-

Investors in his $1.4 billion closed-end offering saw huge gains as a result of stellar performance from his $88.9 billion Income Fund.

August 2 -

Many firms are finding new ways to incorporate computer models and data science into their research.

August 1 -

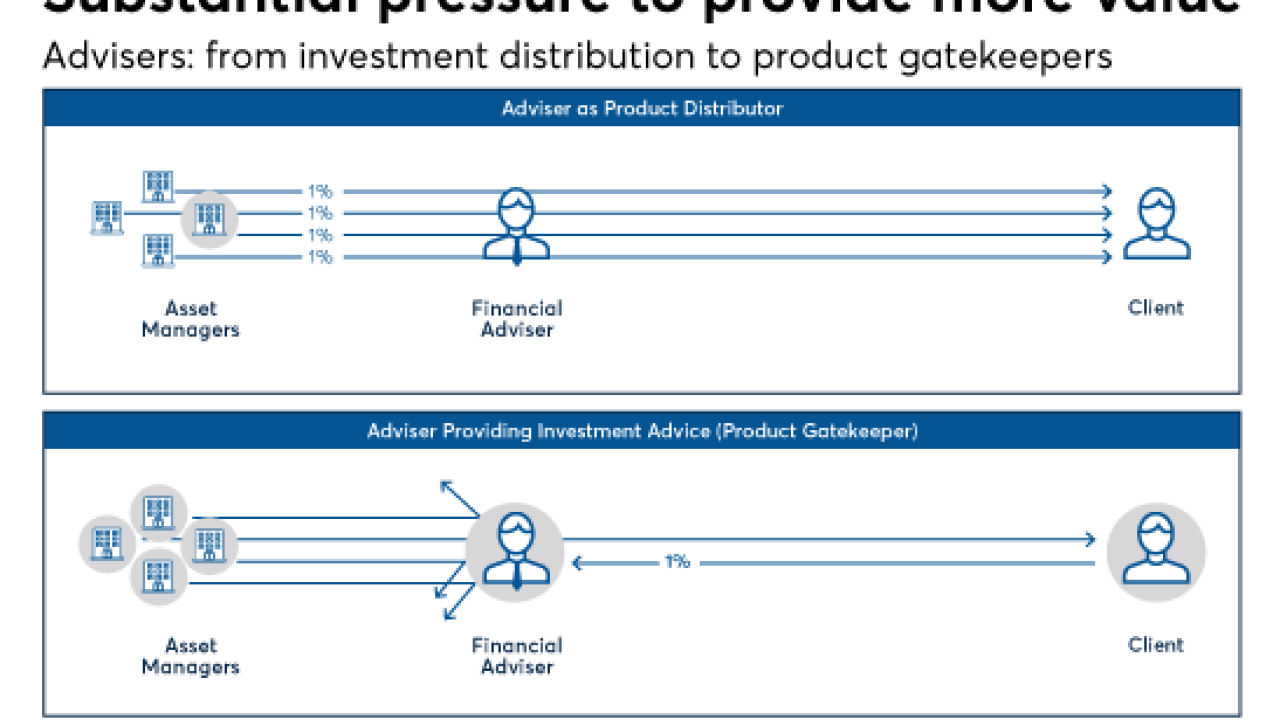

Advisers have turned into the new active investment managers.

August 1 -

Active management supplemented by local knowledge cannot be easily manufactured or automated, an expert says.

July 31 -

The firm is pushing into Europe and Asia-Pacific, but rolling back on the products that brought 75% of its assets in favor of actively managed funds.

July 27 -

In an effort to weather the assault from index funds, a Scottish firm cuts fees but bets that performance is still key to attract clients.

July 17 -

The firm’s growth last quarter was the biggest since the 2014 departure of its co-founder Bill Gross.

July 14 -

Actively managed mutual funds and ETFs that own domestic stocks experienced $98.5 billion in net redemptions in the first six months of 2017, according to Morningstar.

July 14 -

For those worried that high valuations guarantee trouble in the markets, data shows pricey equities can get even pricier.

July 13 -

Fundamental indexing is drawing more scrutiny, and greater concern about how these indexes are assembled.

July 13Ritholtz Wealth Management -

Prices that reached an almost seven-month high in June have now dropped for five straight weeks, the longest slump this year.

July 10 -

The influence of index and ETFs is growing, but it's not destabilizing yet.

July 7 Bloomberg News

Bloomberg News -

East Capital’s founder says investors struggling to demonstrate value in the face of competition from ETFs should take a lesson from investing in Russia.

July 7 -

Even though they have posted positive returns, debt and equities markets have been moving in opposite directions for the better part of two decades.

June 30 -

Despite the trend away from actively managed mutual funds, the firm is bolstering advertising efforts and adding new products to lure clients.

June 29 -

Many new products are great for the industry and not so great for our clients.

June 26 Wealth Logic

Wealth Logic -

More than half of active equity products have beaten their benchmark indexes in the first quarter, JPMorgan Chase data show.

June 21 -

Although the funds experienced a combined $586 billion in outflows over the last two years, this segment reported inflows of $41 billion.

June 7 -

Prudential’s asset management unit is taking a different approach as firms like Vanguard are forcing industrywide retrenchment.

June 6 -

Studies show smart beta beating their benchmarks more than active managers.

May 17