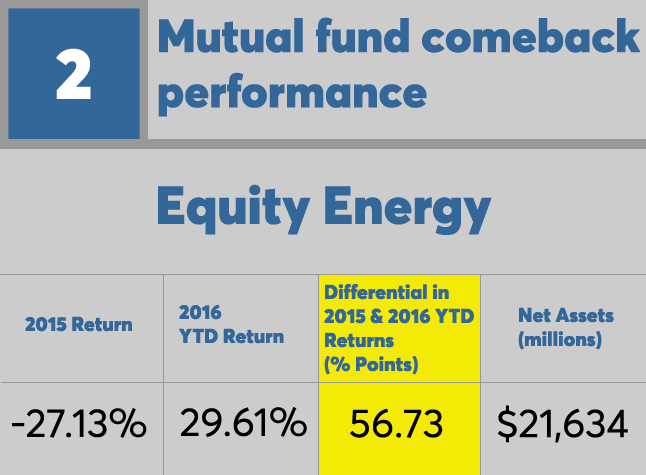

Still, though, when taking a longer-term view of three to five years, both energy and precious metals are still down, notes Andrew Daniels, equity strategies analyst at Morningstar.

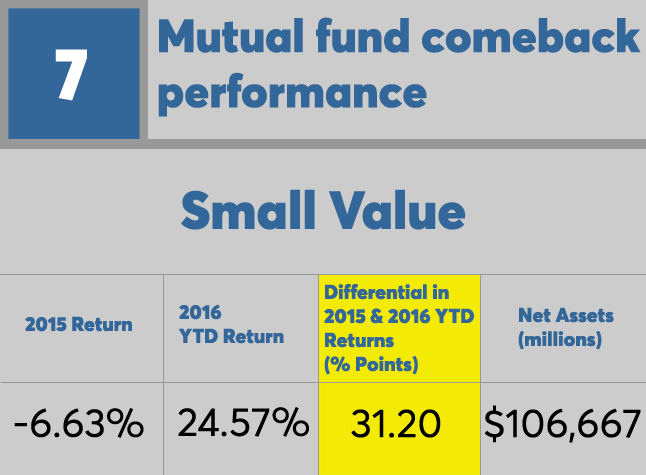

Another notable result was the small-cap comeback, Daniels said. Those smaller companies have historically outperformed large-caps, although that has not been the case over the previous couple of years. He noted that the potential for fiscal stimulus (spending on infrastructure as one example) can create potential growth for small-caps.

Lipper's Roseen summed up by saying that chasing performance can be hazardous to a client's portfolio, noting that "last year’s cellar dwellers turned into this year’s darlings."

Scroll through to see all the big comeback market stories. Comebacks were measured by the largest percentage point increase in 2016 year-to-date performance over 2015 performance. All data is from Morningstar.

