-

The new tax law is expected to drive more money into investment products and push stock and bond prices even higher, says CEO Laurence Fink.

January 12 -

The law allows clients the ability to make tax-free withdrawals for elementary and secondary school expenses.

January 9 -

When giving cash gifts to grandchildren this holiday season, clients have options that can also help minimize their estate taxes in the future.

December 19 -

The right strategy can help minimize their future estate taxes.

December 19 -

Advisors say it’s never too early to start saving for college.

December 11 -

While there’s no fail-safe method for modeling the costs, a popular calculation may significantly under- or overstate the burden of tuition, room and board, Kitces.com research associate Derek Tharp writes.

December 6 -

Clients should consider tax breaks such as education expenses, mortgage interest payment and small business costs.

December 5 -

Retirement location "matters just as much to your tax bill as what you have,” an expert says.

November 17 -

The proposal aims to simplify tax subsidies by increasing qualified withdrawals from 529s in exchange for scrapping the Coverdell account.

November 13 -

Experts say 18-to-36-year-olds should take advantage of workplace 401(k) and Roth IRA tax benefits now and shop around for the best savings rates later.

October 30 -

Clients could face a 100% penalty of taxes owed for filing late.

September 19 -

Making excess withdrawals could result in taxes on the earnings and a hefty 10% penalty.

August 18 -

Claiming the earned income tax and child tax credit may get tougher under Trump’s 2018 budget plan.

June 2 -

Harvesting losses to write off taxable gains is one strategy to address the Trump administration's plan to scrap the 3.8% net investment income surtax.

May 26 -

Each plan has pros and cons: Clients who own a Roth IRA for at least 5 years are entitled to penalty-free withdrawals for education expenses, but they'll owe income taxes on those earnings.

March 23 -

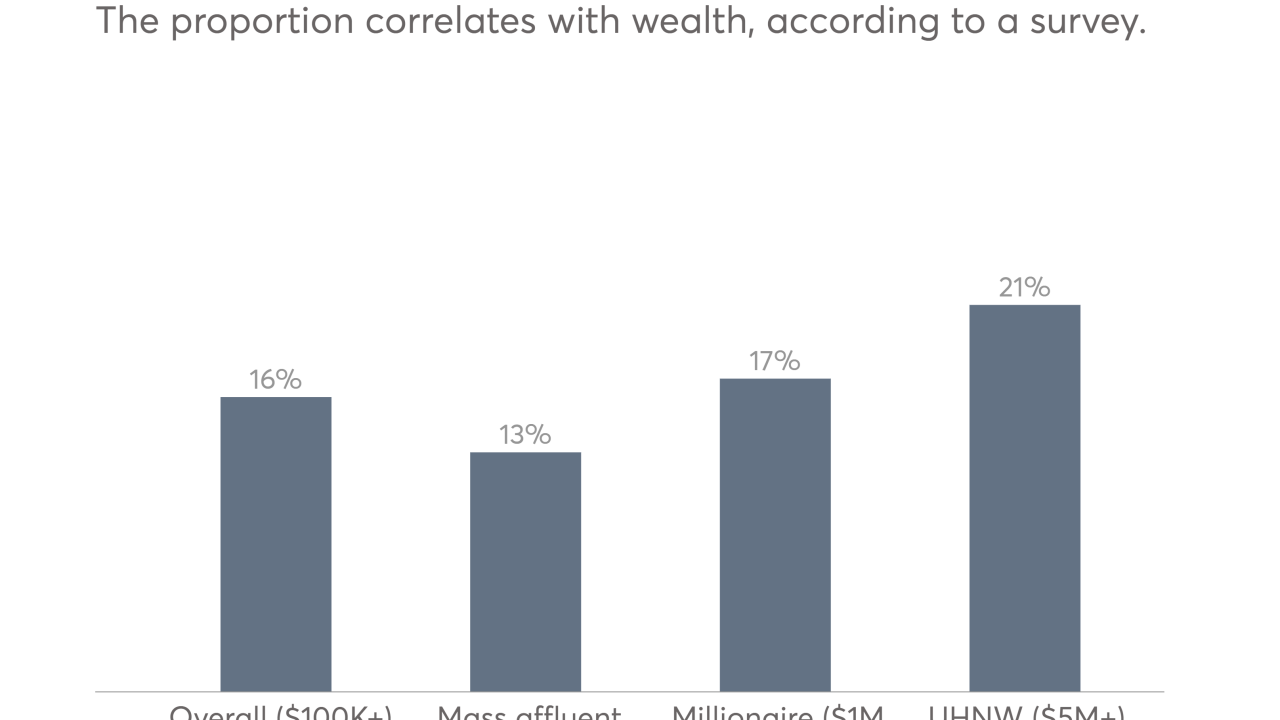

HNW investors and their planners shun the tax-advantaged savings accounts, according to a study.

March 21 -

How advisers focus too much on investments.

November 23 -

How advisers focus too much on investments.

November 23 -

Because federal rules now require parents to plan earlier for funding education, advisers can offer substantial value to clients through their financial aid expertise.

November 7 -

Understanding pro-rata rules can ensure that a client only pays their fair share to the government. Plus, these retirement preparations can boost returns and a look at when spending means better planning.

October 17