These Advisor Technology Trends Will Surprise You

The pace of change has forced all advisors to consider how best to digitize their practices. The process, as Financial Planning’s annual technology survey through the years shows, is an uneven one: some innovations garner quick traction, while advisors stubbornly refrain from adopting others.

Here are some key insights gleaned from a comparison of findings from our technology surveys. Click here for a single page version. – Suleman Din

For Many, it's Either MoneyGuidePro or Nothing at All

But just over 20% of all advisors surveyed said they weren't using any software at all -- and among advisors aged 65-74, that was the majority (35.7%). In 2012, that overall figure was 26%. So while there's been slightly more adoption of financial planning software on the whole, we recommend firms "should invest in this application sooner rather than later."

What, Me, Worry? Risk Software Stagnant

But This Software Has Grown Dramatically

Repeat After Us: Microsoft Office is NOT a CRM

Schwab Now Dominant in Portfolio Software

Robos, Robos, Robos

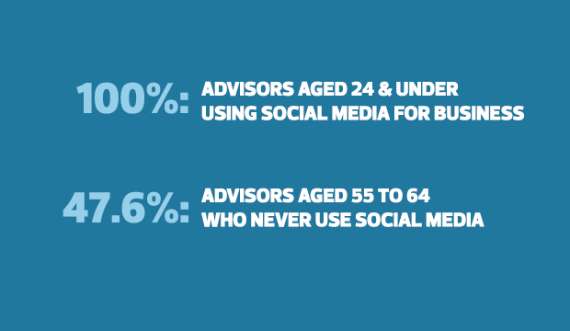

Social Media: We're Still Figuring it Out

We're Phoning It In Now