-

The percentage of workers who say they are ready to retire has dropped by more than 5% in last month, a survey found.

April 24 -

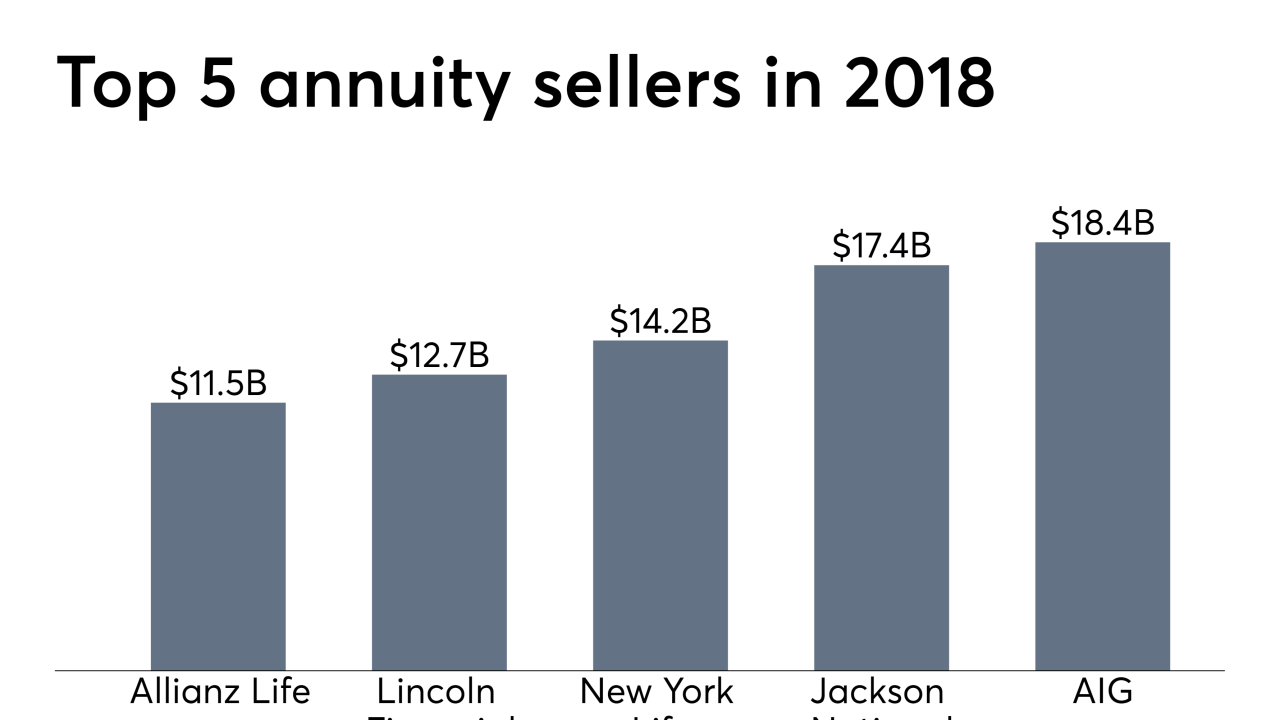

Just as in the wake of the 2008 financial crisis, experts say there's rising interest in the products among advisors.

April 15 -

Retirees tapping their long-term savings accounts for income in an emergency are advised to strongly consider reducing their withdrawal rates.

March 16 -

To ensure their investments stretch as long as they live, clients are advised to develop a sustainable withdrawal plan and consider annuities.

March 6 -

To start, these clients are advised to start saving as early and contribute enough to their 401(k)s to qualify for their employer's matching contribution.

March 3 -

Taking advantage of catch-up contributions is one of several methods that can help them get back on track.

February 12 -

The HSA has become increasingly valuable for future medical expenses, "and the triple tax benefit simply can’t be ignored,” an expert says.

February 11 -

Seniors may consider working longer or relocating somewhere where their benefits are not subject to state taxes.

February 7 -

Clients can void overspending by seeking out sales and discounts to lower their food and entertainment costs.

February 5 -

Sixty percent of advisors cited estimating health care costs as one of the biggest headaches when helping retirees plan for the future.

January 3 -

Higher-than-anticipated health-care costs are among the most unexpected expenditures clients face in retirement.

January 2 -

Deferred taxation on these retirement products, in part, depends on how their distributions are made.

December 23 -

The Secure Act will pave the way for expanded distribution channels, even as J.D. Power finds issuers lagging in measures of client satisfaction.

December 19 -

Those in the workforce will not owe taxes on rollovers to traditional retirement accounts, but will face consequences using the strategy with a Roth.

December 9 -

“If done correctly, dividend-yielding stocks are the gifts that keep on giving,” an expert says.

November 18 -

Buyout amounts are high right now, but there are many other factors to consider when guiding your client to the right choice.

November 8 -

The products provide advantages that “help women build savings faster: tax deferral and generally higher rates than CDs or Treasurys,” an expert says.

November 7 -

Raising the assumed age for decumulation to 67 from 65 could dramatically reduce the percentage of families at risk, an expert says.

October 31 -

With tens of thousands of certificants affiliated with giant BDs, the documents required by the new standards are making their conflicts of interest plain as day.

October 31 -

While many workers don’t have access to pension plans, annuities can provide a source of guaranteed retirement income and address longevity risks.

October 28