Real estate funds: Who’s on top?

Scroll through to see the top real estate mutual funds ranked by three-year returns. Only funds with at least $100 million in assets are listed. All data from Morningstar.

15. Nuveen Real Estate Securities I

1-Yr. Return: 3.48%

3-Yr. Return: 11.24%

Expense Ratio: 1.05%

Total Assets (millions): $5,300

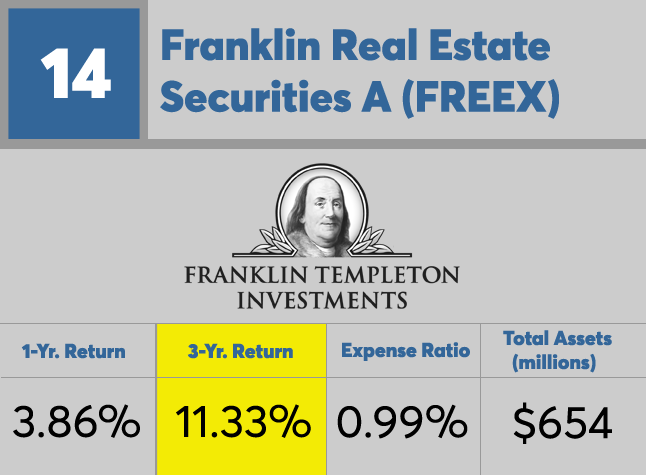

14. Franklin Real Estate Securities A

1-Yr. Return: 3.86%

3-Yr. Return: 11.33%

Expense Ratio: 0.99%

Total Assets (millions): $654

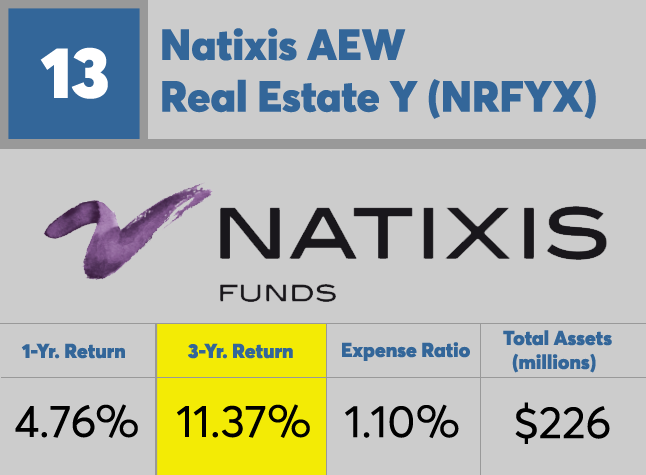

13. Natixis AEW Real Estate

1-Yr. Return: 4.76%

3-Yr. Return: 11.37%

Expense Ratio: 1.10%

Total Assets (millions): $226

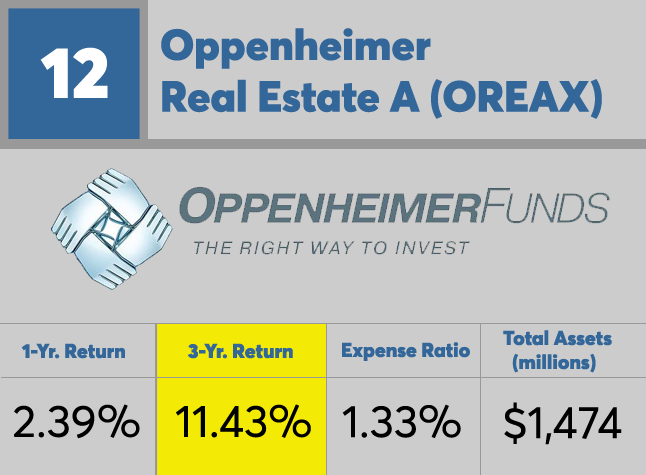

12. Oppenheimer Real Estate A

1-Yr. Return: 2.39%

3-Yr. Return: 11.43%

Expense Ratio: 1.33%

Total Assets (millions): $1,474

