-

Local companies and organizations can spread capital much better than global corporations and institutions, according to practitioners in the field.

December 22 -

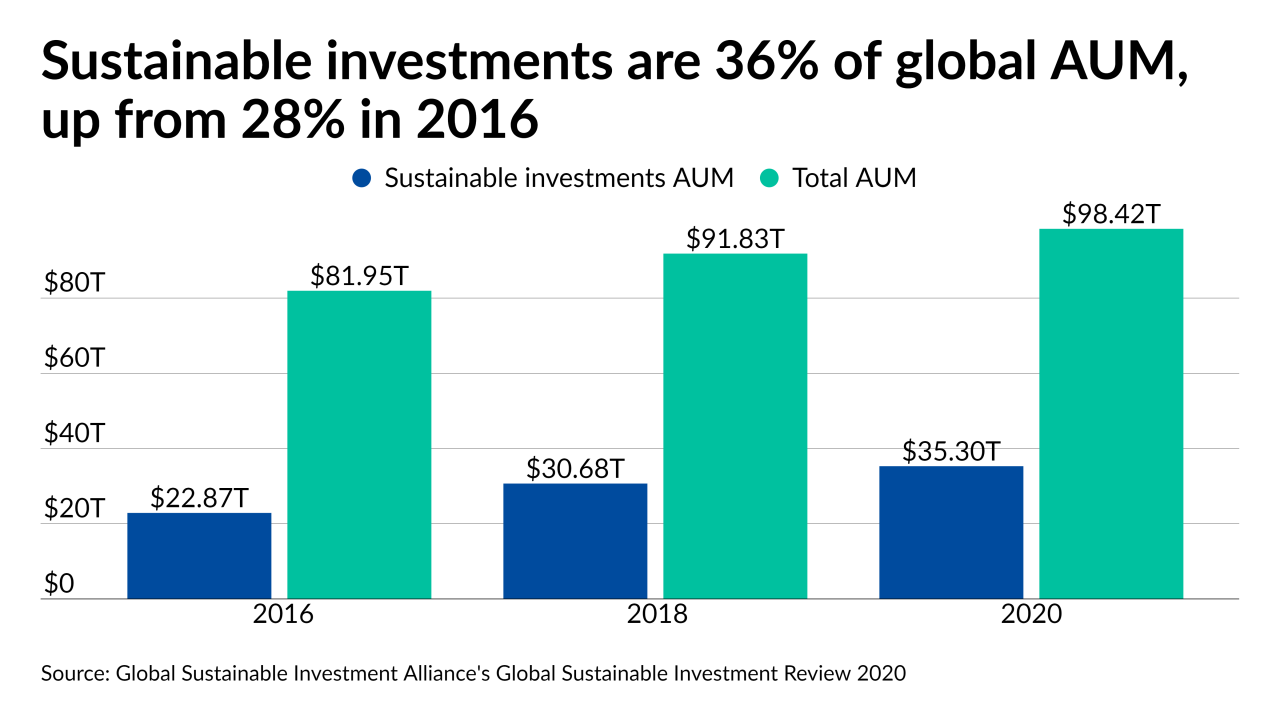

American Friends’ new database joins the expanding research and products on the marketplace, which experts say is at $17 trillion in assets — with room to grow.

November 19 -

New products constructed on more stringent ESG criteria than the so-called greenwashers often can’t be accessed through large wealth managers.

September 17 -

While US investors lag Asia and Europe, their perception of cryptocurrencies as an investment class, not a currency, is rising.

July 21 -

The world's largest asset managers voted against many more directors than the previous year based on climate and racial equity issues.

July 20 -

Titan plans to challenge Fidelity and BlackRock and attract younger generations to active investing.

July 20 -

After hiring Kara Murphy, the wealth manager aims to roll out investment management research and modeling tools for more than 2,400 advisors.

June 29 -

A state treasurer’s program in collaboration with the Ford Foundation has attracted 18 firms including UBS, BlackRock, Morgan Stanley, Citi and Goldman Sachs.

June 8 -

A research and methodology company with a star-studded board launched the product with an eye toward advisors, retail clients and institutional investors.

June 1 -

“Honestly, it’s a little frightening,” said Joel Schiffman, who oversees defined contribution products in North America for Schroders.

March 19 -

A 50% allocation to equities for someone in their 60s still leaves someone with a lot of risk right before retirement, writes Jared Dillian.

November 9 -

Clients are advised to keep some of their savings in cash and focus on their long-term prospects.

March 17 -

Many pre-retirees leave the workforce sooner than anticipated as a result of various factors, such as job loss and illness.

January 22 -

Retirees may benefit from moving money to various locations that offer better savings rates and returns.

January 21 -

Financial planners should at least consider modeling early retirement to prepare clients for the possibility of uncertainty, says Morningstar.

December 31 -

There's a way to offer sound counsel to clients and also permit them the opportunity to take a profitable flier from time to time.

December 12 Mercer Advisors

Mercer Advisors -

Equity funds tracking the sector are the second-most popular asset class after U.S. government bonds this year, BNP Paribas says.

November 14 -

Fee compression and commoditization of investment products over the past decade are threatening already slim margins in asset management.

October 9 Delta Data

Delta Data -

If approved, the fund would be the first in the U.S. to follow a quantitative approach that allocates across asset classes based on risk.

August 20 -

If reached, the deal would precede a potential IPO of the $52 billion firm, which oversees asset allocations of domestic and offshore pension funds.

August 8