Top 10 Tax Mistakes Made by Investors

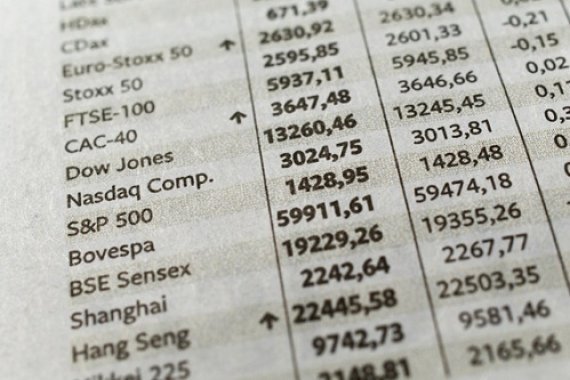

Investing is a complex undertaking. The supply of investment alternatives is seemingly endless. Evaluating various alternatives can be quite difficult and very time consuming.

And unless held in check, the actual decision-making process is fraught with human emotions that often lead investors to make counterproductive investment choices. Add to this the myriad tax rules and regulations that impact investments and you have enough to overwhelm many investors.

Trusted financial professionals are in a position to help make sense of it all. Certainly, appropriate portfolios should be structured for investors, and suitable investments should be chosen given the current economic environment and the investors unique set of circumstances. But tax consequences must also be carefully considered, and the accountant often plays a role in this. Tax treatment, good or bad, can make or break an investment decision.

Here are the top 10 tax mistakes made by investors as gathered in a recent survey we conducted of investment advisors.

Read a single-page version here.

John Burke is the president of Burke Financial Strategies and and Steven Criscuolo is a CPA and and the firm's chief financial officer.

1. Short-term vs. long-term gains

2. Foreign stock investments held in a tax-qualified account

3. Gold and silver held in a taxable account

4. Sale of appreciated securities by elderly investors

5. Generating excess unrelated business income in a tax-qualified account

6. Ignoring local tax laws

7. Failing to consider a Roth IRA conversion

8. Failing to realize capital gains

9. Improperly calculating the cost basis for MLPs

10. Allowing a pension plan to become non-compliant

An effective, long-term investment process must consider and evaluate the overall economic environment, individual investments, tax laws and human emotions. This process is ongoing. Only by constantly balancing all of these elements can after-tax returns be maximized.