11. Fidelity Real Estate Index Instl

1-Yr. Return: 4.39%

3-Yr. Return: 11.66%

Expense Ratio: 0.07%

Total Assets (millions): $843

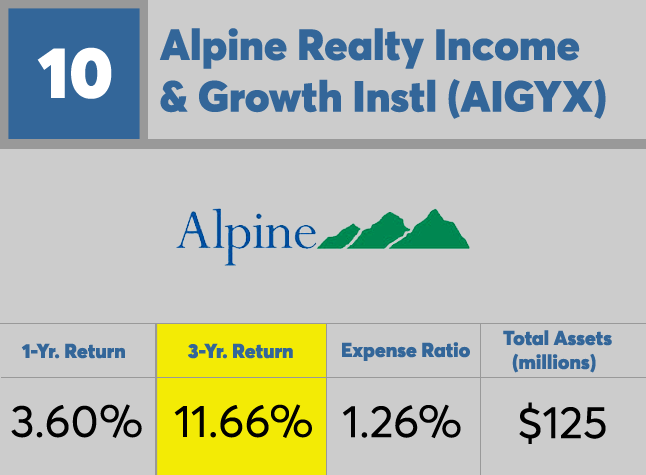

10. Alpine Realty Income & Growth Instl

1-Yr. Return: 3.60%

3-Yr. Return: 11.66%

Expense Ratio: 1.26%

Total Assets (millions): $125

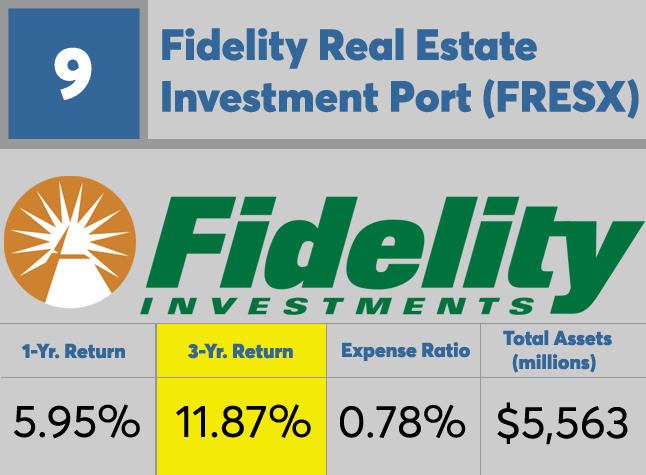

9. Fidelity Real Estate Investment Port

1-Yr. Return: 5.95%

3-Yr. Return: 11.87%

Expense Ratio: 0.78%

Total Assets (millions): $5,563

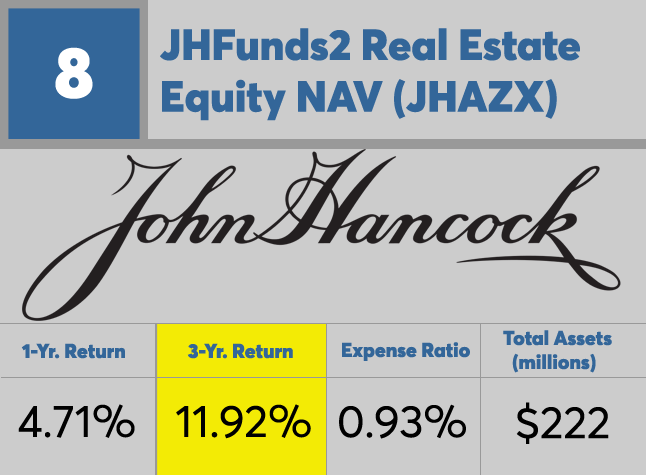

8. JHFunds2 Real Estate Equity NAV

1-Yr. Return: 4.71%

3-Yr. Return: 11.92%

Expense Ratio: 0.93%

Total Assets (millions): $222

7. T. Rowe Price Real Estate

1-Yr. Return: 4.78%

3-Yr. Return: 11.98%

Expense Ratio: 0.76%

Total Assets (millions): $6,856

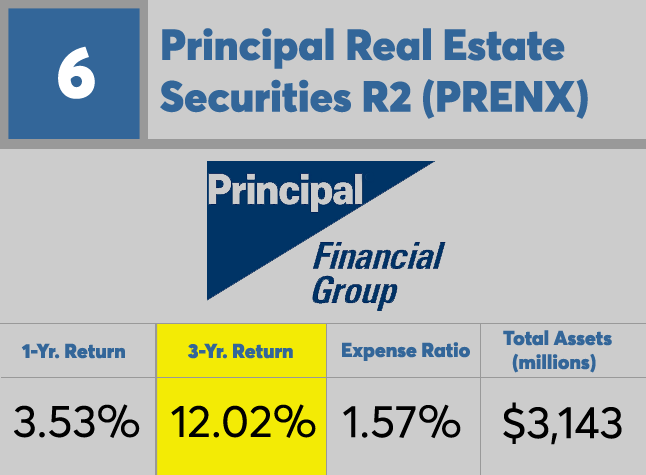

6. Principal Real Estate Securities R2

