These 10 Stories Got Your Attention in 2015

These stories will be as valuable for advisors over the coming year as they were in 2015. Please click on the arrows above, and see how a little hindsight can pay off in coming months.

To view this content as a one page version, click here. - Chelsea Emery

Top 10 Undervalued, Dividend-Paying Stocks

Veres: Why the AUM Fee Is Toast

Books for Advisors: Holiday Gifts & Great Reads for 16

Among the picks: The Supernova Advisor: Crossing the Invisible Bridge to Exceptional Client Service and Consistent Growth, by Robert D. Knapp. This quick and easy read is a great road map for an advisor who is looking to take their practice to the level of client service that would be the envy of other advisors, says Larry Gekiere, senior vice president, Texas Capital Bank/Raymond James.

Long Haul: Best Mutual Funds for the Past 25 Years

Roth: 5 Dumbest Investing Bets

RIA Leaders: Top 20 Firms for 2015

Which Asset Allocation Mix Outperforms?

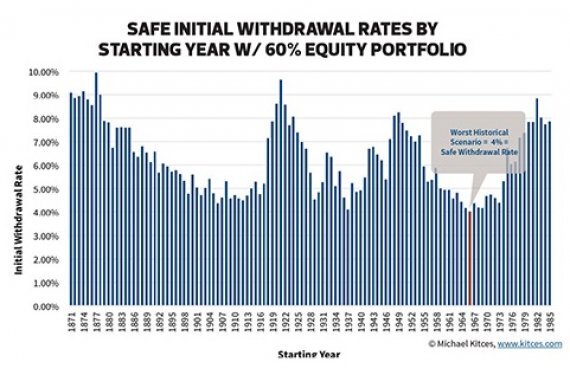

Kitces: Smart Fix for the 4% Rule

Top Tax Issues for 2016