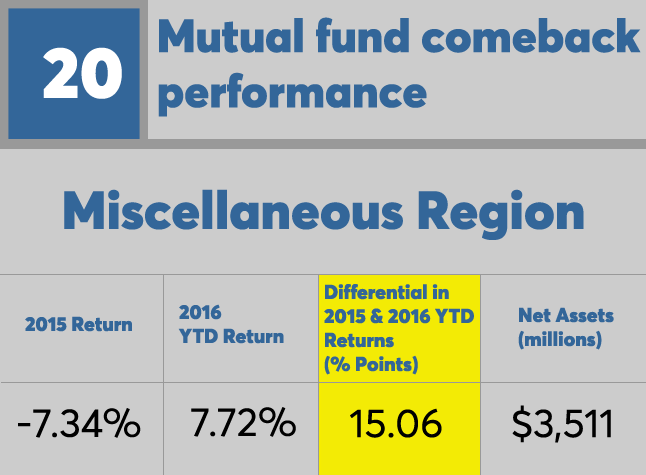

20. Miscellaneous Region

2016 YTD Return: 7.72%

Differential in 2015 & 2016 YTD Returns (% Points): 15.06

Net Assets (millions): $3,511

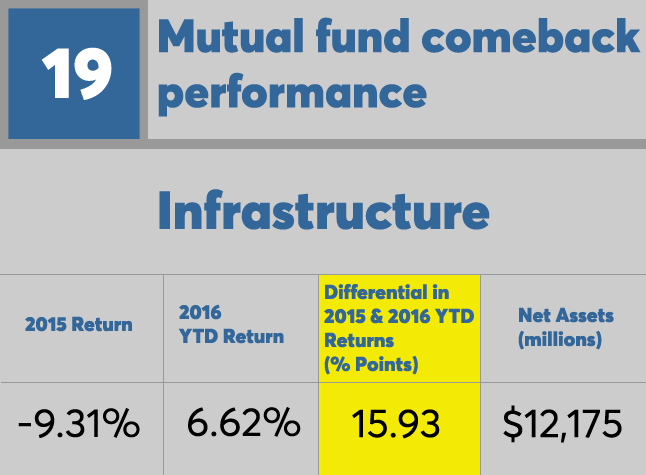

19. Infrastructure

2016 YTD Return: 6.62%

Differential in 2015 & 2016 YTD Returns (% Points): 15.93

Net Assets (millions): $12,175

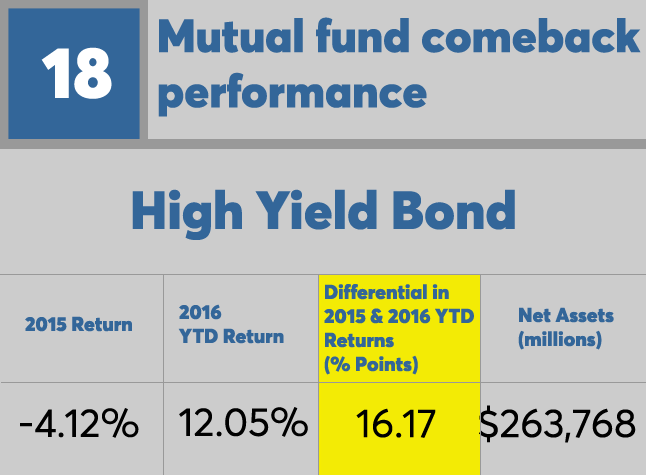

18. High Yield Bond

2016 YTD Return: 12.05%

Differential in 2015 & 2016 YTD Returns (% Points): 16.17

Net Assets (millions): $263,768

17. Financial

2016 YTD Return: 16.40%

Differential in 2015 & 2016 YTD Returns (% Points): 17.23

Net Assets (millions): $8,666

16. Large Value

2016 YTD Return: 13.48%

Differential in 2015 & 2016 YTD Returns (% Points): 17.34

Net Assets (millions): $877,860

15. Mid-Cap Blend

2016 YTD Return: 13.83%

Differential in 2015 & 2016 YTD Returns (% Points): 18.39

Net Assets (millions): $254,364

14. Utilities

2016 YTD Return: 9.35%

Differential in 2015 & 2016 YTD Returns (% Points): 19.56

Net Assets (millions): $21,591

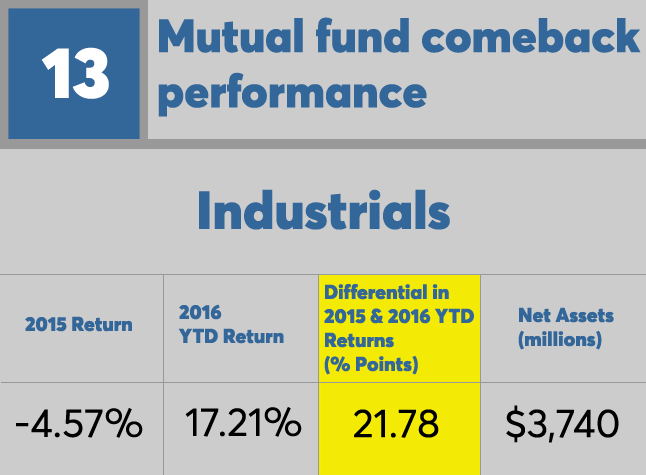

13. Industrials

2016 YTD Return: 17.21%

Differential in 2015 & 2016 YTD Returns (% Points): 21.78

Net Assets (millions): $3,740

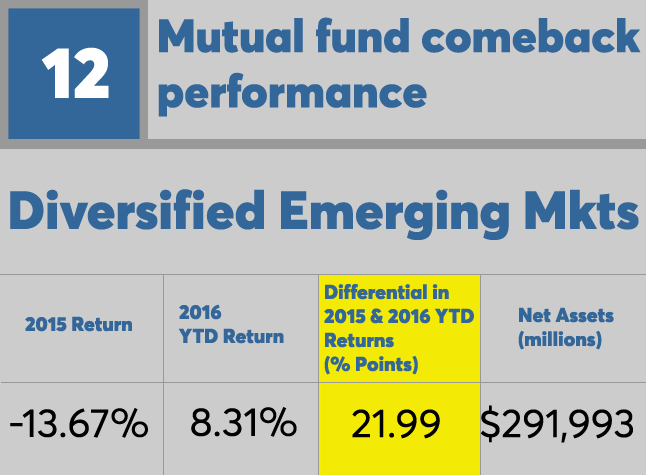

12. Diversified Emerging Mkts

2016 YTD Return: 8.31%

Differential in 2015 & 2016 YTD Returns (% Points): 21.99

Net Assets (millions): $291,993

11. Trading-Leveraged Equity

2016 YTD Return: 17.04%

Differential in 2015 & 2016 YTD Returns (% Points): 22.55