1-Yr. Return: 3.53%

3-Yr. Return: 12.02%

Expense Ratio: 1.57%

Total Assets (millions): $3,143

5. Cohen & Steers Realty Shares

1-Yr. Return: 5%

3-Yr. Return: 12.11%

Expense Ratio: 0.96%

Total Assets (millions): $6,206

4. AMG Managers Real Estate Securities

1-Yr. Return: 5.30%

3-Yr. Return: 12.24%

Expense Ratio: 1.17%

Total Assets (millions): $452

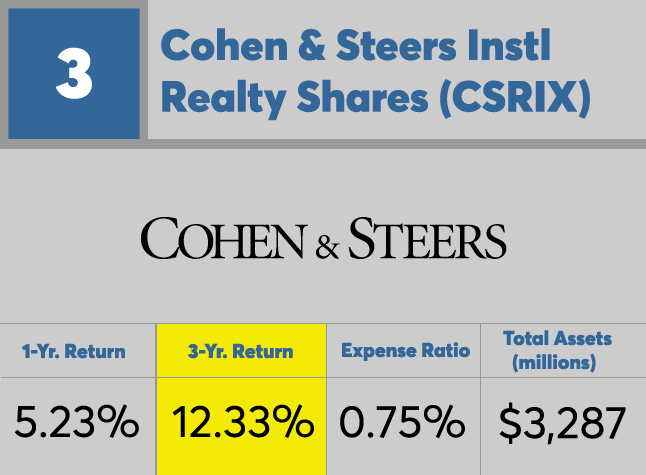

3. Cohen & Steers Instl Realty Shares

1-Yr. Return: 5.23%

3-Yr. Return: 12.33%

Expense Ratio: 0.75%

Total Assets (millions): $3,287

2. Baron Real Estate Institutional

1-Yr. Return: -4.42%

3-Yr. Return: 12.52%

Expense Ratio: 1.06%

Total Assets (millions): $1,254

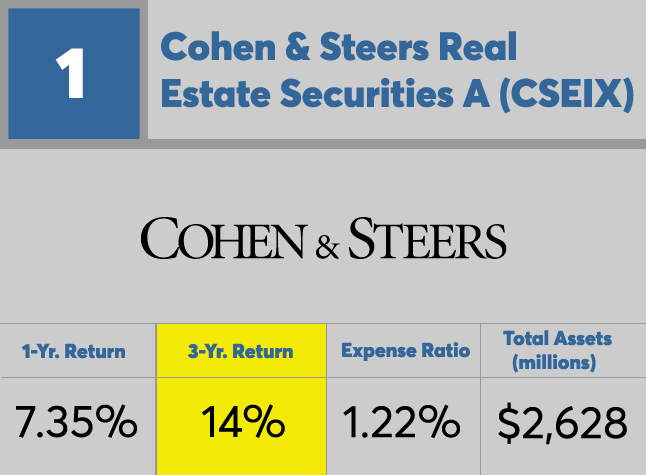

1. Cohen & Steers Real Estate Securities A

1-Yr. Return: 7.35%

3-Yr. Return: 14%

Expense Ratio: 1.22%

Total Assets (millions): $2,628