We reviewed all corporate bond funds with more than $500 million in assets and ranked them by their three-year returns. The average was 3.89%, higher than the returns from government bonds, of course, since there is more risk involved. While government debt carries interest rate and inflation risk, corporate bonds also carry default and downgrade risk. That means greater potential for losses. In the past decade, government bond funds tended to have just one down year, compared with two for many corporate bond funds.

Since corporate bonds are pegged to an underlying issuer, their risk/reward balance behaves more like stocks. Indeed, equities carry the most risk since they're lowest on the capital structure, and offer the highest potential rewards — 8% over the past three years, as measured by the S&P 500.

To qualify for our list, these portfolios must hold more than 65% of their assets in corporate bonds, less than 40% in foreign bonds and less than 35% in high-yield bonds. All data from Morningstar Direct.

20. SPDR Blmbg Barclays IntmTermCorpBd ETF (ITR)

5-Yr. Returns: 2.93%

Expense Ratio: 0.12%

Total Assets (millions): $2,249

19. Guggenheim BulletShrs 2021 Corp Bd ETF (BSCL)

5-Yr. Returns: N/A

Expense Ratio: 0.24%

Total Assets (millions): $760

18. Lord Abbett Income A (LAGVX)

5-Yr. Returns: 4.42%

Expense Ratio: 0.90%

Total Assets (millions): $925

17. USAA Intermediate-Term Bond (USIBX)

5-Yr. Returns: 4.01%

Expense Ratio: 0.63%

Total Assets (millions): $1,974

16. iShares US Credit Bond ETF (CRED)

5-Yr. Returns: 3.19%

Expense Ratio: 0.15%

Total Assets (millions): $1,541

15. T. Rowe Price Corporate Income (PRPIX)

5-Yr. Returns: 3.80%

Expense Ratio: 0.62%

Total Assets (millions): $883

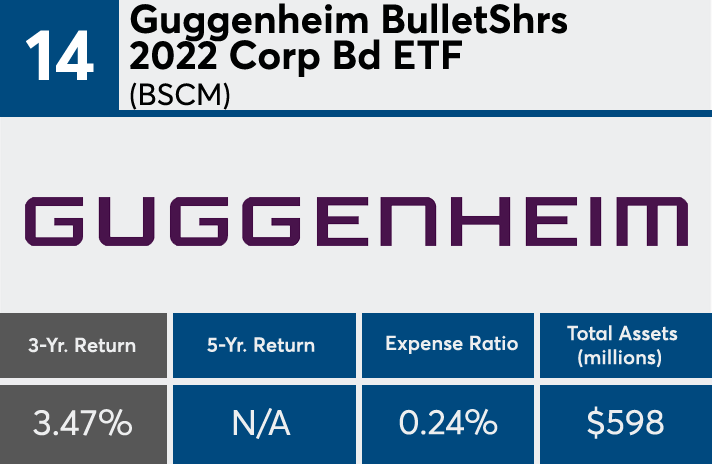

14. Guggenheim BulletShrs 2022 Corp Bd ETF (BSCM)

5-Yr. Returns: N/A

Expense Ratio: 0.24%

Total Assets (millions): $598

13. MFS Corporate Bond (MFBFX)

5-Yr. Returns: 3.59%

Expense Ratio: 0.81%

Total Assets (millions): $1,671

12. Vanguard Interm-Term Inv Grde (VFIDX)

5-Yr. Returns: 3.29%

Expense Ratio: 0.10%

Total Assets (millions): $26,180

11. iShares iBoxx Inv Grade Corp Bd ETF (LQD)

