Of course, when it comes to investment returns, stability can be sexy, so we’ve gathered all the mutual funds with at least $500 million in assets and standard deviations of less than 3%. We list 20 funds ranked by three-year returns.

These options are not dirt cheap. Expense ratios ranged from about 50 to 100 basis points, and two funds were over the 1% mark. All data from Morningstar.

20. Delaware Tax-Free MN A

Standard Deviation: 2.75%

Expense Ratio: 0.85%

Total Assets (millions): $563

19. JHancock Strategic Income Opps NAV

Standard Deviation: 2.25%

Expense Ratio: 0.66%

Total Assets (millions): $7,368

18. Eaton Vance Glbl Macr Absolute Return

Standard Deviation: 2.33%

Expense Ratio: 1.03%

Total Assets (millions): $5,997

17. USAA VA Bond

Standard Deviation: 2.79%

Expense Ratio: 0.60%

Total Assets (millions): $696

16. American Century Global Bond R5

Standard Deviation: 2.67%

Expense Ratio: 0.64%

Total Assets (millions): $1,319

15. Angel Oak Multi-Strategy Income

Standard Deviation: 2.77%

Expense Ratio: 1.25%

Total Assets (millions): $5,393

14. Putnam Tax Exempt Income

Standard Deviation: 2.89%

Expense Ratio: 0.77%

Total Assets (millions): $920

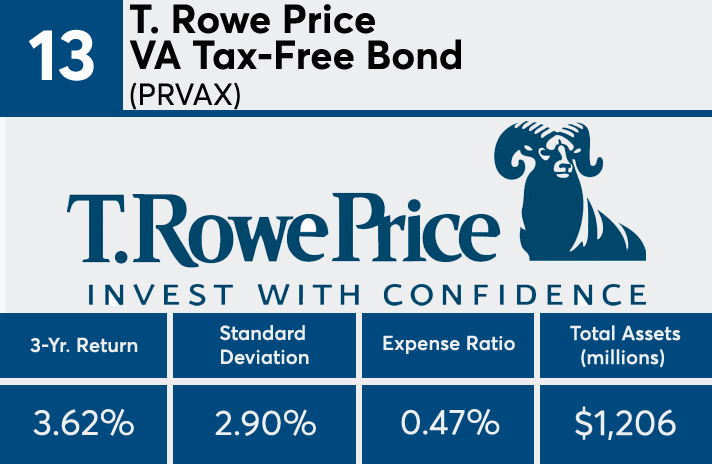

13. T. Rowe Price VA Tax-Free Bond

Standard Deviation: 2.90%

Expense Ratio: 0.47%

Total Assets (millions): $1,206

12. T. Rowe Price MD Tax-Free Bond

Standard Deviation: 2.76%

