-

Stellar U.S. economic data, hawkish monetary expectations and strong commodity prices have pushed 10-year and 30-year Treasurys to breakout range.

October 4 -

One of the firm’s corporate bond funds is down 4.3% this year, while another has lost 5.4%.

October 1 -

The actively managed offering aims to invest in corporate and non-corporate obligations, excluding government-guaranteed issues.

August 15 -

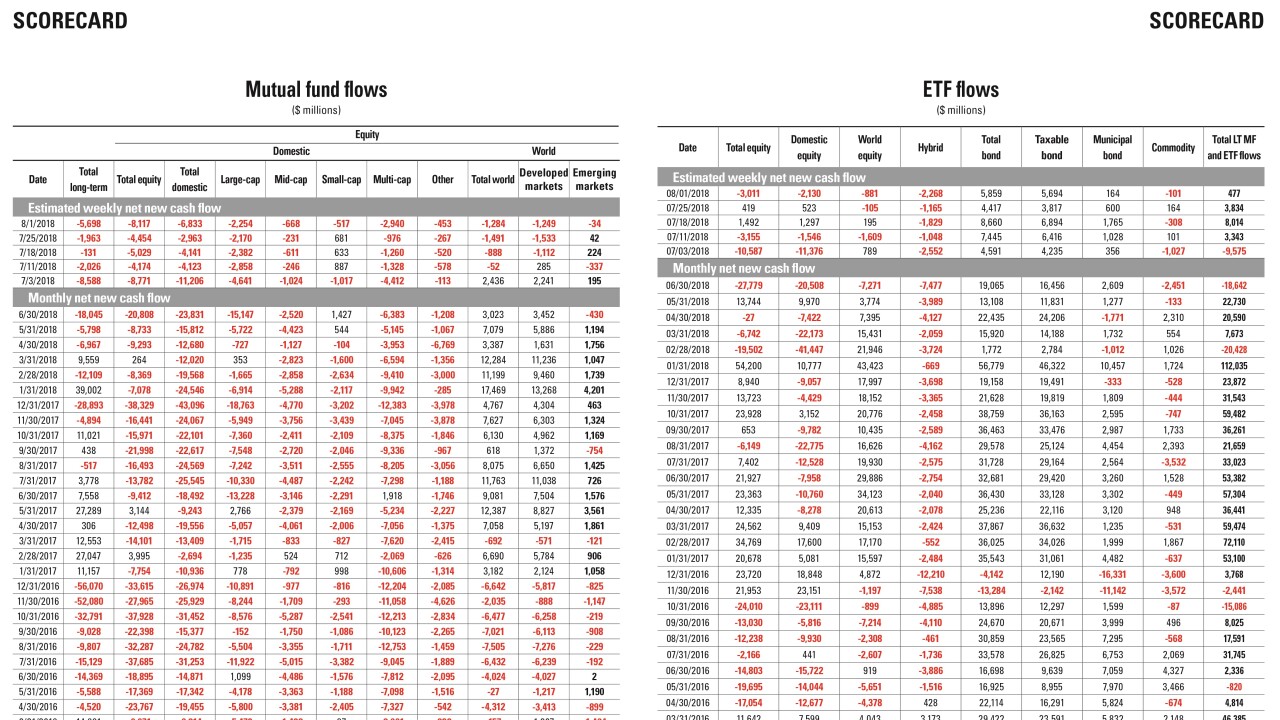

Data reported by the Investment Company Institute.

