A bleak outlook, but lending remains strong

See how the wirehouses are performing this quarter across a variety of metrics by clicking through our slideshow.

Read more:

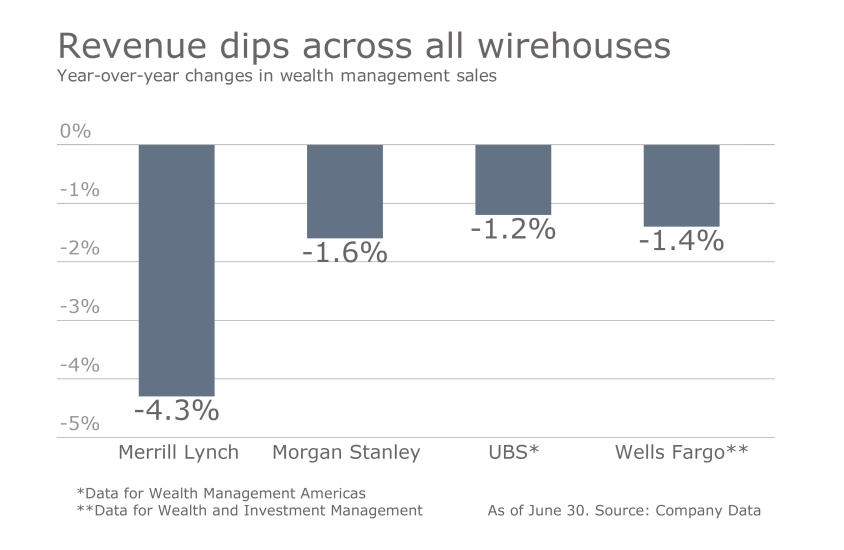

Brokerage transaction decline drives revenue fall

Wells Fargo and UBS also, associated their revenue fall to lower asset-based fees and lower transaction-based incomes.

Morgan Stanley's wealth management transactional revenues for the quarter decreased 8% year-over-year. The firm blamed lower investment banking, commission and fees for the segment. This, however, was partially offset by higher revenues in trading.

Read more:

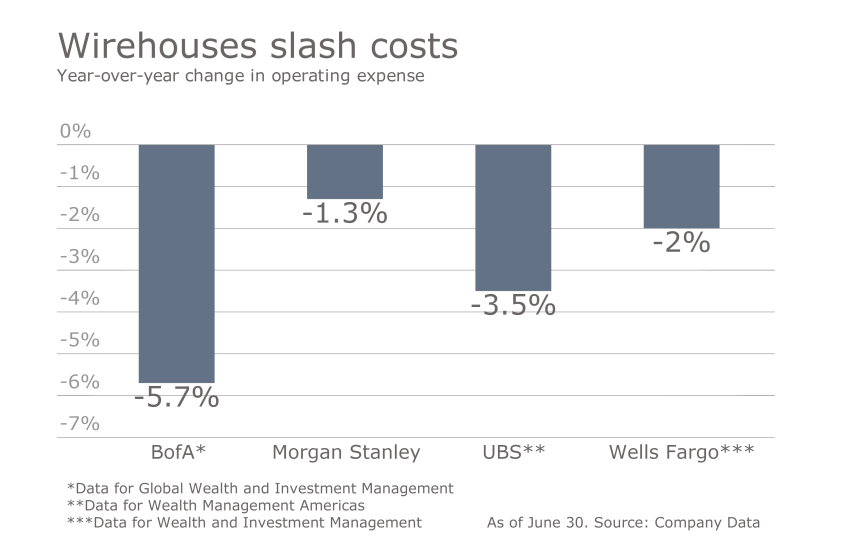

A leaner business

All four wirehouses are employing cost-cutting strategies. Expenses for Morgan Stanley, however, remained relatively unchanged due to an increase in non-compensation charges caused by higher litigation costs. These costs, however, were partially offset by a lower Federal Deposit Insurance Corp. assessment of deposits.