Expense Ratio: 0.46%

Total Assets (millions): $2,251

11. USAA Tax Exempt Long-Term

Standard Deviation: 2.89%

Expense Ratio: 0.51%

Total Assets (millions): $2,395

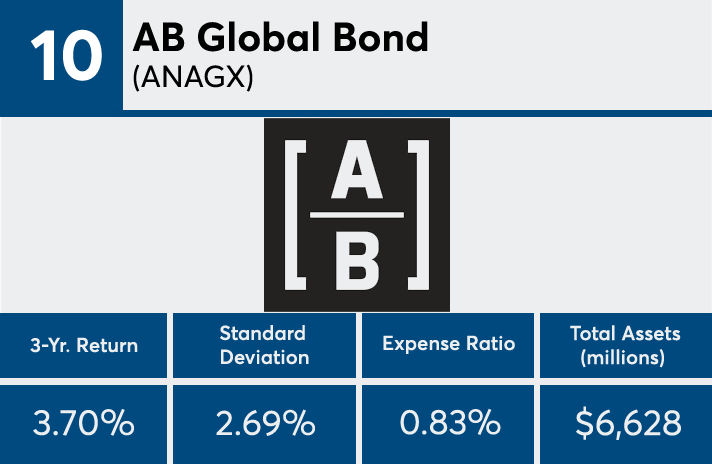

10. AB Global Bond

Standard Deviation: 2.69%

Expense Ratio: 0.83%

Total Assets (millions): $6,628

9. Franklin OH Tax-Free Inc

Standard Deviation: 2.93%

Expense Ratio: 0.63%

Total Assets (millions): $1,608

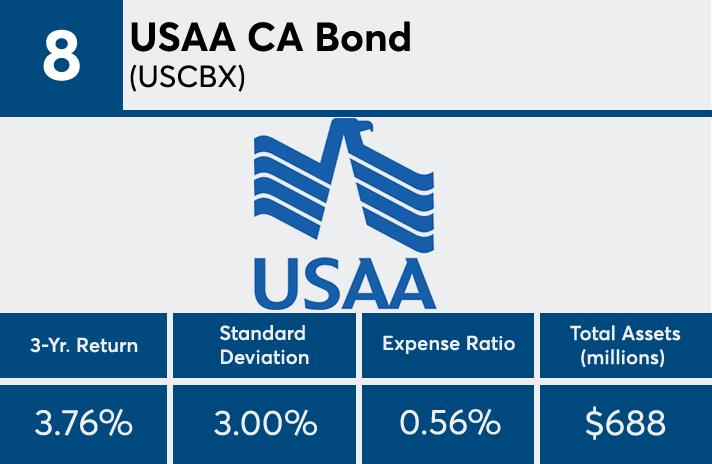

8. USAA CA Bond

Standard Deviation: 3.00%

Expense Ratio: 0.56%

Total Assets (millions): $688

7. Credit Suisse Floating Rate Hi Inc

Standard Deviation: 2.94%

Expense Ratio: 0.95%

Total Assets (millions): $3,461

6. Waddell & Reed Muni Hi-Inc

Standard Deviation: 2.90%

Expense Ratio: 0.88%

Total Assets (millions): $786

5. BNY Mellon Corporate Bond

Standard Deviation: 2.96%

Expense Ratio: 0.56%

Total Assets (millions): $771

4. GMO Opportunistic Income

Standard Deviation: 1.20%

Expense Ratio: 0.46%

Total Assets (millions): $1,250

3. Touchstone Flexible Income

Standard Deviation: 2.77%

Expense Ratio: 0.86%

Total Assets (millions): $711

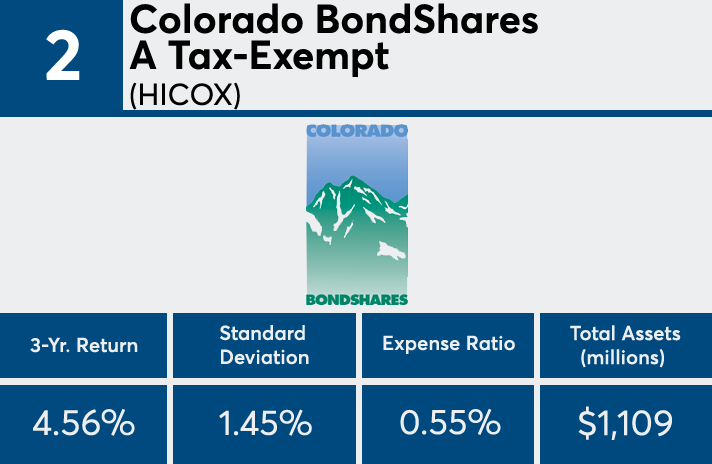

2. Colorado BondShares A Tax-Exempt

Standard Deviation: 1.45%

Expense Ratio: 0.55%

Total Assets (millions): $1,109

1. Performance Trust Strategic Bond

Standard Deviation: 2.15%

Expense Ratio: 0.82%

Total Assets (millions): $949