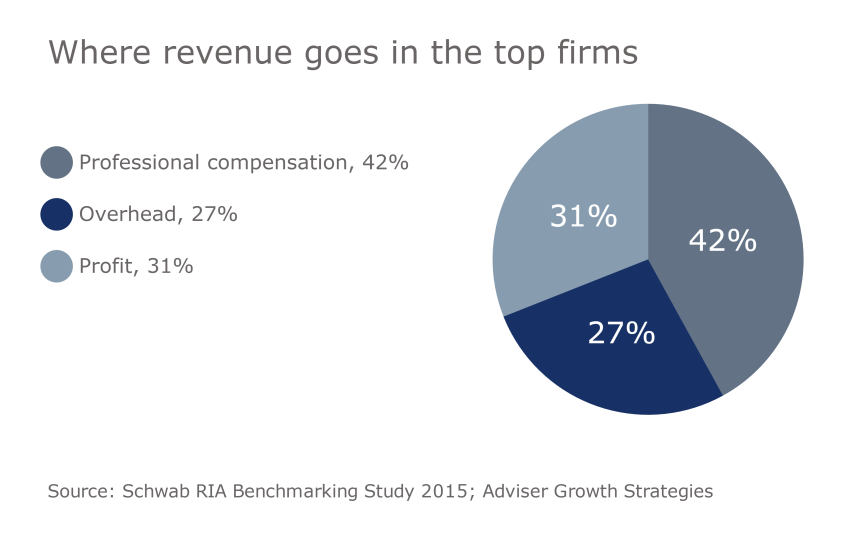

Where it goes

"As RIAs grow and add more employees, it's crucial for owners to refine their approach to reinforce the desired behavior in their employees," says John Furey, principal and founder of Phoenix-based Advisor Growth Strategies.

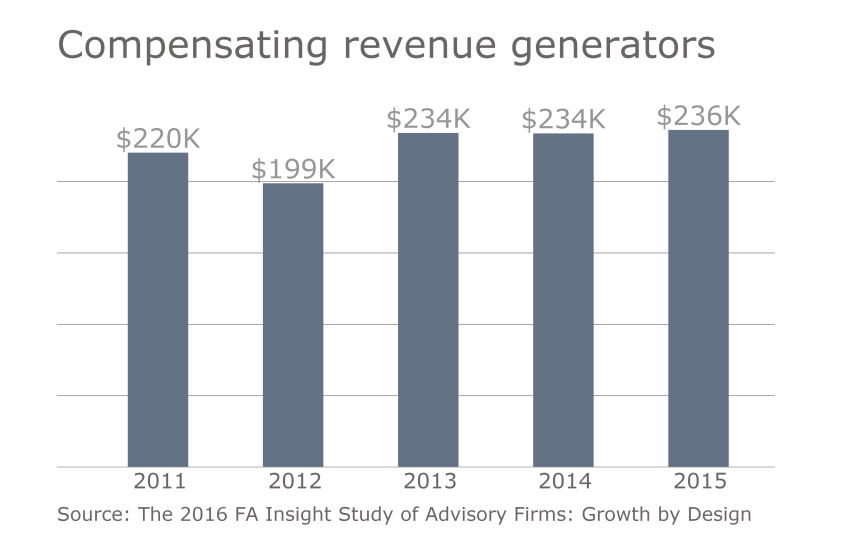

Cash is king

Steady payment

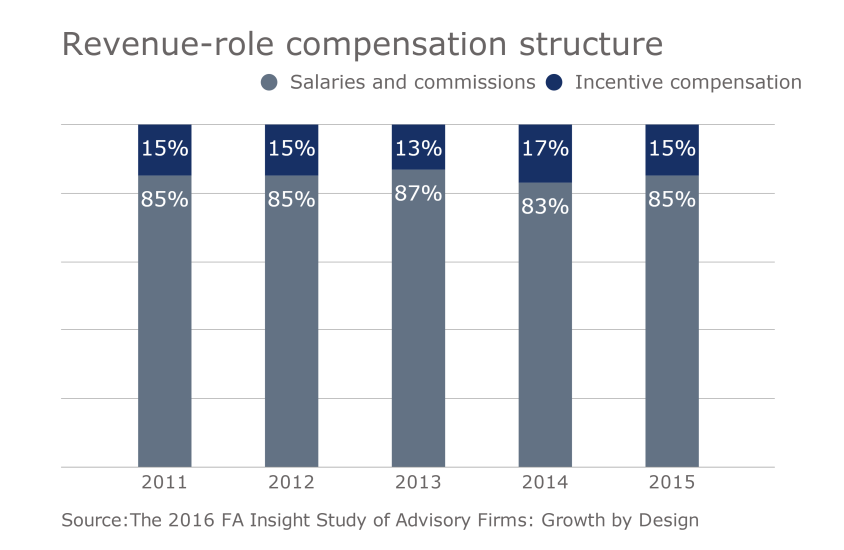

Rise in non-revenue pay

Salary/commission vs. incentive comp

How Wescott determines compensation

"We want to make sure compensation for each position in the firm is carefully aligned with experience and responsibilities," says Grant Rawdin, the firm's founder and CEO.

How Bronfman sets compensation

Simon believes in granting key operational staff, such as directors of investment operations and technology, equity compensation for their contributions.

"We want to align the incentives of our senior staff and key contributors with the success of the firm, and equity compensation is a great way to accomplish that goal," he says.