FP50 2016: Which IBDs made the most in commissions?

For more in-depth coverage, please see

Data as of year-end 2015.

10. MML Investors Services

% Change: -1.6%

9. Voya Financial Advisors

% Change: -3.9%

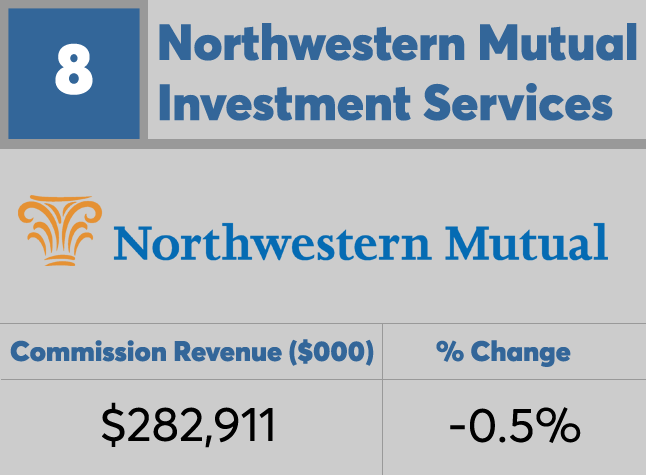

8. Northwestern Mutual Investment Services

% Change: -0.5%

7. Cetera Advisor Networks

% Change: -5%

6. Commonwealth Financial Network

% Change: -3.3%

5. AXA Advisors

% Change: 1.6%

4. Lincoln Financial Network

% Change: 3.5%

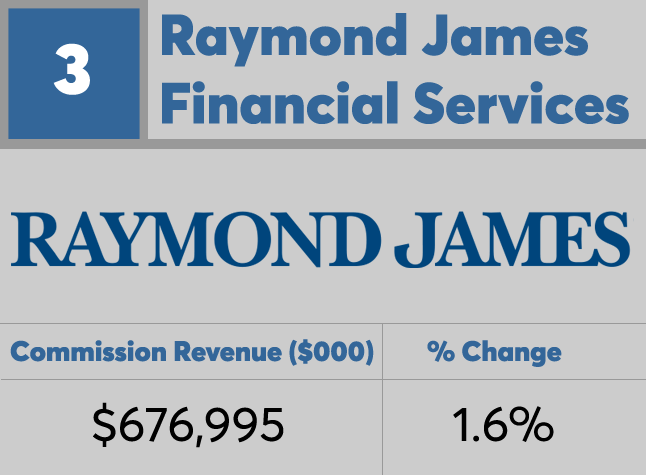

3. Raymond James Financial Services

% Change: 1.6%

2. Ameriprise Financial Services

% Change: -0.3%

1. LPL Financial

% Change: -7%