August 10 -

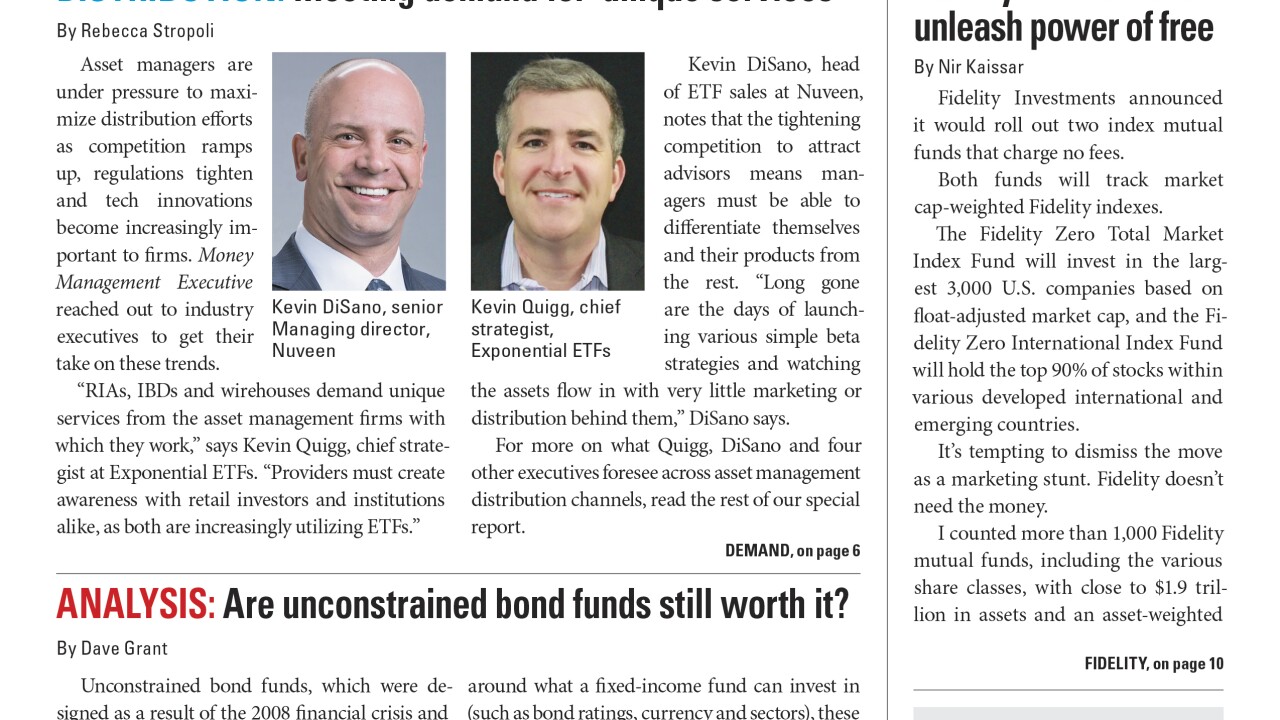

Asset managers are under pressure to maximize distribution efforts amid tightening regulations and tech innovations.

August 10 -

The legendary manager’s Unconstrained Bond Fund ended July down almost $1 billion from its February peak.

August 10 -

The shift in strategy comes as central banks move away from policies that have buttressed markets since the financial crisis.

August 8 -

The funds raked in a combined $840 million last week despite competitive hurdles banks typically face going up against money managers’ core products.

July 17 -

Data reported by the Investment Company Institute.

July 13 -

Muted core inflation increases and relentless haven flows have kept a lid on longer-dated developed-market yields.

July 11 -

Although investors think the 10-year Treasury yield will easily reach 3.5%, analysts warn “there might be a few blips on the way.”

July 2 -

The largest allocation to the iShares fund was a block of 10 million shares worth $251 million after the market closed last week.

June 25 -

The firm’s largest investors have already been in talks about strategic options, according to people familiar with the matter.

June 21 -

An exit from the European Union doesn't necessarily require immediately pulling out from the U.K. bond market.

June 15 -

As interest rates rise, should advisors' thinking change?

June 15 -

Amid rising rates, these vehicles can be helpful — but advisors need to stay vigilant.

June 14 -

Data reported by the Investment Company Institute.

June 8 -

The $55 billion of new cash last week from global investors was the most since 2013.

June 8 -

The declines, he says, were the result of a widening gap between U.S. and German bond yields triggered by the crisis in the eurozone.

June 1 -

Uncertainty over the euro’s future sent the Janus Henderson manager’s $2.1 billion fund plummeting nearly 3%, making a bad year even worse.

May 30