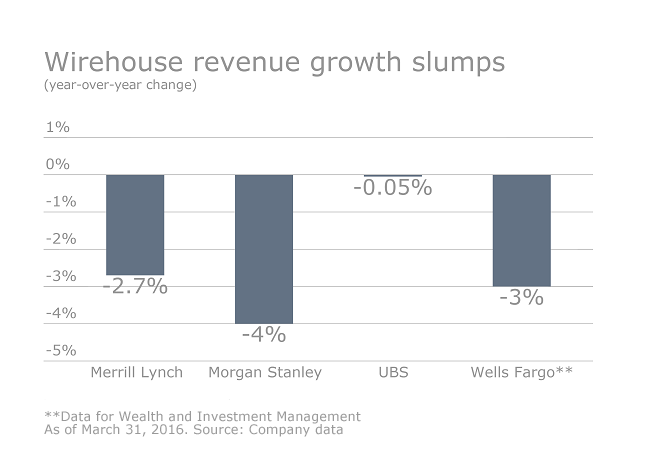

Rough start to 2016 for the wirehouses

To see how the industry's biggest firms are performing across a variety of metrics, click through our slideshow.

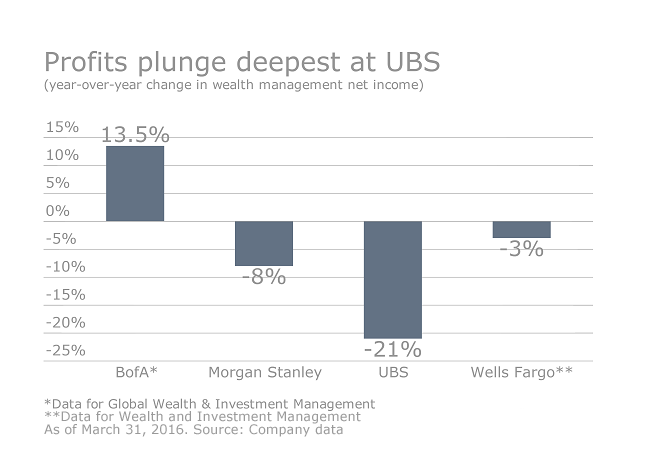

All firms recorded lower incomes

Merrill Lynch blamed "lower market valuations and reduced transactional activity" for their depressed figures. Morgan Stanley made similar comments.

Revenue at UBS was nearly flat. The firm attributed that outcome to an increase in recurring net fee income from higher managed account fees.

Read more:

Lower expenses for all, except one

UBS recorded a reduction in wealth management general expenses due to lower net expenses for litigation and regulatory provisions. But that did not offset the firm's higher variable compensation and personnel expenses. The wirehouse attributed the overall rise in expenses to a new employee healthcare benefit plan and increases in service charges from a Corporate Center – Services cost agreement.

Expenses at Wells Fargo were lower year-over-year thanks to an offset of lower non-personnel expenses, broker commissions and deferred compensation expenses.

Merrill's secret: Leaner expense structure

The unit, which houses Merrill Lynch and U.S. Trust under its wealth management umbrella, attributed their positive operating leverage to solid expense management. The decline in expenses was reported to be more than the firm's revenue dip, improving its pre-tax margin to 26.3%.

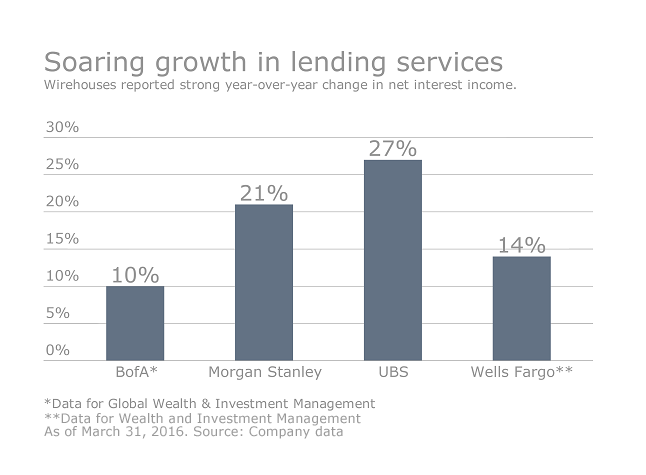

Solid foundations

In this area, UBS took the lead with a 27% increase in interest income, which the firm attributed in part to higher interest rates.

Read more:

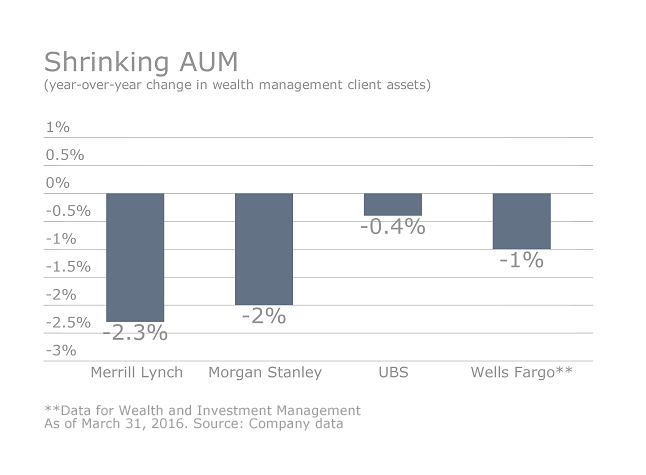

Overall managed assets take hits due to lower market levels

Recruiting stays strong for some

Meanwhile, Wells Fargo's onboarding of Credit Suisse advisers boosted its adviser ranks.