Maybe. Value may sound like a good play with equities having surged 10% since Election Day, but those heady, short-term gains may mean value stocks and the funds that focus on them may also be historically overpriced.

With the S&P 500 trading at more than 25 times its earnings, Morningstar analysts suggest the steady pace could see a reversal.

"There's certainly a fair amount of downside [potential] for all equities," Russell Kinnel, Morningstar's director of manager research, said in a new report. "It seems like the risks have grown."

Value funds outperformed growth categories last year in three- and five-year trailing periods, while growth maintains a slight lead over 10 years, Morningstar said.

Nearly one-third of the holdings of one leading value fund, Towle Deep Value, are in industrials, and that "benefited from the trends," said Morningstar Analyst Gretchen Rupp. “Industrials, infrastructure, energy and financials were often held in these funds.”

Scroll through to see the top 20 value funds with more than $100 million in assets over the last one-, three- and five-year periods. All data from Morningstar.

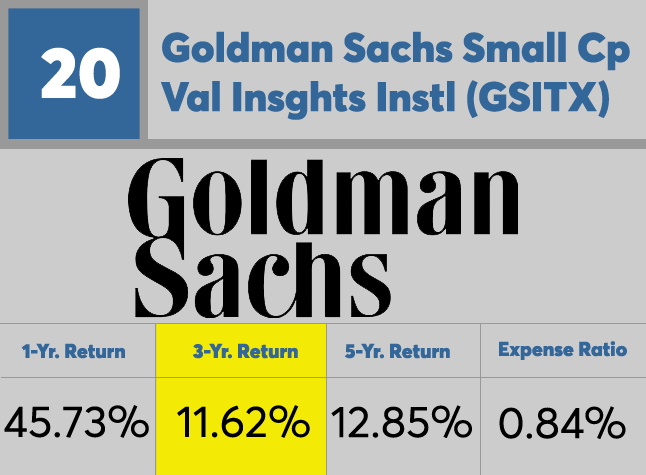

20. Goldman Sachs Small Cp Val Insghts Instl (GSITX)

3-Yr. Return: 11.62%

5-Yr. Return: 12.85%

Expense Ratio: 0.84%

Total Assets (millions): $195.79

19. CornerCap Small-Cap Value Investor (CSCVX)

3-Yr. Return: 11.64%

5-Yr. Return: 14.57%

Expense Ratio: 1.30%

Total Assets (millions): $1.09.50

18. Victory Sycamore Small Company Opp R (GOGFX)

3-Yr. Return: 11.69%

5-Yr. Return: 13.24%

Expense Ratio: 1.53%

Total Assets (millions): $4,285.73

17. Keeley Mid Cap Dividend Value I (KMDIX)

3-Yr. Return: 11.70%

5-Yr. Return: 15.09%

Expense Ratio: 1.05%

Total Assets (millions): $107.79

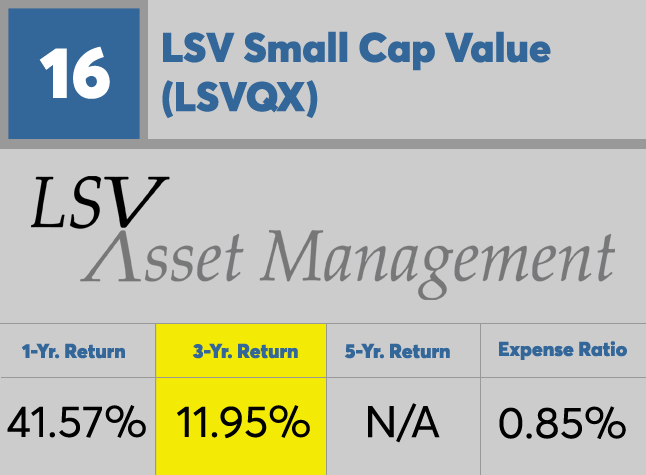

16. LSV Small Cap Value (LSVQX)

3-Yr. Return: 11.95%

5-Yr. Return: N/A

Expense Ratio: 0.85%

Total Assets (millions): $261.74

15. American Century Equity Income Inv (TWEIX)

3-Yr. Return: 11.98%

5-Yr. Return: 12.42%

Expense Ratio: 0.94%

Total Assets (millions): $12,433.95

