<p></p>

"The underlying story behind health care is strong," Morningstar analyst Robert Goldsborough says. "Despite health care reform, there is a lot arguing broadly for health care."

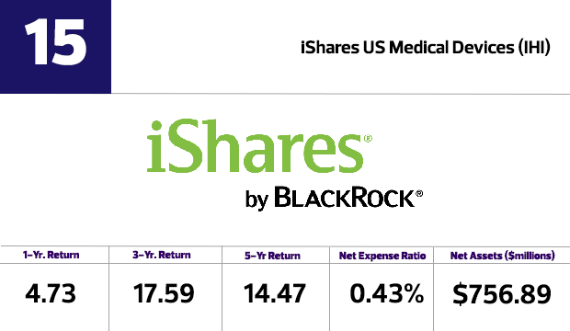

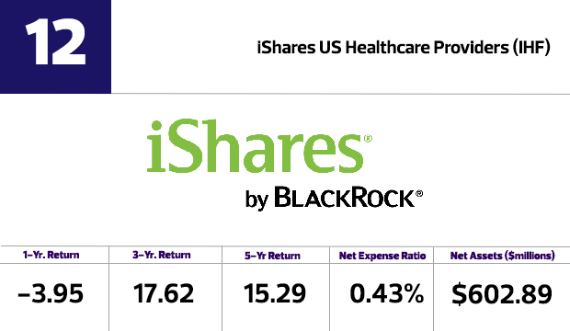

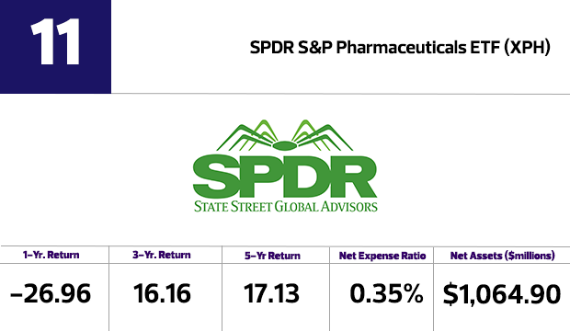

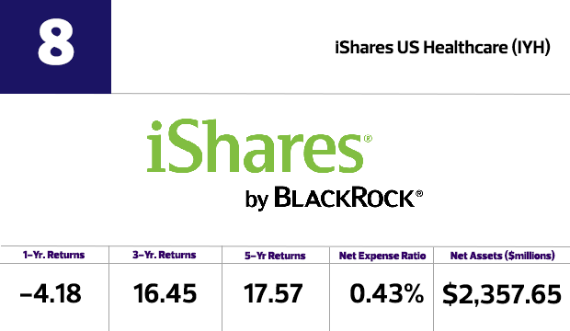

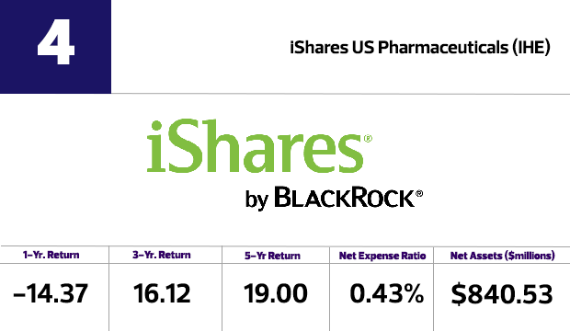

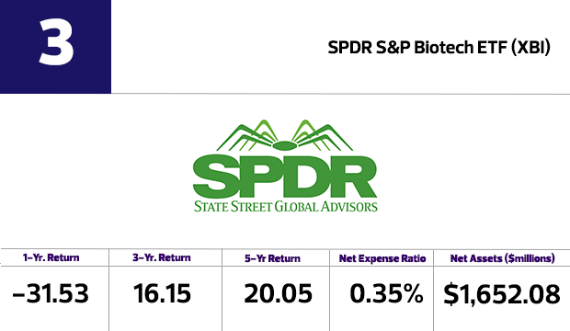

Although they all posted negative returns in the last year, the sector's 15 leading ETFs beat the three-, five- and 10-year performance numbers of the S&P 500, according to Morningstar.

The broad-based index posted annualized gains of 8.91% over three years, 9.27% over five years and 4.52% over 10 years. The one-year return amounted to a loss of 1.64%.

The sector's top ETF performer the past five years, PowerShares Dynamic Pharmaceuticals, illustrates the long-term growth trend for health care equities. While the fund posted a one-year loss of 14.54% through March 11, it also enjoyed a five-year return of 24.06%.

The sector's largest ETF, the $13.58 billion Health Care Select Sector SPDR, incurred a one-year loss of 1.99%, but returned nearly 18% return over the last 10 years.

For this list, we considered all health sector ETFs and ranked them by their five-year annualized returns. All data is from Morningstar.

Click here to view the data on a single page. - Andrew Shilling

Image: Fotolia

Read More:

Top Funds by Total Returns

Biggest Dividend Increases From S&P 500 Companies

On the Look Out for Dividend ETF Standouts

Advisors: Time to Look Beyond Dividends

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>

<p></p>