Net Assets (millions): $3,221

10. Mid-Cap Value

2016 YTD Return: 17.49%

Differential in 2015 & 2016 YTD Returns (% Points): 22.68

Net Assets (millions): $190,381

9. Emerging Markets - Local Curre

2016 YTD Return: 8.08%

Differential in 2015 & 2016 YTD Returns (% Points): 22.77

Net Assets (millions): $8,098

8. Small Blend

2016 YTD Return: 19.85%

Differential in 2015 & 2016 YTD Returns (% Points): 25.24

Net Assets (millions): $215,295

7. Small Value

2016 YTD Return: 24.57%

Differential in 2015 & 2016 YTD Returns (% Points): 31.20

Net Assets (millions): $106,667

6. Commodities Broad Basket

2016 YTD Return: 12.54%

Differential in 2015 & 2016 YTD Returns (% Points): 35.98

Net Assets (millions): $25,818

5. Natural Resources

2016 YTD Return: 28.35%

Differential in 2015 & 2016 YTD Returns (% Points): 50.47

Net Assets (millions): $21,879

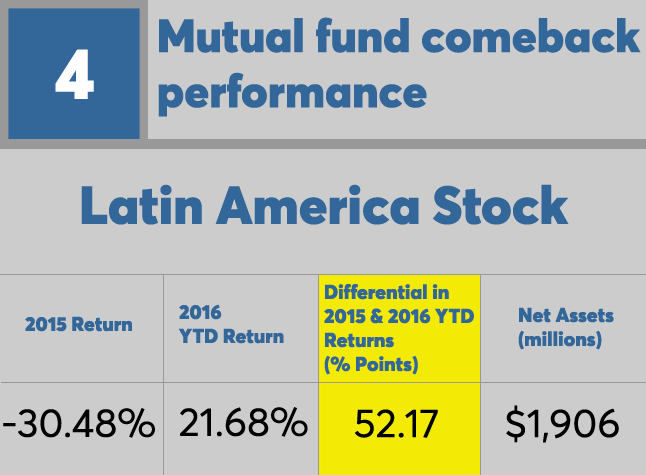

4. Latin America Stock

2016 YTD Return: 21.68%

Differential in 2015 & 2016 YTD Returns (% Points): 52.17

Net Assets (millions): $1,906

3. Energy Limited Partnership

2016 YTD Return: 21.52%

Differential in 2015 & 2016 YTD Returns (% Points): 55

Net Assets (millions): $25,578

2. Equity Energy

2016 YTD Return: 29.61%

Differential in 2015 & 2016 YTD Returns (% Points): 56.73

Net Assets (millions): $21,634

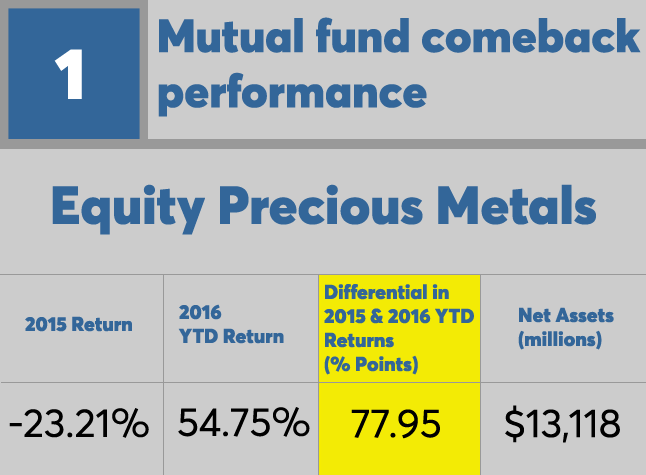

1. Equity Precious Metals

2016 YTD Return: 54.75%

Differential in 2015 & 2016 YTD Returns (% Points): 77.95

Net Assets (millions): $13,118