14. Invesco Dividend Income Investor (FSTUX)

3-Yr. Return: 12.05%

5-Yr. Return: 1.18%

Expense Ratio: 1.18%

Total Assets (millions): $2,512.24

13. SEI US Managed Volatility A SIIT (SVYAX)

3-Yr. Return: 12.07%

5-Yr. Return: 14.83%

Expense Ratio: 0.24%

Total Assets (millions): $1,495.97

12. Principal Small-MidCap Dividend Inc Inst (PMDIX)

3-Yr. Return: 12.23%

5-Yr. Return: 14.59%

Expense Ratio: 1.15%

Total Assets (millions): $3,089.52

11. PF Small-Cap Value P (US69447T8475)

3-Yr. Return: 12.39%

5-Yr. Return: 13.55%

Expense Ratio: 0.90%

Total Assets (millions): $127.62

10. Transamerica Large Cap Value I2 (TWQZX)

3-Yr. Return: 12.47%

5-Yr. Return: 15.71%

Expense Ratio: 0.68%

Total Assets (millions): $2,266.30

9. Victory Sycamore Established Value R (GETGX)

3-Yr. Return: 12.52%

5-Yr. Return: 14.47%

Expense Ratio: 1.16%

Total Assets (millions): $8,133.41

8. Integrity Dividend Harvest A (IDIVX)

3-Yr. Return: 12.62%

5-Yr. Return: N/A

Expense Ratio: 0.95%

Total Assets (millions): $141.85

7. Towle Deep Value (TDVFX)

3-Yr. Return: 12.93%

5-Yr. Return: 17.86%

Expense Ratio: 1.20%

Total Assets (millions): $174.97

6. VY American Century Sm-Mid Cp Val I (IACIX)

3-Yr. Return: 13.07%

5-Yr. Return: 15.28%

Expense Ratio: 0.87%

Total Assets (millions): $369.05

5. American Century Mid Cap Value Inv (ACMVX)

3-Yr. Return: 13.44%

5-Yr. Return: 15.55%

Expense Ratio: 0.98%

Total Assets (millions): $9,008.15

4. American Century NT Mid Cap Value Instl (ACLMX)

3-Yr. Return: 13.72%

5-Yr. Return: 15.82%

Expense Ratio: 0.78%

Total Assets (millions): $1,048.57

3. JPMorgan Large Cap Value Select (HLQVX)

3-Yr. Return: 13.76%

5-Yr. Return: 15.68%

Expense Ratio: 0.77%

Total Assets (millions): $946.09

2. Nuveen Small Cap Value I (FSCCX)

3-Yr. Return: 14.26%

5-Yr. Return: 15.80%

Expense Ratio: 1.13%

Total Assets (millions): $1,223.98

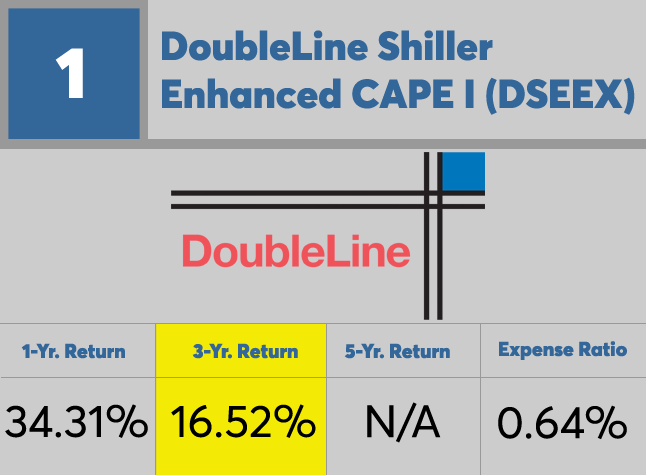

1. DoubleLine Shiller Enhanced CAPE I (DSEEX)

3-Yr. Return: 16.52%

5-Yr. Return: N/A

Expense Ratio: 0.64%

Total Assets (millions): $258.61