5-Yr. Returns: 3.78%

Expense Ratio: 0.15%

Total Assets (millions): $38,632

10. Fidelity Corporate Bond (FCBFX)

5-Yr. Returns: 3.73%

Expense Ratio: 0.45%

Total Assets (millions): $988

9. JPMorgan Corporate Bond (CBFVX)

5-Yr. Returns: N/A

Expense Ratio: 0.41%

Total Assets (millions): $1,798

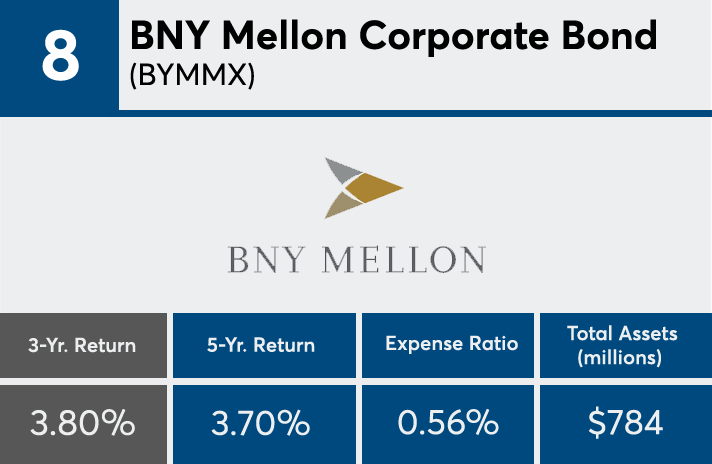

8. BNY Mellon Corporate Bond (BYMMX)

5-Yr. Returns: 3.70%

Expense Ratio: 0.56%

Total Assets (millions): $784

7. Vanguard Interm-Term Corp Bd (VICSX)

5-Yr. Returns: 3.87%

Expense Ratio: 0.07%

Total Assets (millions): $1,014

6. Invesco Corporate Bond A (ACCBX)

5-Yr. Returns: 4.58%

Expense Ratio: 0.90%

Total Assets (millions): $1,003

5. iShares 10+ Year Credit Bond ETF (CLY)

5-Yr. Returns: 4.41%

Expense Ratio: 0.20%

Total Assets (millions): $822

4. Pimco Inv Grade Corp (PBDPX)

5-Yr. Returns: 4.82%

Expense Ratio: 0.61%

Total Assets (millions): $2,429

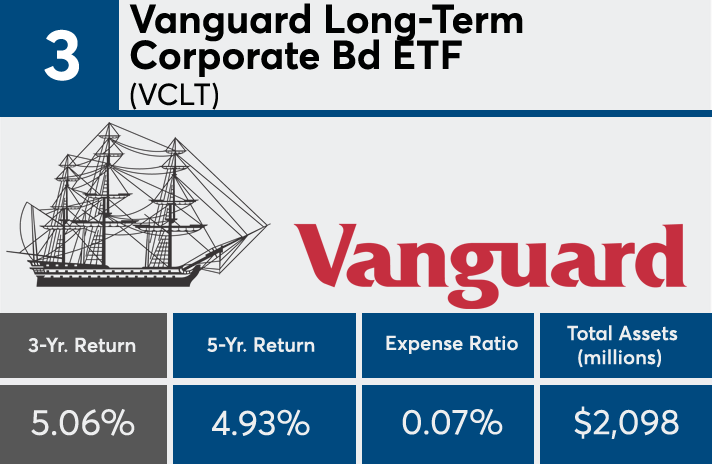

3. Vanguard Long-Term Corporate Bd ETF (VCLT)

5-Yr. Returns: 4.93%

Expense Ratio: 0.07%

Total Assets (millions): $2,098

2. SEI Long Duration Credit (SLDAX)

5-Yr. Returns: 5.12%

Expense Ratio: 0.37%

Total Assets (millions): $3,752

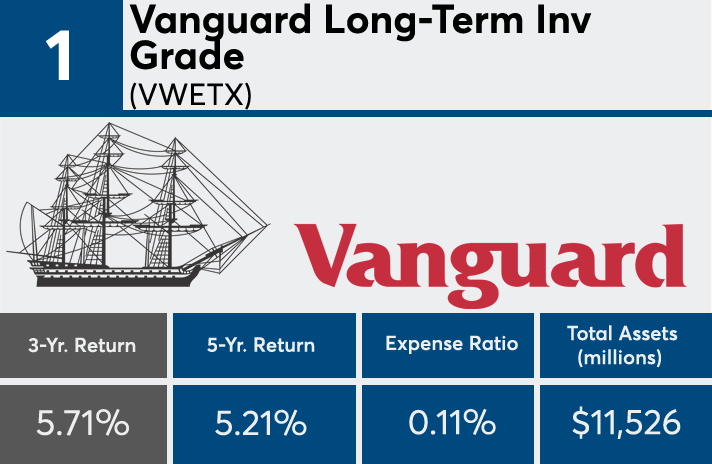

1. Vanguard Long-Term Inv Grade (VWETX)

5-Yr. Returns: 5.21%

Expense Ratio: 0.11%

Total Assets (millions): $11,526