Showing improvement, but needs more work

Scroll through our slideshow to see a demographic breakdown on retirement preparedness.

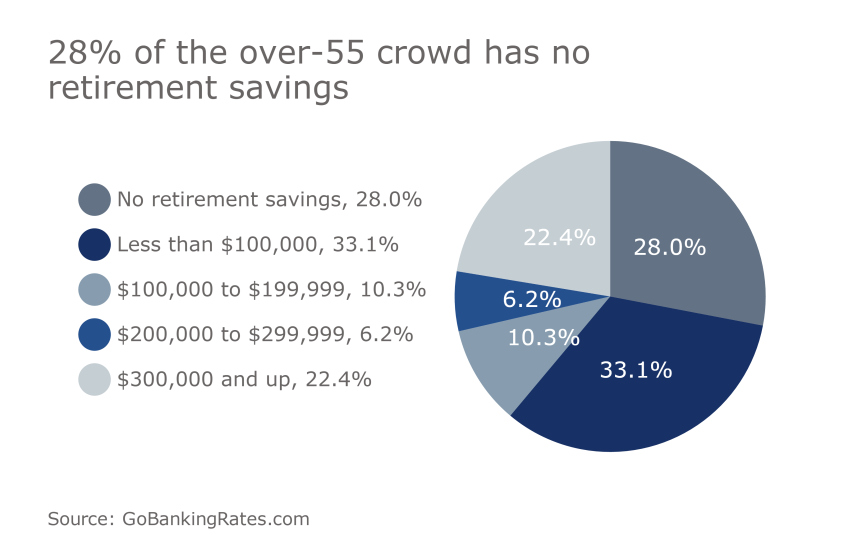

Data for this slide comes from Fidelity. Subsequent slides come from financial website GoBankingRates.com.

All ages

Over 55

Generation X