-

The firm blamed a coding error from a trading software it upgraded at the time. FINRA took nearly eight years to discipline Goldman for the problem, which allegedly began in 2015.

April 5 -

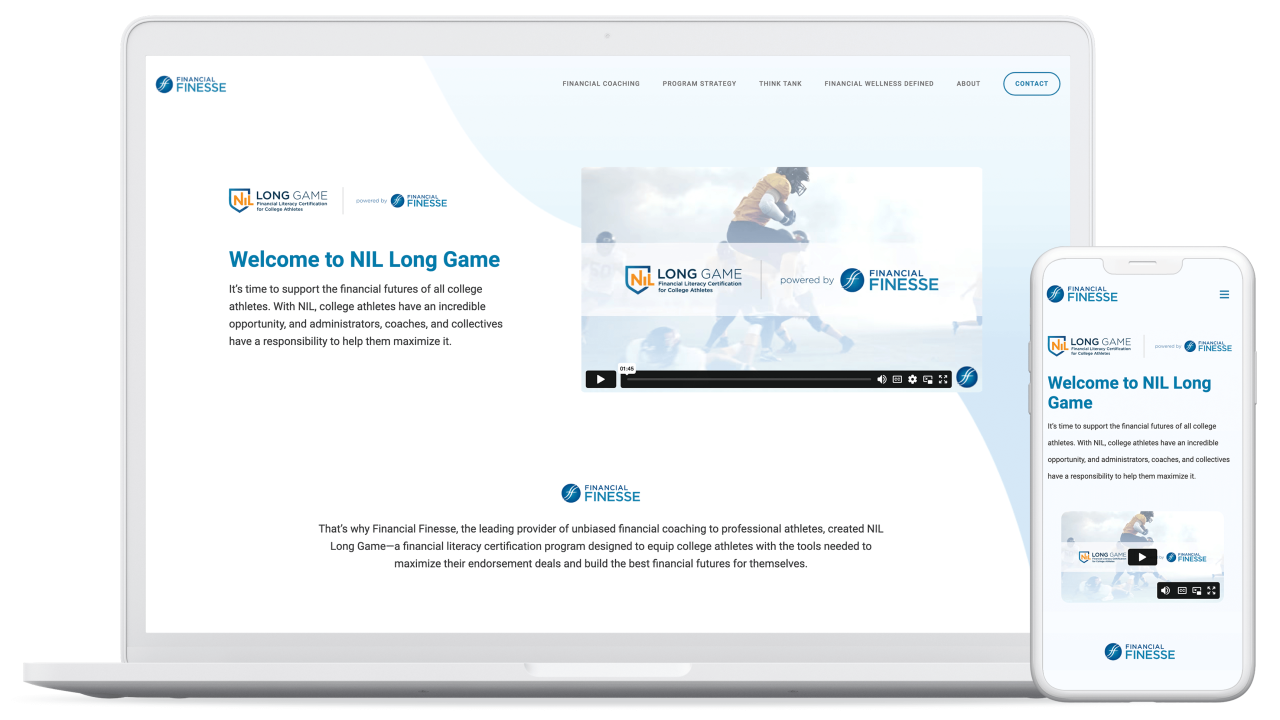

The program, offered by a financial wellness coaching service, joins a burgeoning patchwork of wealth management support systems for student-athletes.

April 5 -

The last-minute changes would loosen inspection requirements but add limits to the type of business brokers can do from home.

April 5 -

UBS has traded steady progress on a low-risk strategy for a political spotlight, years of integration efforts and tens of thousands of job cuts in buying Credit Suisse. Will it pay off?

April 5 -

The second generation financial advisor turned fintech founder wants to help advisors get more personal with their clients.

April 5 -

The fintech leaders said standing out in wealth management is all about finding your firm's "secret sauce."

April 5 -

Millennial investors across wealth segments are beginning to work with advisors at a much earlier age than prior generations did, a new Ameriprise study shows. Here's why, and what advisors can do about it.

April 5 -

The West Coast native and industry veteran talks keeping firm culture strong in a remote world.

April 4 -

The $2.4 billion request for the Wall Street regulator would put 1,434 officers on the compliance beat, up 4% from seven years ago.

April 4 -

This tax-code authorized technique allows clients to remove a personal residence from their estate at a significantly reduced gift tax cost.

April 4 Neal Gerber Eisenberg's Private Wealth Services practice group

Neal Gerber Eisenberg's Private Wealth Services practice group -

By paying more now, a young homeowner could be done with his mortgage a few years early. But would it be worth it?

April 4 -

The forced merger with rival UBS was "the best among bad solutions."

April 4 -

Exchange-traded funds focus on natural gas and technology did horribly last year, but they're still drawing in new money.

April 4 -

CEO Greg Fleming's team secured more than $600 million in capital that brings together two of North America's influential financial families.

April 4 -

Every score fell as investors gave wealth management firms ugly grades in a time of slumping stocks and bonds and fears of a recession.

April 4 -

Wealth managers are increasingly pledging to address diversity, equity and inclusion in their businesses.

April 4 -

Taxable bond exchange-traded funds have drawn floods of cash ever since two banks collapsed in March and deepened fears of an economic downturn.

April 4 -

Although the new leaders at Merrill could offer advisors new hopes, the firm could well suffer further attrition after Andy Sieg's defection last week to Citigroup.

April 3 -

The old-age insurance program is on course to go bust in the early 2030s, right when the last of the boomer generation will reach retirement age.

April 3 -

The SEC and DOJ accused a New Jersey-based broker of using insider knowledge to make more than $3.4 million from a scheme involving special purpose acquisition companies.

April 3