-

New portfolios from BlackRock, Fidelity, T. Rowe Price and Clark Capital underscore the Chicago-based firm's ambitions with independent advisors.

April 25 -

In a panel at the Quad-A conference, executives from the three major firms explained how they view the industry's path forward on diversity.

September 23 -

The new leader will have to focus on actively managed U.S. mutual funds at a time when index-tracking products like exchange-traded funds are attracting increased investment.

July 29 -

While some jobs such as trading are more suited for an office setting, CEO Bill Stromberg says technology and programming roles can be better handled remotely.

April 30 -

As more active strategies embrace the exchange-traded model, the landscape may be shifting.

June 29 -

Vanguard reclaimed its top spot in J.D. Power’s annual ranking of self-directed investor satisfaction. Charles Schwab retained its position as a leader among DIY investors.

April 14 -

With more than $80 billion in combined assets under management, the winners have started out the year with a loss.

March 12 -

The move expands the manager’s commission-free platform, which has included all mutual funds since 1977 and all ETFs since 2010.

January 22 -

The 82-year-old company’s strategy has helped secure net inflows in all but one of the five years through 2018.

December 23 -

The four new types of funds use a so-called proxy basket and will publish some information about their portfolios every day.

December 11 -

Rather than disclosing their portfolios every day like conventional ETFs, the nontransparent products will reveal their holdings at least once a quarter.

November 15 -

The asset managers and a U.S. family office collectively bought a 14.4% position in the company ahead of its IPO, a person familiar with the matter says.

October 4 -

At 84 basis points, the average expense ratio is over 40 basis points pricier than what investors paid on average last year.

September 18 -

When pitted against the broader market, the top 20 outperformed both the Dow and S&P 500 by more than 5 percentage points.

September 4 -

Some of the same features that led to their unpopularity may also be what uncorrelated them from their peers, an expert says.

July 31 -

With double-digit annualized returns produced by nearly all of these funds, the ranking illustrates the broader trend toward passive investing.

May 29 -

The Fed’s pause on interest rate hikes has been a “net positive” for the category, an expert says.

February 20 -

The average fee was nearly 20 basis points higher than the top-performer.

February 13 -

“It’s hard to outrun secular risk,” says T. Rowe Price CIO David Giroux.

November 14 -

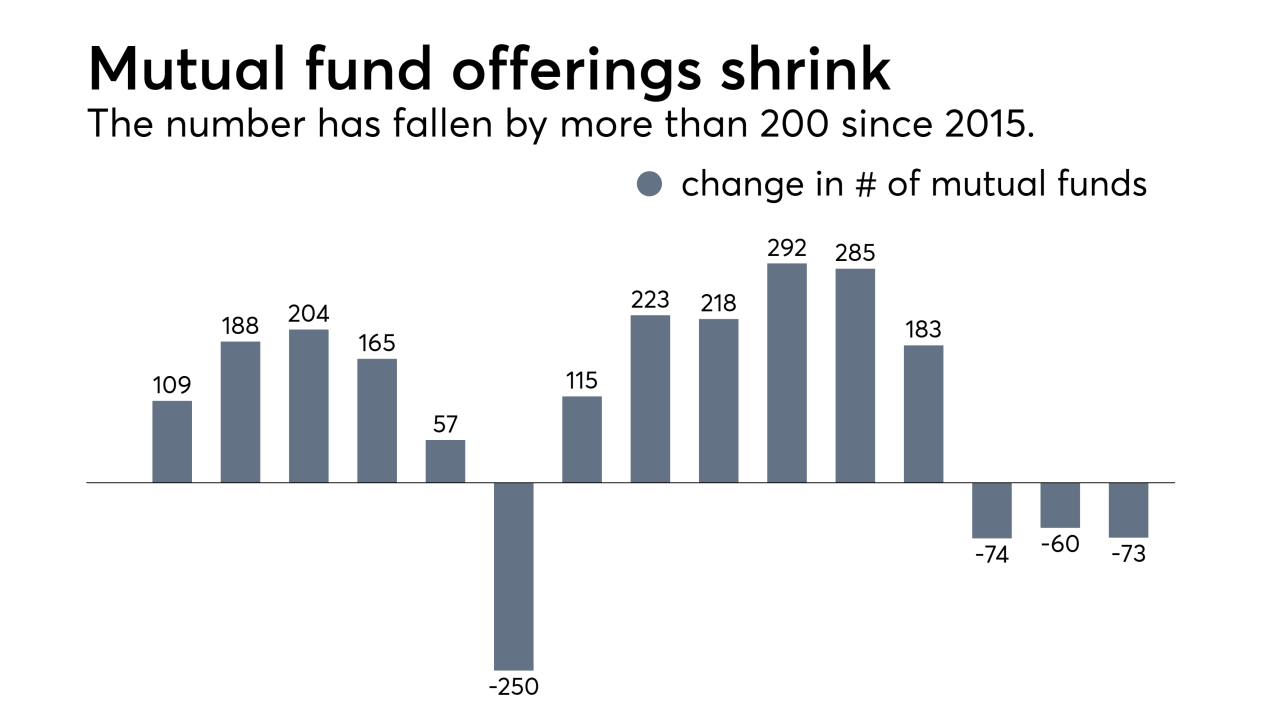

There are at least 200 fewer products available since 2015. Some advisors haven’t noticed. But should they?

November 1