UBS, on the other hand, associated its reduced costs to lower provisions for litigation and regulatory matters. This reduction offset higher adjusted personnel expenses, which includes higher salary costs and compensation commitments.

Read more:

Cost-cutting efforts

UBS leads the pack with double digit growth in net profits. The firm associated its performance to cost-cutting efforts related to lower operating expenses.

BofA's wealth unit also said its positive performance was driven by a decrease in noninterest expenses.

Morgan Stanley remains the worst performer among its peers in terms of net profit. The firm blames stagnant growth in client assets for its disappointing profit figures.

Read more:

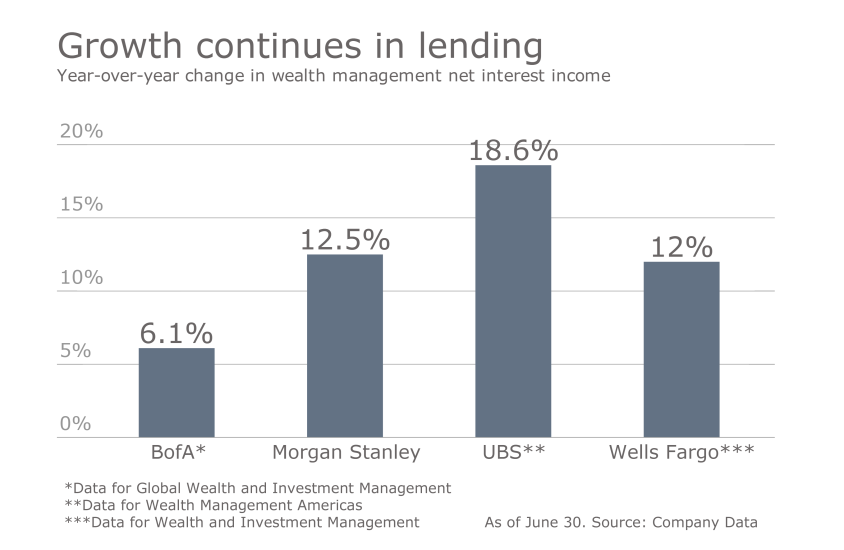

The bread and butter continues to grow

Growth in loan balances and investment portfolios were credited for Wells Fargo's lending progress.

Read more:

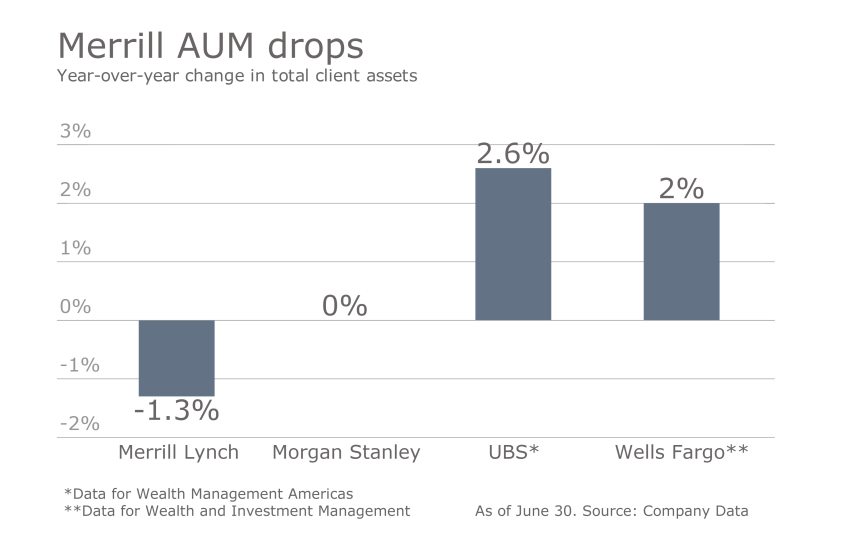

Client balances

Client balances at Morgan Stanley remained flat year-over-year, while both UBS and Wells Fargo saw approximately 2% growth.

Increase in recruits for some

Read more: